Feelings of investor confidence and investment returns in common stocks

Keywords:

Investor confidence, stock investment returnsAbstract

Investors' optimism and pessimism about stock returns is considered as one of the important behavioral determinants of the investment performance of stock markets. The question to be answered is whether a consumer confidence index, as a representative of investor feelings, effect on the common stock returns. In recent empirical evidence in the US financial markets indicate that the investor sentiment associated with an negative relationship with the total return of shares. When confidence feelings is high, the stock returns are low, and vice versa. On the other hand, do these feelings change with the different sectors consisting of equity markets? Does this relationship vary depending on the country in which investors trading in its markets?

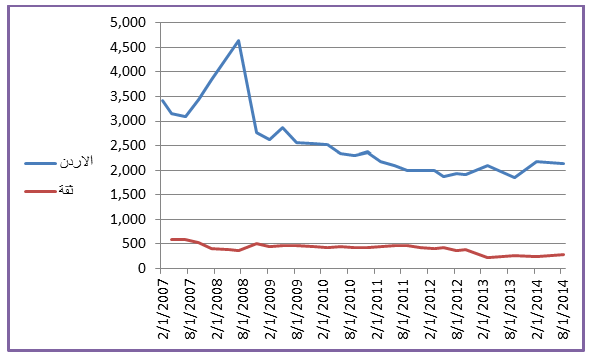

Using a number of financial and statistical methods and their application to the monthly close values of indexes for a group of Arab financial markets for a period of seven years, the study found a number of conclusions, the most important among them there is a positive and significant effect relationship between feelings of investor confidence and investment returns of common stocks in most of the Arab financial markets.

The study came up with a number of recommendations including the need to increase investment awareness for clients in the financial markets, and they must not be influenced by psychological factors related to their feelings, which have a negative implications for the entire trading activity in the market and in contravention of the rationality assumptions of the theory of efficient markets.

References

اولا : البحوث المنشورة:

Baker, Malcolm and Jeffrey Wurgler," Investor Sentiment in Stock Market", Journal of Economic Perspective, vol. 21, No.2, 2007.

Brown, Gregory W., and Michael T. Cliff, " Investor Sentiment and the Near-term Stock Market", Journal of Empirical Finance, Vol. 11, No. 1,2004.

DeLong, J. Bradford, Andrei Shleifer, Lawrence H. Summers, and Robert J. Waldmann, "Noise Trader Risk in Financial Markets" Journal of Political Economy,vol. 98, no.4, 1990.

Hvidkjaer, Soeren, "Small Trades and the Cross-Section of Stock Returns", Review of Financial Studies, vol. 21, 2008.

Kumar, Alexander, " Investor Sentiment, Trading Behavior and Information Efficiencies in Index Future Market", Financial Review, Vol. 43,No. 1, 2008.

Shleifer, Andrei, and Robert Vishny, "The Limits of Arbitrage", Journal of Finance, vol. 52, no. 1,1997.

Stambaugh, Robert F.& Yu, Jianfeny& Yuan, Yu," The Short of it: Investor Sentiment and Anomalies", Journal of Financial Economics, vol. 104, no.2, 2012.

ثانيا: المؤتمرات واوراق العمل

Barber, Brad M, Terrance Odean, and Ning Zhu, "Do Retail Trades Move Markets", Working Paper, 2008.

Christ, Kevin P.,& Bremmer, Dale S., "The Relationship Between Consumer Sentiment and Stock Prices" the 78th Annual Conference of the Western Economics Association International in Denver, Colorado, on July 15, 2003.

Ho, Chienwei& Huang, Chi-Hsion, "Investor Sentiment As Conditioning Information in Asset Pricing", Working Paper, 2008.

Jansen, W. Jos.,& Nahuis, Niek J,. "The Stock Market and Consumer Confidence: European Evidence", Working Paper, July 2002.

Lemmon, Michael,& Ni, Sophia "The Eeffect of Investor sentiment on Speculative Trading and Prices of Stock and Index option", Working Paper , 2010.

Ramkissoon, Ronald and G. Joefield “The Use of Confidence Indices in the Caribbean”, CAIB Caribbean Account, Working Paper.

Schmeling, Maik, "Investor sentiment and stock returns: some international evidence", Working paper, School of Economics and Management of the Hanover Leibniz

University, No. 407, 2008.

Sergeant, Kelvin A.,& Lugay, Beverly.,& Dookie, Michele., "Consumer confidence and economic growth: case studies of Jamaica and Trinidad and Tobago", Working Paper, October 2011.

ثالثا: النشرات والتقارير

Bayt.com Middle East Consumer Confidence Index, 2014

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.