Building and evaluating the performance of active momentum portfolios in the Iraq Stock Exchange

Keywords:

Performance of active momentum portfolios, Iraq Stock ExchangeAbstract

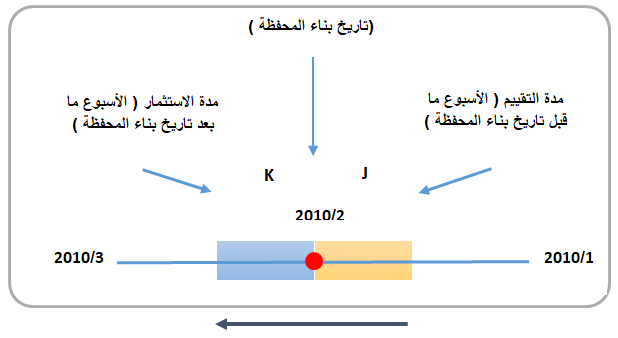

Markets has more active economic actions which changing dramatically among different sectors, especially stock market activity as a requirement for meeting investment needs and money growth. Where portfolio considered as the first step for it and the important for investment activity. Add to that various desires of investors, their risk aversion and return preferences. That brings numerous method and approaches in portfolio formation. Which developed as financial Market and his instruments and approaches. Moreover, from it technical analysis approach, which featured with vast growth in recent decades because of it's depending on information technology and a variety of investors behaviors. Which reflected on his multiple instruments and applications. From it the momentum phenomena which current study deal with it. After studying it in financial markets over the world. Current study tries to use it as technical style to building superior Active portfolio, the study conclude that momentum strategies cannot achieve superior return in Iraqi financial market only in winners portfolios because of the momentum effect very weak and high transaction cost will terminate the return for that the study recommended to make transaction cost less as possible and study another technical analysis methods to enable Iraqi investor to employ vast approaches in its investments .

References

First : Books

- Arnold , Curtis M. "Timing the market : How to profit in Bull and Bear

market with technical Analysis " 1st edition, Mc Graw-Hill , Inc , 1993 .

– Ambrosior, Charles .A.D “ Portfolio Management Basics “ From

Editorial “ Managing Investment Portfolios : A dynamic Process “ 2nd

Edition , Edited by John L . Maginn and Donald L . Tuttle . Warren Gorham

& Lamont ,1990.

- Bernstein , Jake "No Bull investing : Straightforward Advice to

Maximize Your Return in Any Market with Any amount of Money" 1st ,

Dear Born trade publishing 2003.

-Bird , John O. and Cart T.F. Ross "Mechanical engineering principles"

rd edition , Routledge , Inc. 2015.

– Brentani , Christine “ Portfolio Management in Practice “ 1st edition ,

Butterworth-Heinemann , MA , 2004 .

- Brown , David and Kassandra Bentley "All about Stock Market

Strategies : the easy way to get started " 1st edition, McGraw-Hill , 2002 .

- Bodie, Zvi ; Alex Kane and Alan J. Marcus “ Essentials of Investment

“5th edition , McGraw-Hill , 2003 .

– Cohen , Jerome B. ; Edward D. Zinbarg and Arthur Zeikel "

Investment Analysis and Portfolio Management " 5th Edition ,

McGraw/Hill .Inc, 1987.

– Corner , Desmond and David G. Mayers “ Modern Portfolio Theory

and Financial Institutions “ 1st edition , Palgrave McMillian , UK , 1983.

- Ciana , Poul " New Frontiers in Technical Analysis: Effective Tools

and Strategies for Trading and Investing " Bloomberg Press , Published by

John Wiley & Sons, Inc., Hoboken, New Jersey , 2011

– Fabozzi , Frank J. “ Institutional Investment Management : Equity and

Bond Portfolio Strategies and Applications “ 1st Edition ,John Wiley and

Sons, Inc. 2009.

