The attractiveness of the stock for investment according to the perspective of the local and international investment market line - an analytical study

Keywords:

The attractiveness of the stock for investment, the local and international investment market lineAbstract

Risks prices which face stocks are fundamental factors that attract investor due to achieved returns through his investment activities that affected by environment conditions surrounding ( Locally and Internationally ).

These returns differed in its highest and lowest returns due the available investment opportunities at these conditions for local and internal investor which lead to a right investment decision.

Stock attraction comes with the level of return achievement that added to his investment portfolio. Hence, it is better to the investor to consume any opportunity of selling or buying stocks in suitable ways with what he want to reach through risks fluctuation. This study aimed to put light on the effect of these fluctuations on investment activities followed by share attraction.

Analysis was conducted to the factors that affected on these fluctuations on the available data for study sample of market stocks for seven chosen countries with (10) companies of each market on sampling looking conditions from the period of (March, 2011 to April, 2015) , by the use of numerous style of finance and statistics.

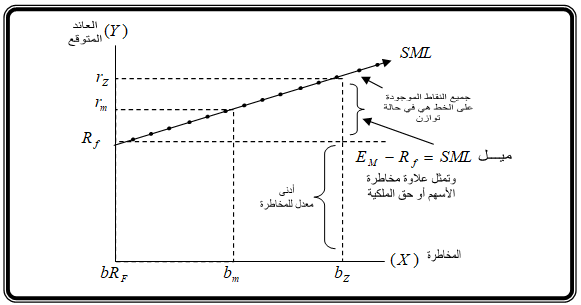

The study revealed the number of conclusions, the most important of them is the presence of different in investment lines ( Securities Market Line ) (SML) locally and internationally, due to the difference in risk shares resulted from the it\'s environment conditions surrounding. This confirms that locally stocks attraction differs from internationally stock attraction due to the difference between locally investment line and internationally investment line.

This study reached a number of recommendations, the most important of all is necessitate of Iraqi investor with a right way to consume any investment opportunities on locally and internationally levels through stocks, If the market exaggerates in price stocks, then the investor should sell, due to loss through keeping them, If the market make the prices too low then he should by them to achieve additional returns, and if the market gave good price, the investor should achieve a balanced state, and selling or buying depend on the investor himself to choose and prefer.

References

أ. الوثائق الرسمية:

البنك المركزي العراقي، التقارير السنوية لأسعار الفائدة لسوق العراق للأوراق المالية للمدة (2011-2015).

البنك المركزي الأردني،التقارير السنوية لأسعار الفائدة لسوق عمان للأوراق المالية للمدة من (2011– 2015 ) .

سوق السعودية للأوراق المالية،التقارير السنوية لأسعار الفائدة لسوق السعودية للأوراق المالية للمدة(2011-2015).

سوق السعودية للأوراق المالية،التقارير الشهرية لأسعار اغلاق أسهم ومؤشر سوق السعودية للأوراق المالية للمدة (2011- 2015).

سوق العراق للأوراق المالية "التقارير الشهرية لأسعار اغلاق اسهم ومؤشر سوق العراق للأوراق الماليةللمدة (2011-2015)" .

سوق عمان للأوراق المالية، "التقارير الشهرية لأسعار اغلاق اسهم ومؤشر سوق عمان للأوراق الماليةللمدة (2011-2015) ".

ثانياً : المصادر الأجنبية :-

A . الكتب :

Bodie, Zvi, Alex Cane. Alan J, Marcus, "Finance Investment"- Investment",5th,ed. ,McGraw H ill/Irwin ,2001. .

…………………………………………………,"Essentials Ofinvestment " , USA, McGraw – Hill , 2007.

…………………………………………………………, "Investment ",7thed., , America, New York,McGraw- Hill/ Irwin, 2008.

Bradford D. Jordan, and Thomas W. Miller. Jr. " Investments – valuationand Management" , 4th ed., china, McGraw-Hill Irwin, 2008.

Brigham &Ehrahradt, "Financial Management –Theory And Practice"11th ,ed., China, Thomson, South-Western , 2005.

.Brealy A. Richard & Stewart E. Myers, " principles of corporate finance" 3ed , McGraw-Hill International Edition , 1988.

Gitman, Lawrences, "Principios de AdministracionFinanciera ",11v, ed. , Jorge CeballosSebastionMerico, Person Education, 2007.

……………………….,,"Principles Of Managerial Tinance, 9th , ed., USA, RR Donnelly and Sons Co., 2009.

Pik Richard, Neale Bill, "corporate Finance and Investment Decisionsand Strategies " , ,2ed Ltd , U.K , Prentice Hall International, 1993.

Reilly Frank K. & Brown, Keith. C., "Analysis of Investment & Management of Portfolios " , 10th ed., Canada, International Edition, South-western, 2012.

Ress Bill, "Financial Analysis", 5th , ed., U.K. , prentice Hall, 1990.

Robert, Alan, Hill, "The Capital Assets Pricing Model ",1st ,ed., ISBN, 2010.

Weston J. Freed and Copeland Thomas, " Managerial Finance", 8th , ed., The Dryden press, 1986.

Weston, Fred Besley , Scott and Brigham , E, " Essentials of ManagerialFinance " , 11th , ed, NY. Dryden press, 4th , ed. USA, 1996.

B . البحوث المنشورة :

Andre, F. Perold, "The Capital Asset Pricing Model" , Journal of Economic Perspectives- volume 18, Number 3-Summer- 2004.

David w. Mullins, Jr." Doe the Capital Asset Pricing Model work?" Harvard Business Review Jan –Feb. 1982.

Fama, Eugene F. Kenneth R. French,, "Random Walk in stock Market prices", Financial Analysts Journal , Vol .( 21), No.(5), (September – October, 1965).

Solink, B.H., "The International Pricing of risk: An Empirical Investigation of the world Capital Market Structure " , The Journal of Finance , Vol. 29. No. 2, papers and proceedings of the Thirty- second Annual Meeting of the American Finance Association, New York, December 28-30, 1973 (May 1974).

Sharpe, W.F. , "Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk" Journal of Finance, September , 1964.

C. الوثائق والاصدارات الرسمية:

Germany Stock Exchange, Monthly Reports to the closing share prices and the Market Index For period (2011- 2015).

Germany Stock Exchange, The Annual Reports of the interest rates forthe period (2011-2015).

Japan Stock Exchange, The Annual Reports of the interest rates For the period (2011- 2015).

Japan Stock Exchange, Monthly Reports to the closing share prices and the market Index for Period (2011- 2015).

London Stock Exchange, The Annual Reports of the interest rates for the period (2011- 2015).

London Stock Exchange, Monthly Reports to the closing share prices and the Market Index For period (2011- 2015).

New York Stock Exchange, The Annual Reports of the interest rates for the period (2011- 2015).

New York Stock Exchange, Monthly Reports to the closing share prices and the Market Index For period (2011- 2015).

The International MonetaryFund, annual report on annual GDP of the Countries of the Study Sample for the Period (2011-2015).

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2015 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.