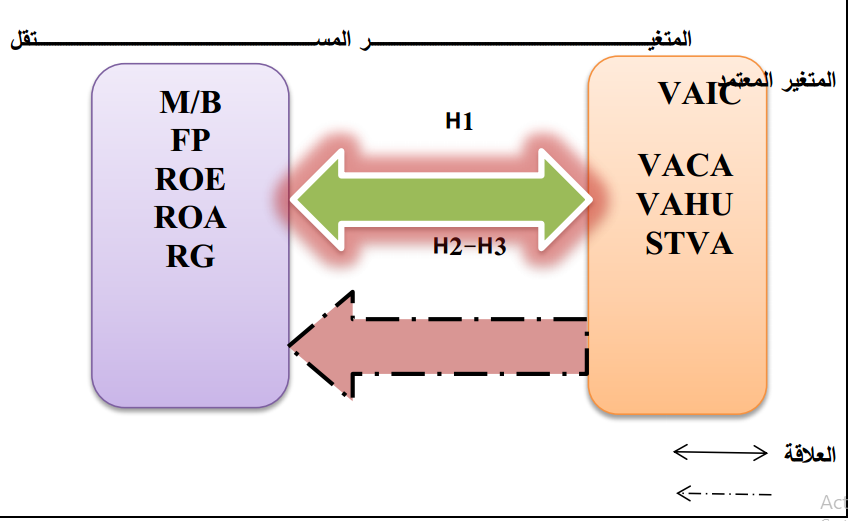

Intellectual capital and its impact on market value and financial performance - an applied study of a sample of banks listed on the Iraqi Stock Exchange for the period from (2008-2013)

Keywords:

Intellectual capital, Market value, financial performanceAbstract

The idea of the research focuses on the nature and type of relationship that links intellectual capital to the dimensions of market value and financial performance among a sample of 20 banks for the period from 2008-2013. The researcher decided to build four mathematical models through the multiple regression equation, and to test the relationships between the variables, a number of statistical methods were used. Suitability such as linear relationship, equality of variance, and (D-W) test. As for testing the hypotheses, Pearson analysis and linear regression analysis were used. The research has reached a number of conclusions, the most prominent of which is that banks’ possession of intellectual capital as an asset contributes to achieving competitive advantage and indicates a positive and morally significant correlation and influence between intellectual capital and both the market value and financial performance of the banks in the research sample. Finally, the research recommended the need to benefit from Intellectual capital measures to diagnose and enhance this asset in line with maximizing the bank’s value and improving its financial performance.

References

Alipour, M.(2012),"the Effect of intellectual capital on firm performance:an

investigation of Iran Insurance companies, "Measuring Business Excellence

,vol.16 ,no.1 ,p-20.

-Bontis Nick( 2004) "national Intellectual capital ndex. Aunited nations

initiative for the Arabregion journal of intellectual capial vol.5, no.1 ,p13-39.

-April ,Kurt. A ,2002.,"Guidelines for Developing a K-strategy ,journal of

Knowledge management ,vol.6,no.5 .

-Thomas Hausel (2001);"Measuring and Managing Knowledge ".Mc raw Hill.

-Stewart .A,(1999)"Intellectual Capital the new weath of qrganization ,Double

Day Carrency ,new york, p 163.6-Bontis, N., 1999, “Managing organizational knowledge by diagnosing

intellectual capital : framing and advancing the state of the field

Intellectual Journal of Technology Management, 18(5/6/7/8), 43-46. 7-

Chen, M.C., S.J. Cheng, and Y. Hwang, 2005, “An empirical investigation of the

relationship between intellectual capital and firms’ market value and financial

performance”, Journal of Intellectual Capital, 6(2), 159-176

-Firer, S., and S.M. Williams, 2003, “Intellectual capital an Traditional

measures of corporate performance”, Journal of Intellectual Capital, 4(3), 348-

-Pulic, A., 2000, “VAIC – an accounting tool for IC management”,

International Journal of Technology Management, 20 (5,6,8), 702-714.

-Roos, G., J. Roos, L. Edvinsson, and N.C. Dragonetti, 1997Intellectual Capital

Navigating in the New Business Landscape, New York University Press, New

York, NY.

-Sullivan, P.H., 2000, Value-driven Intellectual Capital: How toconvert

Intangible corporate Assets into Market Value, John Wiley And Sons

Riahi- .Toronto, Canada

Belkaoui, A., 2003, “Intellectual capital and firm performance of US

multinational firms: a study of the resource-based and stakeholder views”,

Journal of Intellectual Capital, 4(2), 215-226.

Maps: 13-Eppler, M., (2003) "Making Knowledge Visible through Knowledge

Concepts, Elements, Cases," in Holsapple, C. (Ed.), Handbook on

Knowledge Management (New York: Springer,), pp.187-205

-Starovic.g and Marr,b. (2003). “The Dynamic of ValueCreationMapping Your

Intellectual Performance Drivers”. TheCentre for Business Performance,

Grandfield School of Management. .Unpublished

-Hansen M. Nohria. N &Terncy. 1999, Twhats Your Strategy for Managing

Ledge, Harvard Business Review, March-April.

