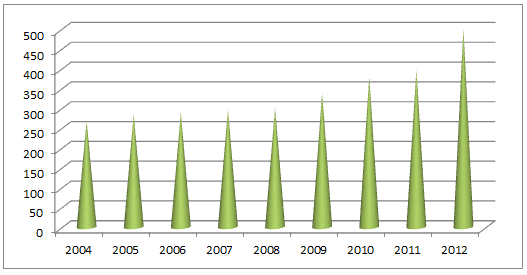

Challenges of Islamic banks in light of financial globalization: An analytical study of the reality of Islamic banks in the world for the period (2004-2012)

Keywords:

Challenges of Islamic banks, financial globalizationAbstract

Witnessed economic sectors in general and the financial and banking sector specifically tremendous changes and the rapid spread effects and Chapkadtha front and rear to nurture and develop the rest of the economic sectors consisting of a country\'s economy, in light of these developments, large global acceleration evolved the idea of Islamic banks, as it is the subject of Islamic banks of modern subjects in Banking and Finance, and has become of these banks under the requirements of the modern era an economic necessity for every Muslim society refuses to deal benefit, but extended attention and application in this field for the rest of Western societies and non-Islamic. spite of these global developments and challenges enormous able Islamic banks to lay foundations and build a knowledge base well established in international financial transactions, it became the Islamic banking is a reality in the life of international banking after it made its way in environments banking far in the foundations and rules and mechanisms for Islamic rules, and was able to achieve tangible successes by providing for a range of formats finance banking successful and distinctive and away from the base of the debt and usury, which is based upon the work of traditional banks, as well as its entry into the financial markets through some financial instruments are consistent with the provisions of Islamic Sharia.

She has lived most of the countries of the world in the recent disturbances and structural imbalances in the overall economic sectors , particularly banking and financial sector as a result of the recent global crisis that hit most countries in the world and is still suffering a lot of countries, and the global impact of the crisis and its repercussions . The nicest specialists and researchers , economists said that the crisis was behind them a lot of reasons perhaps most notably away the financial sector from the real thing , and what was the subprime crisis , but the spark that lit the fuse , and there are those who felt that the most important reasons behind the crisis is the lack of transparency and weak oversight and poor risk management and others.

The recent crisis has highlighted, and proved that there is a fundamental problem at the core of the global economy, which is difficult to achieve a balance of economic and financial under the facts of these economies, making them rely on or look at new data to resolve the economic problems and perhaps among the most prominent data is data Islamic economic thought, which provides Meal integrated economic problems and solutions of any economy. This economic thought in general and Islamic banking in particular represents a real application of the economic and banking transactions based on the real economy. Therefore, this study was to shed light on the nature and origins of Islamic banks and financial impact of globalization on them, as well as the impact of the global financial crisis on the financial sector to some Arab economies and what the most important challenges facing the Islamic banking in the light of globalization of financial data.

References

• القرآن الكريم

اولاً : المصادر العربية : أ-الكتب :

- دنيا , شوقي احمد , الجعالة والاستصناع (تحليل فقهي واقتصادي ) , الطبعة الثالثة , المعهد الاسلامي للبحوث والدراسات , البنك الاسلامي للتنمية , جدة-السعودية , 2003.

ب- البحوث والمقالات :

- بلوناس , عبد الله , عولمة الاقتصاد-الفرص والتحديات - , مجلة جامعة دمشق للعلوم الاقتصادية والقانونية , المجلد /24 , العدد/ 1 , سوريا , 2008 .

- دردور,اسماء و بن زواي , نسرين , الازمة المالية الحالية ومستقبل العولمة المالية , الملتقى العلمي الدولي حول الازمة المالية والاقتصادية الدولية والحوكمة العالمية , جامعة فرحات عباس –سطيف , الجزائر , 2009 .

- عبد اللطيف ,مصيطفى و سليمان , بلعور , تحديات العولمة المالية للمصارف العربية واستراتيجيات مواجهتها : مع الاشارة الى القطاع المصرفي الجزائري , ضمن ملتقى المنظومة المصرفية الجزائرية والتحولات الاقتصادية – واقع وتحديات - , جامعة الشلف , الجزائر , 2004 .

- فاروق , تشام , العولمة المالية واثارها على القطاع المصرفي والنمو الاقتصادي في البلدان العربية , من بحوث المؤتمر العلمي الاول لكلية الاقتصاد والعلوم الادارية , جامعة العلوم التطبيقية , عمان – الاردن , 2003 .

