Psychological perspective of investing in the stock market (Introduction to behavioral finance)

Keywords:

Psychological perspective of investing, stock market, behavioral financeAbstract

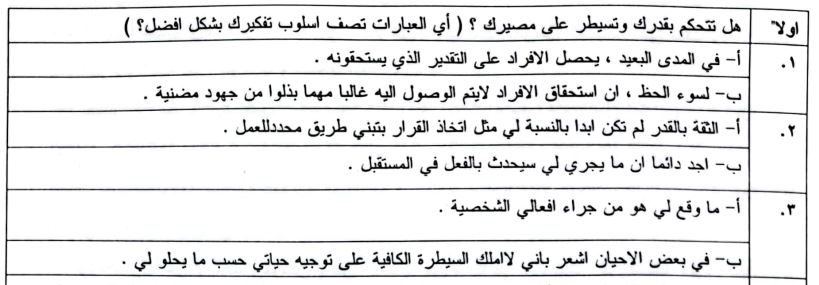

The first important question that comes to mind is whether there is a place for the impact of human behavior and its fluctuations in the efficient market theory and the modern portfolio theory? According to the supporters of these two theories, the efficient market occurs when the optimal return is achieved in light of the availability of complete information about prices and risks, which are supposed to be determined rationally. The other question that arises here is when individuals are rational in investing their money in the stock market? In other words, this means that investors are rational, and therefore they seek to maximize the benefit they obtain from exploiting their wealth. So, can these questions be achieved in practical reality? We see that many aspects of human existence are affected in their relationship with emotions or feelings more than money as a material resource. Individual investors often make irrational decisions, sometimes due to the dominance of these emotions or feelings when it comes to money, more than they do towards other activities in their public and private lives. Trying to understand the financial awareness of investors without taking into account the human factor after an existing problem can be likened to trying to navigate using a compass, but without indicative maps. It is therefore very important here that the necessity of the subject comes, which is to introduce the human factor when we talk about investing in shares in the stock market. It appears from field work in this context that there is an assumption that the more the environment is viewed impartially, as well as shares, the more intangible psychological factors become stronger and more effective in the stock market. This means, as a result, that many of the issues that guide the investment decisions made by individuals regarding the purchase of financial assets (Financial Assets) of shares, bonds and other securities, can only be explained by referring to the principles of human behavior. It is no exaggeration to say that the market in general, in terms of collective decision-making when buying securities, advances and lags, flourishes and wanes by looking at the psychological factors that govern the actions of individuals after they collect and analyze information.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2001 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.