Evaluating the transparency in the disclosure of financial and non-financial information for private Iraqi banks and its impact on the market value of shares

Keywords:

Transparency, disclosure of financial and non-financial informationAbstract

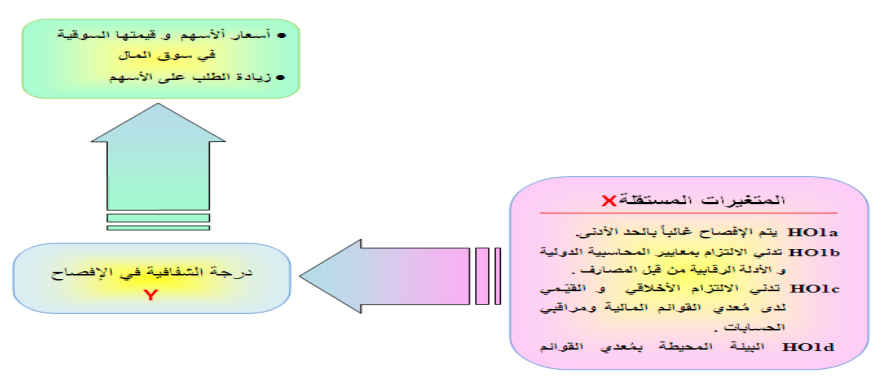

Transparency in Accounting an attractive issue, The objective of this research is to Evaluating of Transparency in the Disclosure of Financial Information Published for Iraqi Private Banks and its Reflections on Market Value of Shares. Banks are main sector that make correlative with the world Transparency as a concept isn’t a replacement concept of disclosure but it is a tool to confirm full disclosure. Then to know the methods to close the gaps between Attainable level and Ideal level, and between accountants and users of financial statement.

Transparency is measured according to standards & poor scale. Iraq is third country in the Arab countries used this scale in this research to measuring transparency.

The main result of this research is that highly transparency degree of financial information for Iraq private banks reflect in increasing order to its stocks and highly value of its. The research contents five chapter , first present general framework of research and previous research , the second present theoretical background , the third present transparency and Qualitative characteristics of accounting information and kinds of disclosures , the forth present historical brief of Iraqi banks and transparency measurement and testing of hypotheses , the last chapter present conclusions and recommendations .

References

Laurence Lescourret, Christian Y. Robert: 2011 “Transparency rules: Price

formation in the presence of order referencing “Journal of Financial Markets,

Volume 14, Issue 2, May 2011.

FASB, SFAC,NO.8,2010:”Qualitative Characteristics of Accounting Theory,

th

.

Klan-Ping Lim, Robert D. Brooks, Jae H. Kim: 2008 “Financial crisis and

stock market efficiency: Empirical evidence from Asian countries”,

International Review of Financial Analysis ,Volume 17, Issue 3,June 2008 .

Robert , m. v., clear as glass,2005, “transparent financial reporting ,healthcare

financial Management” ,vol.59.

Oxford English Readers Dictionary ,1959,London,Oxford Press.

.Kieso , Weygandt ,Warfield,” Intermediate Accounting”, IFRS edition, 2011.

Kieso, et al.” Intermediate Accounting “,volume2,IFRS. WILEY Middle

East,(2012).

.Jeter,Chaney,2010,” Advanced Accounting”4th Edition,

Patel ,S .,and Dallas. 2002 ”transparency and disclosure :overview of

methodology and study results– united states, governance standard and poor‘s

com

Yang & Tony Aranoff, ,2003 “Improving Disclosure and Transparency in

Nonprofit Accounting”

,Michael ,o.,et. al. ,2006 transparency in financial statements A conceptual frame

work from A perspective.

Che Haat et al. 2008"Transparency and Performance of Malaysian

Companies"

Kian-Ping Lim, Robert D. Brooks, Jae H. Kim: “Financial crisis and stock

market efficiency: Empirical evidence from Asian countries”, International

Review of Financial Analysis ,Volume 17, Issue 3,June 2008

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2014 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.