The effect of weather on investment returns in common stocks - an applied comparative study of the Iraqi and Jordanian stock exchanges

Keywords:

Investment returns, common stocksAbstract

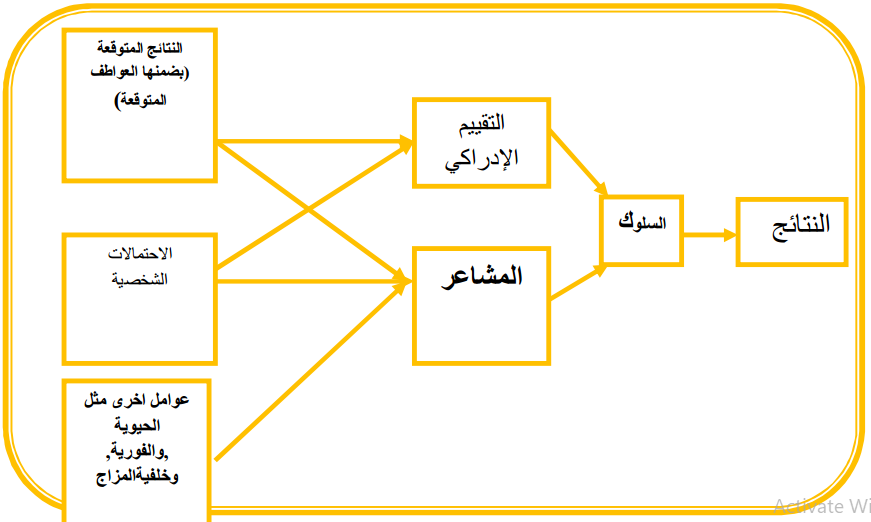

Weather can be one of the market anomaly reasons, so should find

evidence for it against the efficient market theory. Psychological studies support

an existence of the weather effect on mood, which in turn will effect on all

decisions of investors and their behavior in the financial market, despite the fact

that classical economic theories assume that the preferences of the investor are

fixed and fully rational and do not affected by mood. The recent studies and

literature have indicated that weather causes a given mood status and this in

turn will effect on the risk and return assessments and on stock prices in many

global stock markets. The purpose of this study is to see whether the weather

affects stock returns. This study examines the impact of weather on stock returns

of the Jordanian and Iraqi Stock Exchange with the aim of enhancing the

efficiency of the market by identifying the source of the irrationality of the

market, compare the performance of the two markets to see how the impact of

weather on the behavior of investors and its reflections on the stocks returns, in

order to identify which one of the weather variables will effect on the stocks

returns. This study was based on the daily closing prices for the Iraqi and

Jordanian market indexes throughout the period (28 11 2013 - 27 2 2014),

which corresponds to the timing of the weather variables observations which are

represented by a level of cloudiness, temperature, humidity level, wind speed,

and showed its impact on the returns of ordinary stocks listed on the two

markets. This study reaches out to number of conclusions, the most important

among them is existence of a significant relationship between temperature and

investment returns of ordinary stocks listed on the Iraqi market. In regard to

Amman Stock Exchange, it has been shown that there is a significant

relationship between the level of cloudiness and investment returns of ordinary

stocks listed on the Jordanian market. This study reaches out to number of

recommendations including the need to increase investment awareness of

participants in the Iraqi and Jordanian markets and make them aware that they

must not be affected by psychological factors that leaves negative effects on the

overall trading activity in the market and unlike the logical fundamentals of the

efficient financial markets principles.

References

- Akhtari, Mitra (2011) "Reassessment of the Weather Effect: Stock Prices

and Wall Street Weather," Undergraduate Economic Review Volume 7 Issue 1

Article 19,2011

- Cao, M. and Wei, J.(2005) “Stock market returns: A note on temperature

anomaly”. Journal of Banking and Finance, vol. 29, pp. 1559-1573.

- Chang, Tsangyao., Chien-Chung Nieh, Ming Jing Yang, Tse-Yu Yang, (2006)

Are stock market returns related to the weather effects? Empirical evidence from

Taiwan, Physica A 364 (2006) 343–354.

- Conlisk, J. (1996) "Why bounded rationality?" Journal of Economic

Literature, vol. 34, pp. 669-700.

- Dowling, M. and Lucey, B.M. (2005) “Weather, biorhythms, beliefs and stock

returns: Some preliminary Irish evidence”. International Review of Financial

Analysis, vol. 14, pp. 337-355.

- Goetzmann, W. N. and Zhu, N. (2005) "Rain or shine: Where is the weather

effect?" European Financial Management, vol. 11, pp. 559-578. 7- Hanoch, Y. (2002) "Neither an angel nor an ant: Emotion as an aid to

bounded rationality". Journal of Economic Psychology, vol. 23, pp. 1-25.

- Hirshleifer, D. and Shumway T. (2003) "Good day sunshine: Stock returns

and the weather". The Journal of Finance, vol. 58, pp. 1009-1062.

