The analysis of the Effect of the Exchange Rates Risk on the Market Value of the Common Stocks -An applied Study on A sample of Banks, Which Branched internally and externally

Keywords:

Exchange rate risk, market value of stocksAbstract

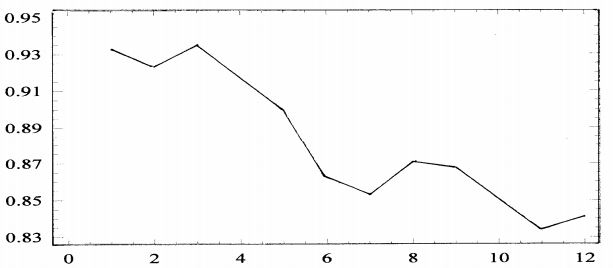

The world has recently witnessed the opening of global markets to the flow of capital, goods, and services with complete freedom. Countries are racing to join the World Trade Organization and the European Union to obtain economic gains. Developing countries have joined developed countries in entering those markets. This means that governments will change the methods of managing the national economy by reducing restrictions on exchanging capital, goods, and services. Here, our local organizations are exposed to intense competition from foreign organizations due to the lifting of the protection that the government had imposed in favour of local organizations, which will be reflected in their market share. The time has come for our national organizations to think about the necessity of rushing to global markets. This requires developing their working methods to achieve a competitive advantage that enables them to enter those markets, in addition to the necessity of remaining in our local markets due to the threat from foreign organizations, and the industry does not exist. Banking is more sensitive to this challenge than it is to these changes due to the nature of its activity in providing credit and other banking operations to complete international commercial transactions. Therefore, it will be exposed to economic risks, which are concerned with studying the impact of fluctuations in exchange rates on the current and future cash flows of the operations it carries out. Banks outside their national borders, which is reflected in the prices of their shares in the financial markets, negatively or positively, and thus on their market value.

This is an attempt to identify which banks are more exposed to exchange rate risk, those that engage in local activity only or those that have local and foreign activity, to inform our organizations of the risks that they will face in the future and adapt to them in a way that serves their survival. Therefore, the research was divided into: first, the research methodology that included the problem, importance, hypothesis, and objectives of the study. The scientific method, population, and sample of the research. Secondly, the theoretical aspect included the exchange rate and its problem, the factors affecting it, and a definition of exchange rate risk and methods of analyzing it. Thirdly, it dealt with the applied aspect. Fourthly, it included the most important conclusions and recommendations.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2008 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.