Calendar approaches accounting of interest rate swaps Between traders in the financial markets (Descriptive and analytical study)

Keywords:

Calendar approaches accounting,interest rate,financial marketsAbstract

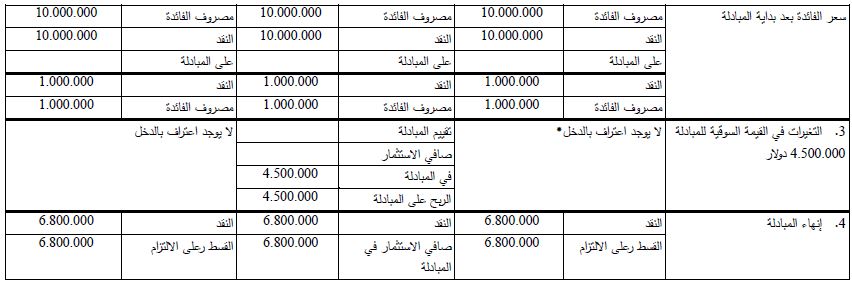

The aim of this study is to evaluate the accounting for interest rate swaps and develops a theoretical Framework for analyzing the accounting for swaps-including the identification of specific conditions under which an interest rate swap would quality as a hedge. Three different accounting perspectives on swaps-synthetic instruments (current practice), refinancing, and separate instruments-are described.

Issues addressed in the paper include recognition of swaps at inception, recognition of gains and losses at terminations of swaps, and disclosures of information about swaps.

One of the major conclusions of the study is that, to be consistent only swaps that meet all the hedging criteria of SWAPS 80 should be treated as hedges.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2012 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.