رأس المال الفكري واثره في القيمة السوقية والاداء المالي - دراسة تطبيقية لعينة من المصارف المدرجة في سوق العراق للاوراق المالية للمدة من ( 2008-2013)

الكلمات المفتاحية:

رأس المال الفكري، القيمة السوقية، الاداء الماليالملخص

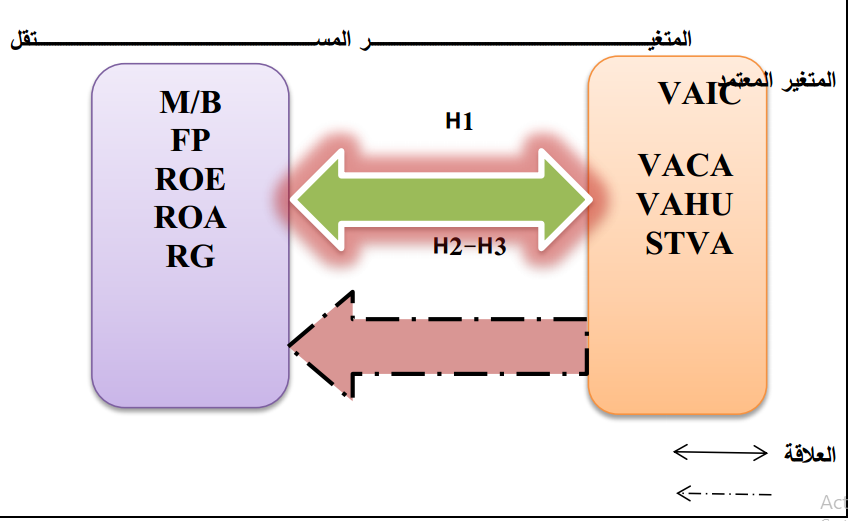

تنصرف فكرة البحث إلى طبيعية ونوع العلاقة التي تربط رأس المال الفكري ببعدي القيمة السوقية والأداء المالي لدى عينة متكونة من 20 مصرفا للمدة من 2008-2013 وقد ارتأت الباحثة بناء أربعة نماذج رياضية من خلال معادلة الانحدار المتعدد ولاختبار العلاقات بين المتغيرات تم استخدام عدد من الوسائل الإحصائية المناسبة كالعلاقة الخطية وتساوي التغاير و اختبار (D-W) أما اختبار الفرضيات فقد تم استخدام تحليل بيرسون وتحليل الانحدار الخطي . لقد توصل البحث إلى عدد من الاستنتاجات أبرزها أن امتلاك المصارف الرأس المال الفكري بوصفه موجوداً يسهم في تحقيق الميزة التنافسية ويشير إلى علاقة ارتباط وتأثير موجبة وذات دلالة معنوية بين رأس المال الفكري كل من القيمة السوقية والأداء المالي للمصارف عينة البحث وأخيرا فقد أوصى البحث بضرورة الاستفادة من مقاييس رأس المال الفكري لتشخيص وتعزيز هذا الموجود بما يتماشى و تعظيم قيمة المصرف وتحسين أدائه المالي.

المراجع

Alipour, M.(2012),"the Effect of intellectual capital on firm performance:an

investigation of Iran Insurance companies, "Measuring Business Excellence

,vol.16 ,no.1 ,p-20.

-Bontis Nick( 2004) "national Intellectual capital ndex. Aunited nations

initiative for the Arabregion journal of intellectual capial vol.5, no.1 ,p13-39.

-April ,Kurt. A ,2002.,"Guidelines for Developing a K-strategy ,journal of

Knowledge management ,vol.6,no.5 .

-Thomas Hausel (2001);"Measuring and Managing Knowledge ".Mc raw Hill.

-Stewart .A,(1999)"Intellectual Capital the new weath of qrganization ,Double

Day Carrency ,new york, p 163.6-Bontis, N., 1999, “Managing organizational knowledge by diagnosing

intellectual capital : framing and advancing the state of the field

Intellectual Journal of Technology Management, 18(5/6/7/8), 43-46. 7-

Chen, M.C., S.J. Cheng, and Y. Hwang, 2005, “An empirical investigation of the

relationship between intellectual capital and firms’ market value and financial

performance”, Journal of Intellectual Capital, 6(2), 159-176

-Firer, S., and S.M. Williams, 2003, “Intellectual capital an Traditional

measures of corporate performance”, Journal of Intellectual Capital, 4(3), 348-

-Pulic, A., 2000, “VAIC – an accounting tool for IC management”,

International Journal of Technology Management, 20 (5,6,8), 702-714.

-Roos, G., J. Roos, L. Edvinsson, and N.C. Dragonetti, 1997Intellectual Capital

Navigating in the New Business Landscape, New York University Press, New

York, NY.

-Sullivan, P.H., 2000, Value-driven Intellectual Capital: How toconvert

Intangible corporate Assets into Market Value, John Wiley And Sons

Riahi- .Toronto, Canada

Belkaoui, A., 2003, “Intellectual capital and firm performance of US

multinational firms: a study of the resource-based and stakeholder views”,

Journal of Intellectual Capital, 4(2), 215-226.

Maps: 13-Eppler, M., (2003) "Making Knowledge Visible through Knowledge

Concepts, Elements, Cases," in Holsapple, C. (Ed.), Handbook on

Knowledge Management (New York: Springer,), pp.187-205

-Starovic.g and Marr,b. (2003). “The Dynamic of ValueCreationMapping Your

Intellectual Performance Drivers”. TheCentre for Business Performance,

Grandfield School of Management. .Unpublished

-Hansen M. Nohria. N &Terncy. 1999, Twhats Your Strategy for Managing

Ledge, Harvard Business Review, March-April.

