The effect of the informational content of stock buyback announcements on their prices depending on the size of the company

Keywords:

Informational content, share buybacksAbstract

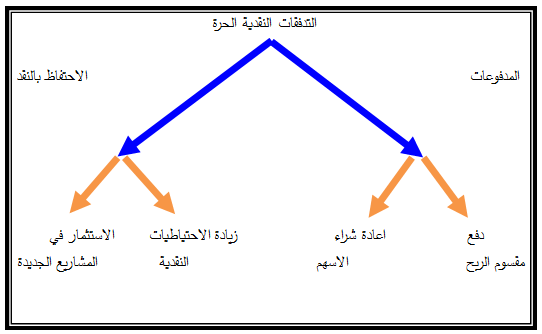

Main aim of this study to reveal the impact of repurchases announcement of Common Stock on its Prices in the Formwork of Signal Theory based on the size of firm , and the role of this theory in explaining processing the informational asymmetry of supports efficiency of the market and the availability of information to help investors making decisions rational , repurchases is a positive signal sent to the investors in financial market its including that the management believesthat stock is trading in financial market are below their fair value . The study is based on two main dimensions of the problem for which the following two hypotheses were devised : -

• The size of firm has no relationship on the strength of the signal sent to the market through the repurchasing announcement , and therefore the does not vary size of informational asymmetry according to firm size .

• The Kuwait Stock Exchange is not efficient in level a half strong in response to the informational content of the repurchase announcement .

The study sample included 170 announcement made by 65 firm listed on the Kuwait Stock Exchange for the period from 1/1/2012 to 24/4/2015 . It is worth mentioning that the selection of Kuwait Stock Exchange was a means, not an end, since the foundation end is studying Iraq Stock Exchange but for technical reasons related with the absence of the academic awareness needed for repurchase programs by the firms on the one hand and the dealers in the market from the other hand , this creative mechanism of the policy of payment was not used and the many advantages of it were lost which that can interests of all the parties in market , and does not end with bridging the gap of informational asymmetry and improve the efficiency of the market specialized of the rare economy resources .

Through the use of various financial and statistical methods using (EXCEL) for analyze the variables of the study and test its hypotheses, the study reached the following conclusions, most important of which is that size of firm has relationship on the strength of the signal sent to the market through repurchases announcement , and argued on through the results average of the accumulated abnormal return value stocks versus growth stocks . the most effect was of value stocks with great difference , this is contrary to the first hypothesis . the study also proved that there was an inefficient response to the informational content of the repurchase announcement by the Kuwait Stock Exchange . This confirms the market inefficiency in a half strong manner and this supports the truth of second hypothesis of the study . Based on this , the study reached a number of recommendations including necessity of adopting on the signal theory especially in inefficient financial markets to reduce the problem of informational asymmetry between insiders and outside investors.

References

Brigham , Eugene . F, &Ehrhardt , Michael, "Financial Management Theory and Practice"11th ed. , U.S.A: South / Westernin, Thomson Learning , 2005 .

Berk , Jonathan & DeMarzo , Peter ,"Corporate Finance", New York : Pearson/ Addison Wesley, 2007 .

Brown , Keith ,C. & Rielly, Frank , K. , "Analysis of Investment and Management of Portfolios", 9th ed. , South-Western , 2009 .

Vernimmen, Pierre "Finance d’ Enterprise", 5th ed. , Dalloz , Paris , 2002 .

Brennan , Michael, J. & Avanidhar , Subrahmanyam " Investment analysis and price formation in securities markets","Journal of Financial Economics" ,Vol . 38, 1995 .

D Mello, Ranjan & Shroff, Pervin "Equity Undervaluation and Decisions Related To Repurchase Tender Offers: An Empirical Investigation", "The Journal of Finance" ,Vol .5 , 2000 .

Elfakhani ,Said, " An Empirical Examination of The Information Content of Balance Sheet and Dividend Announcements: A Signaling Approach", "Journal Of Financial And Strategic Decisions" ,Vol . 8, No( 2) , 1995 .

Fama, E., & French, K. , "New Lists: Fundamentals and Survival Rates", "Journal of Financial Economics" ,Vol . 73, No (2), 2004 .

Fama, Eugene, & French, Kenneth " Disappearing dividends: changing firm characteristics or lower propensity to pay", "Journal of Financial Economics" , Vol. 60, No(1) , 2001 .

Firth, Michael ;Leung ,T.Y.& Rui ,O.M.,"Double Signals or Single Signal?An Investigation of Insider Trading Around Share Repurchases" HKIMR Working Paper No.22 , 2008.

Gup , Benton & Nam, Doowoo"Stock Buybacks , Corporate Performance and EVA" , " Journal of Applied ,Corporate Finance" ,Vol . 14, No(1) , 2001 .

Gupta , S . ; Kalra , N. & Bagga , R . " Do Buybacks Still hold their Signaling Strength? An Empirical Evidence from Indian Capital Market ", "Amity Business Review" ,Vol .15, No(1) , 2014 .

Isa , Mansor ; Ghani, Zaidi and Lee, Siew‐Peng "Market Reaction to Actual Share Repurchase in Malaysia ", "Asian Journal of Business & Accounting", Vol .4,No (2) , 2011 .

