Financial leverage, growth, size, and their impact on agency costs: an analytical study of companies in the industrial and hotel sectors traded on the Iraqi Stock Exchange.

Keywords:

Leverage, growth, size, الرافعة الماليةAbstract

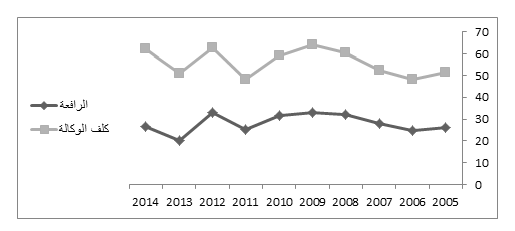

This study aims to demonstrate the impact of some independent financial variables combined and separate (financial leverage and the size of companies and the growth rate) in the dependent variable (the agency cost) through the study and analysis of a sample of industrial companies and hotels listed in the Iraq Stock Exchange for the period of (2005-2014). The study using a range of financial metrics that represent the four variables (asset turnover as a proxy of cost Agency, and the proportion of debt as a measure of financial leverage ,Assets of company as a measure of the size and the market-to-book ratio as a measure of the rate of growth). The study concluded that the impact of these variables are combined in the agency cost varies depending on the sector as it was adversely affecting the industrial sector clearly influenced by the effect of the reverse effect for leverage on the agency costs in sense that the rise of these variables are generally leads to a decrease Agency costs, while It was a positive influence in the hotels sector, influenced by the impact of a significant inverse relationship of leverage on the agency costs, in that any interaction between these independent variables together increases the agency costs in the hotel sector.

References

- Ang ,James S. & Cox, Don R., " Controlling the Agency Cost of Insider Trading", Journal Of Financial And Strategic Decisions Vol. 10, no. 1, 1997.

- Ang, James S., R.A. Cole. and J.W. Lin ‘‘Agency Costs and Ownership Structure.’’ Journal of Finance, vol. 55, Issue,1, 2000.

- Baker, H. Kent and Anderson, Ronald, "Corporate governance: a synthesis of theory research and practice ",. John wiley and Sons, Hoboken, New Jersey, 2010.

- Byrd, John, " Financial Policies and the Agency Costs of Free Cash Flow: Evidence from the Oil Industry", International Review of Accounting, Banking and Finance, vol. 2, Issue2, 2010.

- Cadot, Julien, " Agency costs, vertical integration and ownership structure: the case of wine business in France", European Association of Agricultural Economists - EAAE, 2014.

- Chernenko, Sergey& Foley, C. Fritz& Greenwood, Robin, " Agency Costs, Mispricing, and Ownership Structur", Working Paper 15910, National Bureau of Economic Research Cambridge, MA 02138,2010.

- Faccio, Mara & Lasfer, Meziane, "Managerial Ownership, Board Structure and Firm Value: The UK Evidence", 1999 Cass Business School Research Paper. Available at SSRN, 1999.

- Florackis, Chrisostomos& Ozkan, Aydin, " Agency costs and corporate governance mechanisms: evidence for UK firms",", International Journal of Managerial Finance, Vol. 4, Issue: 1, 2008.

- Ghosh, Chinmoy& Sun, Le, " Agency Cost, Dividend Policy and Growth: The Special Case of REITs", The Journal of Real Estate Finance and Economics, Volume 48, Issue 4, 2014.

- James S. Ang,& Rebel Cole & James, Wuh Lin ," Agency Costs and Ownership Structure"Journal of Finance , vol. 55, issue 1, 2000

- Jensen, Michael C.& Meckling, William H., " Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structur" Journal of Financial Economics, vol. 60, Issue 3, 1976.

- Khan, Asma& Kaleem, Ahmad& Nazir, Mian Sajid, " Impact of Financial Leverage on Agency cost of Free Cash Flow: Evidence from the Manufacturing sector of Pakistan", Journal of Basic and Applied Scientific Research, vol. 7, Issue 2, 2012.

- Li, Hongxia & Cui, Liming, " Empirical Study of Capital Structure on Agency Costs in Chinese Listed Firms", Nature and Science ,vol. 1, Issue1, 2003.

- Missim, DORON & PENMAN, STEPHEN H., " Financial Statement Analysis of Leverage and How It Informs About Profitability and Price-to-Book Ratios", Review of Accounting Studies, vol. 8,Issuw 1, 2003.

- Moussa, Fatma& Chichti, J., " Interactions between Free Cash Flow, Debt Policy and Structure of Governance: Three Stage Least Square Simultaneous Model Approach", Journal of Management Research, vol. 3, Issue2,2011.

- Offenberg ,David, "Agency Cost and The Size Discount : Evidence From Acquisitions" , Journal of Economics ,Financial and Administrative Science,Vol,15,No.29,2010 .

- Pao, Hsiao-Tien, "A comparison of neural network and multiple regression analysis in modeling capital structure", Expert Systems with Applications, vol. 35, Issue 1, 2008.

- Sajid, Gul & Sajid, Muhammad& Razzaq Nasir& Afzal, Farman, " Agency Cost, Corporate Governance and Ownership Structure: The Case of Pakistan ", International Journal of Business and Social Science, Vol. 3, No. 9, 2012.

- Singh, M. and W.N. Davidson , " Agency costs, ownership structure and corporate governance mechanisms", Journal of Banking and Finance, vol. 27, Issue,1, 2003.

- Zhang, Yilei," Are Debt and Incentive Compensation Substitutes in Controlling the Free Cash Flow AgencyProblem?" Financial Management,vol. 38,Issue 3, 2009.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.