- هاوسلر , جيرد , عولمة التمويل , بحث منشور في مجلة التمويل , صندوق النقد الدولي , العدد 1 , 2002 .

ثانياً: المصادر الاجنبية :

A- Books

- Iqbal , Zamir & Mirakhor , Abbas , "An Introduction to Islamic Financial :theory and practice " , John Wiley & Sons (Asia) Pte. Ltd. , Singapore , 2007 .

- Kose, M. Ayhan , Prasad, Eswar , Rogoff, Kenneth & Wei , Shang-Jin , " Financial Globalization and Economic Policies", Handbook of Development Economics, Copyright in Elsevier BV, North-Holland, 2010 .

- Walf ,M .Fixing Global Finance ,the Johns Hopkins university press , Maryland.2008

B- Journals & Articles

- Asutay , Mehmet , Conceptualising and Locating the Social Failure of Islamic Finance: Aspirations of Islamic Moral Economy vs the Realities of Islamic Finance , Asian and African Area , studies ,Vol. 11 ,No. 2 , 2012 .

- Arestis, Philip & Basu, Santonu , " Financial Globalization and

Regulation" , The Levy Economics Institute 2003 All rights

reserved, Working Paper No. 397 ,U.S.A , 2003.

- Canterbery , E.Gray, 'A brief history of Economics : artful approaches to the dismal science ,New Jersey :World science ,2001 .

- Cebeci , Ismail , " Integrating the social maslaha into Islamic finance ", Emerald Group Publishing Limited, Accounting Research Journal , Vol. 25 , No. 3, 2012 .

- Ebrahim, M. Shahid& Joo , Tan Kai ," Islamic banking in Brunei Darussalam", International Journal of Social Economics, Vol. 28, No. 4, 2001.

- Imam, Patrick and Kpodar , Kangni , Islamic Banking: How Has it Diffused, IMF Working Paper, International Monetary Fund , August 2010 .

- Khan, M. Mansoor & Bhatti, M. Ishaq , " Development in Islamic banking: a financial risk-allocation approach" , The Journal of Risk Finance , Vol. 9, No. 1, 2008 .

- Al-Muharrami ,Saeed & Hardy , Daniel C. , ''Cooperative and Islamic Banks: What can they Learn from Each Other '' , IMF Working Paper in Monetary and Capital Markets , 2013.

- Prasad, E., K. Rogoff, S-J. Wei and M. A. Kose , “Effects of Financial Globalization on Developing Countries: Some Empirical Evidence.” , 17 March, Washington D.C.: International Monetary Fund, 2003 .

- Priest , Diana, “CIA Holds Terror Suspects in Secret Prisons”, Washington Post, 2 November , 2005 .

- Sadove, Diana & Cuza, Alexandru Ioan ," Islamic Banking European Union Countries : CHALLENGES AND OPPORTUNITIES", Working Papers, Vo,3,No. (4), 2011.

- Shah,Syed Farhan ,Raza , Muhammad Wajid & Khurshid ,Malik , Islamic Banking Controversies and Challenges interdisciplinary journal of contemporary research in business , Vol. 3, No. 10 , 2012 .

- Siddiqi , Mohammad Nejatullah , Islamic Banking and Finance in theory and practice , Islamic Economic studies ,Vol. 13 , No. 2 , 2006.

- Wilson , Rodney , The development of Islamic finance in the GCC, Working Paper, Kuwait Programmed on Development, Governance and Globalization in the Gulf States , 2009 .

- Zaman , Raquibuz M. , Movassaghi , Hormoz , ' Islamic Banking :A Performance Analysis' , The Journal of Global Business, Volume 12, No. 22, Spring 2001 .

C- Reports

- Central Banks; The Banker; Islamic Business and Finance Network; Islamic Development Bank; Printed in Booz & Company Inc., USA ,2008.

- ERNST & Young , the world Islamic banking , competitiveness report , 2012 .

- HSPC Bank , Introduction to Islamic Investing : For professional clients only , Of individual reports to the bank ,2012 .

- Islamic Financial Services Board , Islamic Financial Services Industry , Report 2013.

- World Bank , World development indicators 2008.table1-1 size of the economy ,2008 .

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2015 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.