The effect of VIX index volatility on the S & P 500 index and gold prices

Keywords:

VIX index (VIX), S&P 500 index, gold pricesAbstract

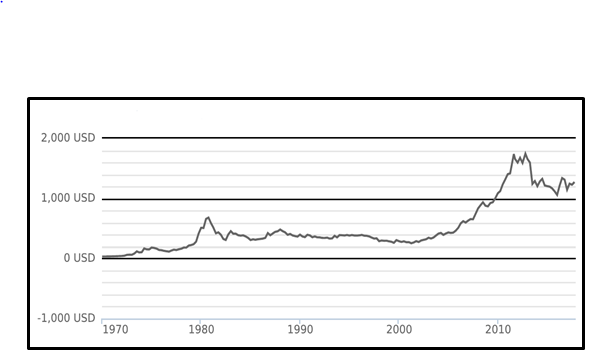

The stock market and commodity markets in general are witnessing continuous fluctuations at a different pace depending on the economic changes and the various geopolitical events. There are a huge amount of economic and financial changes and geopolitical events affecting the financial markets and commodities and bond markets, but vary according to the expectations of traders and investors in those markets. This study is marked by the impact of VIX volatility on the S & P 500 and gold prices to highlight the most important indicators that measure stock risk or stock volatility and its impact on the S & P 500 and gold prices. The importance of the study is that it focuses on the study of the important subject of the index (VIX) and what this indicator and how to build and calculate this indicator and its impact on stock prices and prices of gold. The study aimed at identifying the theoretical and practical aspects of the index and dependent indicators, and studying the relationship between the VIX index, the S & P 500 index, and the gold prices.

The hypotheses of the study were tested through two methods: the analytical and descriptive method of the historical data series, the use of graphs, the statistical methodology using Eviews (7) and the Excel program.

The most important conclusions of the study are: First: the VIX index or variance index of different denominations is a measure of the magnitude of the risk expected in the US stock market. Secondly, there is a negative correlation between the FEX index and the (S&p) The higher the index, the lower the index (S & P) index the third: there is a direct correlation between the index and the price of gold.

The most important recommendations of the study are: First: the need for interest of researchers and academics concerned with the study of the US financial markets and the factors and indicators affecting these markets as the US financial markets play an influential role in the global economy and the global financial markets. Second: the need to follow up and study the index by researchers and academics because it gives clear perception of the magnitude of risk investors expect in the US stock market and the US economy.

References

- Baur Dirk G. , Lucey Brian M. ,( Is Gold a Hedge or a Safe Haven? AnAnalysis of Stocks, Bonds and Gold),2010, Dublin City University, Business School.

-Bodie Zvi , Alex Kane and Marcus Alan J. ,"Elements of Investment ", Mcgraw-hill, Fifth Edition, 2003.

-Cook Timothy. D,( The Demand For Gold By industry),International Gold Corporation, Gold Bull ,1982,15.

-D’Anne Hancock( VIX and VIX Futures Pricing Algorithms: Cultivating Understanding ) Modern Economy, 2012, 3, 284-294

,Finance University of Missouri-St. Louis, St. Louis, USA ,.

-Imlak Shaikh ,Puja Padhi (The Behavior of option S implied Volatility index:A Cas of india VIX),2015 , www.btp.vgtu.lt.

-LARRY WILLIAMS, (The VIX fix)December 2007, www.activetradermag.com.

-LBMA, Datastream, Bullion Desk /Fast Markets,World Gold .Council.

-Mao Xin (The VIX Volatility Index),2011, Uppsala University.

-Michael Jalonen, Jason Fairclough, Stephen Gorenstein,( Gold & gold industry primer),Bank of amerce 2013.

-Mohd Fahmi Ghazali, Hooi-Hooi Lean, Zakaria Bahari,( Is Gold a Hedge or a Safe Haven? An Empirical Evidence of Gold and Stocks in Malaysia), International Journal of Business and Society, Vol. 14 No. 3, 2013, 428 – 443.

-Rachel Harvey,( The Early Development of the

London Gold Fixing),2011, Alchemist issue Sixty five .

-Sally Jewell , Suzette M. Kimball ,( MINERAL COMMODITY), Manuscript approved for publication January 28, 2016 .

-Sabine Dammasch,( The System of Bretton Woods) 2000.

-Tony Christie , Bob Brathwaite (Mineral Commodity Report 14 — Gold),1997, Institute of Geological and Nuclear Sciences

Limited.

-www.CBOE.com , Chicago Board Options Exchange ,2016.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2019 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.