-Farley , Alan S. The Master Swing Trader Toolkit: The Market

Survival Guide " 1st edition, McGraw-Hill , Inc. 2010.

– French , Dan W. " Security and Portfolio Analysis: Concepts and

Management " 1st Edition , Merrill Publishing Company , 1989.

- Jegadeesh , Narasimhan and Sharidan Titman "Returns to Buying

Winners and Selling Losers : Implications for stock Market Efficiency" the

Journal of finance , Vol.48 , No.1 , 1993, PP 65-91 .

– Gitman , Lawrence J. and Michael D. Joehnk “ Fundamentals of

Investing “ 10th Edition , Pearson Education Inc. MA, USA, 2008

- Haight , G. Timothy ; Stephen Morrell and Glenn E. Ross “ How to

Select investment managers and Evaluate Performance “ 1st Edition ,John

Wiley and Sons, Inc. 2007.

– Hearth , Douglas and Janis K . Zaima “ Contemporary Investment :

Security and Portfolio Analysis “ 4th edition , Thomson Learning , USA ,

- Kaufmann, Perry J. "A Short Course in Technical Trading" 1st

edition, Wiley & Son.Inc, New Jersey , USA ,2003.

-Kirkpartrick,Charles D. "Beat the market invest by Knowing What

Stocks to buy and What Stocks Sell" 1st edition , Pearson Education , Inc.

.

-Krikpatrick II , Charles D " Time the Markets: Using Technical

Analysis to Interpret Economic Data, Revised Edition " 1st edition ,

Pearson Education , Inc , 2012 .

- Ilmanen , Antti "Expected Return :An Investor's guide to Harvesting

Market Rewards " 1st edition John Wiley and Sons , Inc. USA , 2011 .

- Iverson , David " Strategic Risk management:A practical Guide to

portfolio Risk management " 1stedition , John Wiley and Sons, Inc., 2013.

– Levy , Haim & Theirry Post “ Investment” 1st Edition , Pearson

Education Limited , 2005.

- McDowell, Bennett A. "the Art of Trading: Combining the Science

of Technical Analysis with the Art of Reality – Based trading" 1st edition

, John Wiley and Sons , Inc. 2008 .

- Miner , Robert C. "High Probability trading strategies : entry to Exit

Tactics for forex , Futures , and stock Markets "1st edition John wiley and

Sons , Inc. 2009 .

-Pring , Martin J. "How to select Stocks Using technical Analysis" 1st

edition , McGraw – Hill, Companies , Inc. 2002.

– Reilly , Frank K. and Keith C. Brown " Investment Analysis &

Portfolio Management " 10th Edition , South-Western , Cengage Learning

,2012.

– Renneboog , L “ Advances in Corporate Finance and Asset Pricing

“ 1st Edition , Elesever, Inc . 2006.

-Snopek , Lukasz "the Complete Guide to portfolio Construction and

Management" 1st edition , John Wiley and Sons , Inc. 2012 .

- Satchell , Stephan Forecasting Expected Returns in the Financial

Markets " 1st edition , Academic press , Elesever press , 2007 .

– Strong , Robert A. " Portfolio Construction Management and

Protection " 5th edition , Cengage Learning , Mason , 2009.

- Tortoriello, Richard "Quantitative Strategies for Achieving Alpha"

st edition , McGraw – Hill, Companies , Inc. 2009.

-WarWick , Ben "the Worldly investor guide to Beating the market :

Beat the pros at their Own Game" 1st edition , John Wiley and Sons , Inc.

-Weir , Deborah , J "Timing the Market : How to profit in the Stock

market using the Yield Curve , technical Analysis and Cultural indicators"

st edition , John Wiley and Son , Inc. 2006 .

- Woods , Steve " Float Analysis: Powerful Technical Indicators Using

Price and Volume " 1st edition , John Wiley and Sons , Inc. 2002.