-Edvinsson,l.&Malone,M.,1997 study:"intellectual capital : realizing your

companys true vale by finding its hidden brainpower" ,harper

Busiess.newyork,p34-35

- Hamel, Grary & Heene, Airne,(1994)"Competence-Based Competition",

JohnWiley& SonsInc, U.S.A,

-Karp, Tom, 2003, INTELLECTUAL CAPITALISM: Is Intellectual Capital the

New Wealth of Business Organisations? http://tom.karp.as/capital.pdf.

- Charles Despres and D. Chauvel (2000): Butterworth Heinemann, Boston,

p317.

- Miller, William, Building The Ultimate Resource, Management Review, 88 (1),

Jan. 1999, p. 42-45.5

- Bassi, Laurie, J, Harnessing the power of intelectual capital, Training &

Development, 51 (12), Dec. 1997,p. 25-30

- Xiao , Huafang , " Corporate Reporting of Intellectual Capital : Evidence

from China " , The Business Review , (Vol.11 , No.1 , 2008) Available From

www.proquest.com

- Campisi, D., and R. Costa, 2008, “A DEA-Based Method to EnhanceIntellectual Capital Management”, Knowledge and Process Management

-Kannan, G. and Aulbur, W. G. (2004) “Intellectual capital

Measurementeffectiveness”, Journal of Intellectual Capital, Vol. 5 No.

-Skyrma,D.,2002,Measuring intellectual capital Aplelhara of methods lnsinh

,journal of banking and finance,vol.1.no.24.

- Swart,jouani.2005" indentifying the sub .compoments of intellectual capital

:Aliteraturereviven& development of measures ,school of management ,university

of Bath uk .

-Ding,Yonliang & li ,Guauzhay " study on the management of intellectual

capital ini journal of business & management vol.5,no.2 f 2010

-Fath,Saeed ." Farahmand& ,shekalteh Khoransani ,Mahnas" Imact of

intellectual capial on financial performance " intetrnayionl journal of

Acodemicresarh in economic and management sciences vol .2,no.1,2013.

-Shkina,elena, Barajas,angal,"the relation ship between intellectual capial

quality and corporate performance : an empirical study of Russian and European

campaniesecomomic annals vol.7,no. 192,2012.

-Reid , J9 (1998 ) Intellectual capital , Business Quarterly , vol.1.NO6

-Harrison ,s.,& Sullivan,p.,2000study"profiting from intellectual capital

,vol.1,no.1.

-Unger, Marius, 2004, Developing core capabilities In A Financial Services

Firm: An Intellectual Capital Perspective Dissertation For Commerce Degree

ph.D.Rand Afrikaans University, p112

-BDL,(2007) , "Intellectual Capital Statement" Business & Development

Learning Institute – BDL Institute -51, rue Saint Charles 78000 Versailles –

France .

-Royal ,Carol& Donnell ,Loretta O ,(2008) ," Differentiation in financial

markets: the human capital approach" Journal of Intellectual Capital ,Vol.9

No.4.

-Royal ,Carol& Donnell ,Loretta O ,(2008) ," Differentiation in financial

markets: the human capital approach" Journal of Intellectual Capital ,Vol.9

No.4.

-Milost , Franko(2007) , "A dynamic monetary model for evaluating employees

" , Journal of Intellectual Capital ,Vol. 8 No.1.

-Roos, G. and Roos, J. (1997) “Measuring your company’s intellectual

performance”, Long Range Planning, Vol. 30, No.

-Hansen M. Nohria. N &Terncy. 1999, Twhats Your Strategy for

Managing Ledge, Harvard Business Review, March-April.

-Martin ,boddy.( 2005)"the knowkedge driven economy ,regional economic

strategy& regional spatial strategy in the south west of England " final lrepot to

the south west of England regional development april.

-Wiig, K.M. (2000), Study: “Knowledge Management: An Emerging Discipline

Rooted In A Long History”, Knowledge Horizons, Butterworth-Heinemann,

Boston, pp. 3-2642-Marr B., Schiuma.G. & Neely A. (2003). “The Dynamic of Value Creation-

Mapping Your Intellectual Performance Drivers”. The Centre for Business

Performance, Grandfield School of Management. “Unpublished”

-Marian Gruian C.(2011) “The influence of intellectual capital on Romanian

companies financial performance .” Annalesuniversitatis Apulensis series

oeconomica, Vol. 2, p. 9

-Malhotra, Yogesh, 2003, ” Measuring Knowledge Assets of a Nation

Knowledge systems for Development”, UN. New York 4-5-Sptember, P.16.

-Sharabati, A.A., Jawad, S., &Bontis, N. (2010). Intellectual Capital

andBusiness Performance in the Pharmaceutical Sector of Jordan.

Management Decision, Vol. 48, No. 1, 2010, pp. 105-131, ©Emerald

-Rehman, W., Ghaudhary, A., Rehman, H., &Zahid, A. (2011).

“Intellectual Capital Performance and its Impact on Corporate Performance: An

Empirical Evidence from Modaraba Sector of Pakistan”,Australian journal of

Business and Management Research, August, Vol.1, No. 5, pp. 08-16.

-Pulic, A 2002, “Do We Know if We Create or Destroy Value?”, VAIC.

Retrieved February 20, 2007, from http://www.vaic-on.net/download/Konf2002-

Pulic.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2014 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.