From traditional finance to behavioral finance: radical intransigence - a theoretical study of the most important contemporary traditional and behavioral financial doctrines

Keywords:

Traditional finance, behavioral financeAbstract

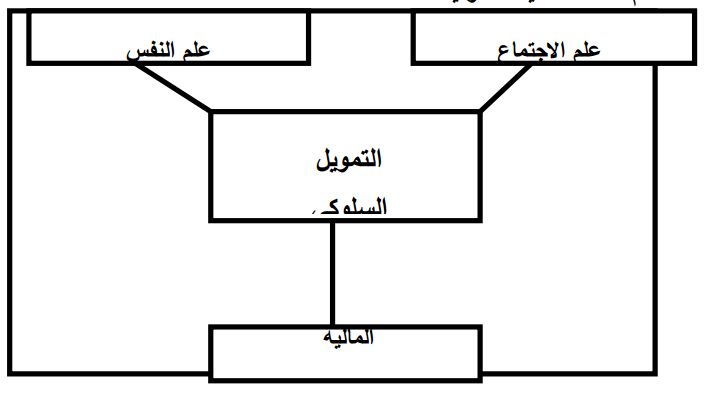

Traditional finance has relied on understanding financial markets using models that consider participants in the markets to be rational, and rationality here means two basic things: updating ideas and beliefs when receiving any new information, and making standardly acceptable decisions based on this information. But this traditional understanding of the markets Finance could not explain many of the unusual phenomena in these markets, such as the emergence of bubbles and financial crises that plague these markets. Therefore, the study aimed to present and present the most important intellectual controversies and disagreements about behavioral finance theories and their ability to analyze markets. The study was based on a theoretical problem represented by the continuation of intellectual controversy. The theoretical conflict between supporters of traditional financial theories and advocates of behavioral finance theory, as the study attempts to shed light on the most important proven and refuted evidence for these theories by presenting the ideas and foundations on which both groups relied, while clarifying the dividing points that separated financial thought from the traditional approach based on market hypotheses. Efficiency and the ability to arbitrage to the behavioral approach, which added the psychological and social behavioral variables affecting the investment decision-making process to traditional financial models in order to understand, evaluate and predict financial market movements. Hence the problem arose, which is framed by not taking into account the cognitive biases affecting investors’ decisions when making buying or selling decisions and thus misestimating the prices of financial assets in these markets. Psychology has tried to explain and explain the set of errors and cognitive biases that the investor suffers from when making the investment decision and this appears. The importance of the study that attempts to understand the reasons for the emergence and recurrence of anomalies in stock markets, such as bubbles or successive crises, which deviate slightly or greatly in their general behavior from the basic assumptions of traditional finance, which attempted to explain and analyze financial markets from the perspective of investor rationality and the ability of arbitrage operations to stabilize fair prices for financial assets. Behavioral finance therefore emerged in response (at least in part) to the difficulties facing the traditional model. In a broader sense, there is a set of phenomena that can be better understood using models that assume the irrationality of some market participants. This occurs precisely when one or both of the doctrines associated with the rationality of investors are relaxed. In some models of behavioral finance, market participants may fail to update their beliefs and expectations correctly upon receiving new information, and sometimes participants make choices that are questionable at best. This study attempts to delve into the depths of the human psyche of investors in stock markets to explore subjective tendencies, emotions, feelings, and elements Psychological factors that affect investors\' decisions in stock markets and make them not make the optimal rational decision. The study concluded that most traditional financial models are unable to explain anomalies in stock market movements without paying attention to the psychological and social elements that guide investor behavior when making investment decisions, so it confirmed. The importance of understanding investor behavior through knowing and understanding the psychological and social behavioral elements that lead him to make a decision to buy or sell any securities because understanding investor behavior helps to understand and predict future market movements accurately, and thus achieve returns higher than the average or avoid the risks accompanying the decisions. Investment.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2014 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.