- Howarth, E. and M. S. Hoffman (1984) "A multidimensional approach to the

relationship between mood and weather". British Journal of Psychology, vol. 75, pp.

-23.

- H. M Weiss and R. Cropanzano, "Affective Events Theory: A Theoretical

Discussion of the Structure, Causes and Consequences of Affective Experiences at

Work, "in BM Staw and LL Cummings (eds.), Research in Organizational

Behavior, vol. 18 (Greenwich, CT: JAI Press, 1996), . 17-19

- Keef, S. P. and Roush M. L. (2003) "The Weather and Stock Returns in New

Zealand". Quarterly Journal of Business & Economics, vol. 41, pp. 61-79.

- Loewenstein, G. (2000) "Emotions in Economic Theory and Economic

Behavior". American Economic Review, vol. 65, pp. 426-432.

- Loewenstein, G.F., Elke, U.W., Christopher, K.H., and Welch, N. (2001)

“Risk as feelings”. Psychological Bulletin, vol. 127, pp. 267–286.

- Pardo, A. and Valor E. (2003) "Spanish stock returns: Where is the weather

effect?" European Financial Management, vol. 9, pp. 117-126.

- Pitcher, J. J., E. Nadler, and C. Busch (2002) "Effects of hot and cold

temperature exposure on performance: A meta-analytic review". Ergonomics, vol.

, pp. 682-698.

- Saunders, E. M., Jr. (1993) "Stock prices and Wall Street weather." The American

Economic Review, vol. 83, pp. 1337-1345.

- Schwarz, N. (1990) “Feelings as information: Informational and motivational

functions of affective states”. In: Higgins, E.T., Sorrentino, R.M. (Eds.), Handbook of

Motivation and Cognition, vol. 2, pp. 527–561.

- Schwarz, Norbert.,& Clore, Gerald L., Mood as Information: 20 Years

Later, Lawrence Erlbaum Associates, Inc. Psychological Inquiry Copyright ,2003,

Vol. 14, No. 3&4, 296–303.

- Trombley, M., A. (1997) "Stock prices and Wall Street weather: Additional

evidence". Quarterly Journal of Business and Economics, vol. 36, pp. 11-21.

- Tufan, Ekrem., Do Cloudy Days Affect Stock Exchange Returns: Evidence

from Istanbul Stock Exchange ,Journal of Naval Science and Engineering 2004, Vol.

, No.1, pp. 117-126.

- Tufan, E. and Hamarat B. (2004) "Are investors affected by the weather

conditions: Evidence from the Istanbul Stock Exchange". ISE Review, vol. 8, pp. 31-

- Wright, W. F. and Bower, G. H. (1992) “Mood effects on subjective

probability assessment”. Organizational Behavior and Human Decision Processes,

vol. 52, pp. 276-291.

- Blom, Jan Erik.,HEDGING REVENUES WITH WEATHER

DERIVATIVES, NORGES HANDELSHoYSKOLE,Bergen, 20th of June 2009.

- Cohen, Alexander H. Climate, weather, and political behavior,University of

Iowa Iowa Research Online,2011.

- Zaghloul, Omar, WEATHER'S EFFECT ON STOCK MARKET RETURNS

EVIDENCE FROM THE KUWAIT STOCK EXCHANGE, A thesis submitted in

partial fulfilment of the requirements for the degree of Masters of Business Administration (MBA) of the Maastricht School of Management (MSM), Maastricht,

the Netherlands,

Month 22, 2012 .

:شبكة المعلومات الدولیة -3

- Akhtari, Mitra.,( 2010) Reassessment of the Weather Effect: Stock Prices and

wall street Weather, University of California, Berkeley,2010.

- Dong, Ming& Tremblay Andréanne,. Does the Weather Influence Global

Stock Returns?, November 15, 2013.

- Harding, Noel, & Wen He, Does investor mood really affect stock prices?An

experimental analysis, 2012.http :/ / ssrn.com / abstract = 1786344.

- Hume , David,.Emotions and Moods,2008.

- Kamstra Mark, Lisa Kramer, and Maurice., Winter Blues: A SAD Stock

Market CycleWorking Paper 2002-13.

- Kliger, Doron, Yaron Raviv, Joshua Rosett, Thomas Bayer, John Page,.

Auction Prices and the Weather: New Evidence from Old Masters, August 26, 2010

. Electronic copy available at: http://ssrn.com/abstract=1666550 .

- Modigliani, Franco., and Pogue Gerald A. , AN INTRODUCTION TO RISK

AND RETURN CONCEPTS AND EVIDENCE, March 1973,73-646 .

- N

.H. Frijda, “Moods, Emotion Episodes and Emotions,” Handbook of Emotions(New

York: Guilford Press, 1993), pp. 381–403.

- National Science Standards, Adapted from Global Climates - Past, Present,

and Future. EPA Report No EPA/600/R-93/126 and Project LEARN(

ww.ucar.edu/learn) and recommended by Sandra Henderson.

- www.arabgeographers.net/vb/attachment.php?attachmentid=1345&d.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2014 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.