Lakonishok , J. &T. Vermaelen "Anomalous Price Behavior Around Repurchase Tender Offers,” , "Journal of Finance", Vol .45, 1990 .

Nossa , S. N; Lopes , A. B. & Teixeira, A . "Stock repurchases and fundamental analysis: an empirical study of the brazilian market in the period from 1994 to 2006", "Brazilian Business , Review Vitoria" ,Vol . 7, No ( 1) , 2010 .

Pettit , J. "Is a Share Buyback Right for Your Company?" , "Harvard Business Review", Vol . 79, No (40), 2001 .

Rajabimoghadam, M. & Khalatbari, A. " The Effect of Market Conditions on Information Content of Dividend ". "Interdisciplinary Journal of Contemporary Research In Business", Vol . 5, No (4) , 2013 .

Travlos, N.; Trigeorgis , L. &Vafeas , N. "Shareholder Wealth Effects of Dividend Policy Changes in an Emerging Stock Market: The Case of Cyprus" ,"Multinational Finance Journal", Vol. 5, No.(2), 2001 .

Washer, Kenneth M. & Blanch,G . F. " Actual Share Repurchases and Capital Gains In The Hospital Lity Industry ", "Journal of Business Administration online", Vol. 2 No(2) , 2003 .

Wu, Ming-Cheng ; Kao C.H , Erin & Fung , Hung-Gay" Impact of Dividend-Protected Employee Stock Options on Payout Policies: Evidence from Taiwan ","Pacific Economic Review", Vol. 13, No(4), 2008 .

Andreas , Hackethal & Alexandre , Zdantchouk , " Share Buy-Backs in Germany Overreaction to Weak Signals?" Goethe University Frankfurt , 2004 .

Chen, Chao, " The Credibility of Stock Repurchase Signals" California State University , 2007 .

Chen, Fei,"Capital Market Reaction to Share Repurchase Announcements : An Empirical Test on Shanghai Stock Exchange (SSE)", A research project submitted in partial fulfillment of the requirements for the degree of Master of Finance, Saint Mary’s University , 2013 .

Chiao, Chaoshin; Chih, Hsiang-Hsuan; Wang, Zi-May & Hsu ,Ya- Rou " The Order Submission Behaviors surrounding Open-Market Repurchase Announcements: The Examination of a Missing Link Embedded in the Signaling Hypothesis "National Dong Hwa University , 2007 .

Cremers, J.S. ,"Testing the Motivation for Share Repurchases: Firms in the Netherlands and Germany" Master Thesis Finance, Tilburg University , 2012

De Vyver, Riaan Van , " Stock Repurchases by Real Estate Investment Trusts : Investors Reactions mad the Impact on Shase Price Performance " University of Pretoria , 2011 .

Espenlaub, Susanne ;Khurshed, Arif & Yang, Tianna " Why closed- end funds make open-market repurchases"tianna,2010 yang@postgrad. mbs. ac. uk .

Frilander, Juho ,"Study of Share Repurchases & Cash Holdings: Nordic Evidence" Master’s Thesis , Aalto University, 2013 .

Ghosh. C; Giambona. E; Harding . P. J; Sezer.o & Sirmans .F. C, " The Role of Managerial Stock Option Programs in Governance : Evidence from REIT Stock Repurchases". 2010 .

Kim , Inho & Kim ,Y. H . , " Share Repurchase Rumors : Signaling, Publication, and Reputation Effects" University of Cincinnati , 2012.

Lee, Sangwon, Seunghun Han, & Minhee Kim ,"Information asymmetry, corporate governance, and shareholder wealth: Evidence from unfaithful disclosures of korean listed firms", Working paper, 2011 .

Markopoulou , M.K. & Papadopoulos. D.L. ,"The Capital Structure of Companies Listed in The Greek Stock Exchange" University of Macedonia Thessaloniki, Greece , 2010 .

Micheloud ,G . A . ," How Do Investors Respond To Share Buyback Programs? Evidence From Brazil During 2008 Crisis ", 2013 .

Mu, Lin" Stock Price Reactions To Dividend Changes: Evidence From The Johannesburg Stock Exchange", A dissertation presented to the Faculty of Commerce at the University of Cape Town in partial fulfilment of the requirements for the degree of Master of Commerce in Financial Management , 2006 .

Otchere, Isaac & Ross, Matthew , " Do Share Buy Back Announcements Convey Firm Specific or Industry wide Information? A Test of the Undervaluation Hypothesis" , University of Melbourne , 2000 .

Teng, M . & Hachiyab , T. , " The Pump-Priming Effect of Regulatory Reform on Stock Repurchases: Evidence from Lifting the Ban on Treasury Stocks in Japan " Hitotsubashi University, Japan , 2010a.

Thanatawee ,Yordying ,"The Information Content of Dividends and Open market Share Repurchases: Theory & Evidence" A thesis submitted to the degree of Doctor of Philosophy , University of Bath , 2009 .

Wada , Kenji , " Stock Repurchases in Japan" , Keio University , 2010 .

www.kuwaitse.com .

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2015 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.