Applications of quadratic programming in capital investment

Keywords:

capital investment, Quadratic programmingAbstract

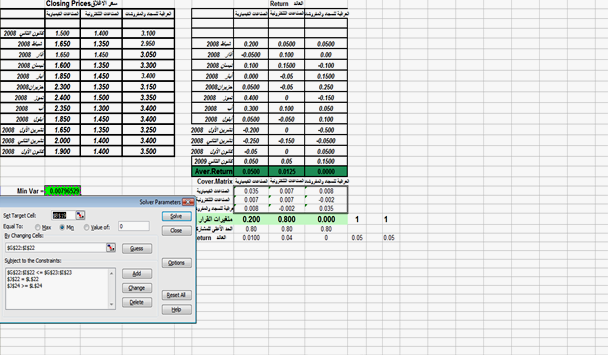

No one ignores the advantages of investment in two sides . The first is for the invested economic sector . If the process of investment is objective , the sectors under investment will be prosperous and participate in the national income effectively and as a result the whole national economy will recover . The second is for the benefit of the invested capital which will get the profit coming from the adventure of using the capital , for example here, we have to say that wherever the adventure is great , the profits will be extremist . So , this study analyzed the investing facts and deduced the best solution in the process of investment by using one of the progressed means in the operation research which is the “Quadratic Programming “ , and finding the available substitutes and their profits according to the investors ، desire and then giving them a practical idea about their ability to have the adventure by applying the programmes to the computer Excel spreadsheet on the data of the profit of three companies in the financial markets, the chemical industries , the electronical in dustries and the Iraqi company for carpets and furnishing .

References

- د.حامد سعد نور الشمرتي ، بحوث العمليات ( مفهوما" وتطبيقا")، الطبعة الاولى ، 2010

Eppen G.D. et al., 1998 – Introductory Management Science, 5.ed ., Prentice – Hall, Inc., 762 pages.

Markowitz H., 1952- Portfolio selection , Journal of finance , vol 7,pp:77-91

Papahristodoulou c., 2002-Optimal Portfolios using linear Programming Models, Optimization Online Digest October.

Rardin R.L., 1998- Optimization in Operation research, Prentice – Hall, Inc., 919pages.

Published

How to Cite

Issue

Section

License

Copyright (c) 2013 Iraqi Journal for Administrative Sciences

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.