-Edvinsson,l.&Malone,M.,1997 study:"intellectual capital : realizing your

companys true vale by finding its hidden brainpower" ,harper

Busiess.newyork,p34-35

- Hamel, Grary & Heene, Airne,(1994)"Competence-Based Competition",

JohnWiley& SonsInc, U.S.A,

-Karp, Tom, 2003, INTELLECTUAL CAPITALISM: Is Intellectual Capital the

New Wealth of Business Organisations? http://tom.karp.as/capital.pdf.

- Charles Despres and D. Chauvel (2000): Butterworth Heinemann, Boston,

p317.

- Miller, William, Building The Ultimate Resource, Management Review, 88 (1),

Jan. 1999, p. 42-45.5

- Bassi, Laurie, J, Harnessing the power of intelectual capital, Training &

Development, 51 (12), Dec. 1997,p. 25-30

- Xiao , Huafang , " Corporate Reporting of Intellectual Capital : Evidence

from China " , The Business Review , (Vol.11 , No.1 , 2008) Available From

www.proquest.com

- Campisi, D., and R. Costa, 2008, “A DEA-Based Method to EnhanceIntellectual Capital Management”, Knowledge and Process Management

-Kannan, G. and Aulbur, W. G. (2004) “Intellectual capital

Measurementeffectiveness”, Journal of Intellectual Capital, Vol. 5 No.

-Skyrma,D.,2002,Measuring intellectual capital Aplelhara of methods lnsinh

,journal of banking and finance,vol.1.no.24.

- Swart,jouani.2005" indentifying the sub .compoments of intellectual capital

:Aliteraturereviven& development of measures ,school of management ,university

of Bath uk .

-Ding,Yonliang & li ,Guauzhay " study on the management of intellectual

capital ini journal of business & management vol.5,no.2 f 2010

-Fath,Saeed ." Farahmand& ,shekalteh Khoransani ,Mahnas" Imact of

intellectual capial on financial performance " intetrnayionl journal of

Acodemicresarh in economic and management sciences vol .2,no.1,2013.

-Shkina,elena, Barajas,angal,"the relation ship between intellectual capial

quality and corporate performance : an empirical study of Russian and European

campaniesecomomic annals vol.7,no. 192,2012.

-Reid , J9 (1998 ) Intellectual capital , Business Quarterly , vol.1.NO6

-Harrison ,s.,& Sullivan,p.,2000study"profiting from intellectual capital

,vol.1,no.1.

-Unger, Marius, 2004, Developing core capabilities In A Financial Services

Firm: An Intellectual Capital Perspective Dissertation For Commerce Degree

ph.D.Rand Afrikaans University, p112

-BDL,(2007) , "Intellectual Capital Statement" Business & Development

Learning Institute – BDL Institute -51, rue Saint Charles 78000 Versailles –

France .

-Royal ,Carol& Donnell ,Loretta O ,(2008) ," Differentiation in financial

markets: the human capital approach" Journal of Intellectual Capital ,Vol.9

No.4.

-Royal ,Carol& Donnell ,Loretta O ,(2008) ," Differentiation in financial

markets: the human capital approach" Journal of Intellectual Capital ,Vol.9

No.4.

-Milost , Franko(2007) , "A dynamic monetary model for evaluating employees

" , Journal of Intellectual Capital ,Vol. 8 No.1.

-Roos, G. and Roos, J. (1997) “Measuring your company’s intellectual

performance”, Long Range Planning, Vol. 30, No.

-Hansen M. Nohria. N &Terncy. 1999, Twhats Your Strategy for

Managing Ledge, Harvard Business Review, March-April.

-Martin ,boddy.( 2005)"the knowkedge driven economy ,regional economic

strategy& regional spatial strategy in the south west of England " final lrepot to

the south west of England regional development april.

-Wiig, K.M. (2000), Study: “Knowledge Management: An Emerging Discipline

Rooted In A Long History”, Knowledge Horizons, Butterworth-Heinemann,

Boston, pp. 3-2642-Marr B., Schiuma.G. & Neely A. (2003). “The Dynamic of Value Creation-

Mapping Your Intellectual Performance Drivers”. The Centre for Business

Performance, Grandfield School of Management. “Unpublished”

-Marian Gruian C.(2011) “The influence of intellectual capital on Romanian

companies financial performance .” Annalesuniversitatis Apulensis series

oeconomica, Vol. 2, p. 9

-Malhotra, Yogesh, 2003, ” Measuring Knowledge Assets of a Nation

Knowledge systems for Development”, UN. New York 4-5-Sptember, P.16.

-Sharabati, A.A., Jawad, S., &Bontis, N. (2010). Intellectual Capital

andBusiness Performance in the Pharmaceutical Sector of Jordan.

Management Decision, Vol. 48, No. 1, 2010, pp. 105-131, ©Emerald

-Rehman, W., Ghaudhary, A., Rehman, H., &Zahid, A. (2011).

“Intellectual Capital Performance and its Impact on Corporate Performance: An

Empirical Evidence from Modaraba Sector of Pakistan”,Australian journal of

Business and Management Research, August, Vol.1, No. 5, pp. 08-16.

-Pulic, A 2002, “Do We Know if We Create or Destroy Value?”, VAIC.

Retrieved February 20, 2007, from http://www.vaic-on.net/download/Konf2002-

Pulic.pdf

التنزيلات

منشور

كيفية الاقتباس

إصدار

القسم

الرخصة

الحقوق الفكرية (c) 2014 كلية الإدارة والإقتصـــاد _ جامعة كربـــلاء

هذا العمل مرخص بموجب Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

يحتفظ المؤلفون بحقوق الطبع والنشر لأوراقهم دون قيود.