Investment policies in working capital and their impact on return and risk

an applied study in industrial sector companies for the period from 2006 to 2013

Keywords:

سياسات الاستثمار, العائد, المخاطرةAbstract

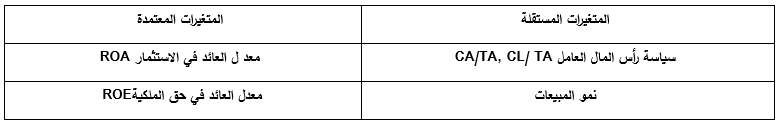

The purpose of this study is to analyze the relationship between the working capital investment policies and their effect on the return and risk by analyzingthe financial statements of the general budget and the income statement. The budget statements were used to the determining the adopted policy in current assets that forms the working capital which is of great importance to companies, administration especially business firms.

A Sample of (15) Companies is chosen from (21) industrial sector companies for (8) years period from 2006-2013 Those companies are registed in the Iraqi stock exchange market (10) companies form the sample adopted a conservative Policy, ( 3) companies adopted a moderate Policy and two of them adopted a aggressive policy.

A scientific statistical methodology was used to analyze the adopted policies . The main result of this study is that the working capital needs efficient administration which guarantee good depends for the analysis of these policiesWhere researcher to concluded to a group of most important conclusions the of the components of this variable So as to guarantee the good performance that effects companies return and profit.

References

قائمة المصادر العربية

ألنعيمي, عدنان تايه, والساقي, سعدون مهدي وسلامة,اسأمه عزمي, ونوري, موسى شقيري, 2006, الإدارة المالية, النظرية والتطبيق, دار المسيرة للنشر, الأردن.

العامري,محمد علي إبراهيم, (2002), الإدارة المالية, الطبعة الأولى, دار المناهج للنشر والتوزيع, مطبعة دار المناهج, عمان, الأردن.

الشماع, خليل محمد حسن, (1992), الإدارة المالية, الطبعة الرابعة, مطبعة الخلود,للنشر والتوزيع, بغداد.

الميداني, أيمن عزت, (2004), الإدارة التمويلية في الشركات, الطيعة الرابعة, مكتبة العبيكات, الرياض.

المصادر الأجنبية

Arnold, Glen,(2008) Corporate financial management",4th edition, Harlow; Financial Times Prentice Hall.

Gitman, Lawrence, "Principles Of Managerial Finance", Twelfth Edition Prentice – Hall , New York – USA , ( 2008 ).

Afza T and MS Nazir (2007). Working Capital Management Policies of Firms: Empirical Evidence from Pakistan. Presented at 9th South Asian Management Forum (SAMF) on February 24-25, North South University, Dhaka, Bangladesh.

Lamberson M (1995). Changes in Working Capital of Small Firms in Relation to Changes in Economic Activity. Mid-American Journal of Business 10(2): 45-50.

Abdul Raheman, Afza, T. And Abdul Qayyum, B. M. (2010). Working capital Management and Corporate Performance of Manufacturing Sector in Pakistan. International Journal of Finance and Economics, 47, 153-163.

Filbeck G & Krueger, T.(2005). Industry Related Difference in Working capital Management .Mid_ American Journal of Business.

Van Horne , C. , James , “ Financial Management of Policy . ’’ , 11th ed. , prentice – Hall International , Inc. , 1998 .

Al-Mwalla, M. (2012). The Impact of Working Capital Management Policies on Firms Profitability and Value: The case of Jordan. International Research Journal of Finance and Economics, Vol. 85, pp. 147-153.

Ikram, H., Mohammad, S., Khalid, Z. &Zaheer, A. (2011). The relationship between Working Capital Management and Profitability: A Case study of Cement Industry in Pakistan, Mediterranean Journal of Social Sciences, Vol. 2 No. 2,

Hussein, A., Farooz, S. U. & Khan, K.U. (2012). Aggressiveness and Conservativeness of Working Capital: A case of Pakistan Manufacturing Sector, European Journal of Scientific Research, Vol. 73, No. 2, pp. 171-182.

Pinches, G (1997). Essentials of financial management, New York: Harper Collis Publishing.

Brigham , Eugene F .&Joel F. HoustonFundamentals of FinancialManagement" 12th edition , South-Western Cengage Learning , Mason , USA , 2009.

Ross- peter," commercial bank management" 4 ,ed ,MC -Graw – Hill companies,inc,1999.

Brealy, R.A, Meyers, S.C, Allen, F. (2006). Corporate Finance. 8th edition, New York: Mc Graw_ Hill / Irwin.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 Iraqi Journal for Administrative Sciences

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.