Second : Journals

- Ambachtsheer , Keith “ Active Management that adds value : Reality

or Illusion ?” The Journal of Portfolio Management 1994 No21, Vol 1,

pp89-92.

- Carhart , Mark M. “ On Persistence in Mutual Fund Performance “

The Journal of Finance, Vol. 52, No. 1 (Mar., 1997), pp. 57-82.

- Chordia , Tarun and Lakshmanan shivakumar " Momentum,

Business Cycle, and Time-varying Expected Returns " the Journal of

finance , VoL 57 , No.2 , 2002 . PP 985-1019 .

- Cooper , Micheal J. , Roberto G. Gutierrez and Allaudeen Hameed

"Market State and momentum "Journal of finance , VoL. 59 , No. 3 , PP

-1365 . 2004.

- Daniel, Kent and Tobias J. Moskowitz "Momentum Crashes ",

Journal of Financial Economics, Volume 122, Issue 2, ,2016, PP221–247.

- Dichev , llia , Kelly Huang and Dexin Zhou "the Dark side of

Trading" Journal of Accounting Auditing & Finance , Vol 29 , No.4 ,

pp 492-518 , 2014 .

– Grinblatt , Mark and Sheridan Titman “ Mutual Fund Performance:

An Analysis of Quarterly Portfolio Holdings” The Journal of Business,

Vol. 62, No. 3 , 1989 , PP 393-416.

- Grobys , Klaus "another look at momentum crashes: momentum in

the European monetary Union "Applied Economics , Vol.48, No.19 ,

, PP 1759-1766 .

– Harlow , W.V. and Keith C. Brown “ The Right Answer To The

Wrong Question : Identifying Superior Active Portfolio Management “

journal of investment management , Vol. 4, No. 4 , 2006 , PP 1-26 .

- Hendricks ,Darryll, Jayendu Patel, Richard Zeckhauser "Hot Hands

in Mutual Funds: The Persistence of Performance, 1974-87" the Journal of

finance , Vol 48 , No.1 , 1991 , PP 93-130.

-Hwang , Soosung and Alexander Rubesam "the disappearance of

momentum "the European Journal of Finance , Vol. 21 , No 7 , PP 584-607

.

- Jensen , Michael C. , “ The Performance of Mutual Funds in the

Period 1945-1964 “The Journal of Finance, Vol. 23, No. 2, 1968, pp. 389-

- Jegadeesh , Narasimhan and Sharidan Titman "Returns to Buying

Winners and Selling Losers : Implications for stock Market Efficiency" the

Journal of finance , Vol.48 , No.1 , 1993, PP 65-91 .

- Jegadeesh , narasimhan and Sheridan Titman "profitability of

momentum Strategies : An Evaluation of Alternative Explanations" the

Journal of finance , Vol. 56, No.2 , 2001 , PP 699-718 .

- Korajczyk Robert A. and Ronnie Sadka "Are Momentum profits

Robust to trading Costs?" the Journal of finance Vol. LIX, No.3 , 2004 ,

PP 1039-1082

- Levy , Robert A "Relative strength as a Criterion for investment

Selection " Journal of finance , VoL.22 , Issue . 4, 1967 , PP 595-610 .

- Malkiel , Burton G. " The Efficient Market Hypothesis and It's Critics

"Journal of Economics perspectives , Vol .17 , No1 ,2003 ,PP 59-82 .

- Rouwenhorst, K. Geert "international momentum Strategies" The

Journal of finance , Vol.53 , Issue 1 , 1998 , 267-284.

– Sharpe , William F. “ Mutual Fund Performance “ The Journal of

Business, Vol. 39, No.1, 1966 , pp. 119-138.

Third : Unpublished Works

- Daniel , Kent " Momentum Crashes ", Columbia Business School

Research Paper Series , unpublished work, April 12 , 2011.

– Park , Kyung-In and Dongcheol Kim " Source of Momentum Profits

in International Stock Markets" unpublished work , 2011.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.