The impact of earnings management strategies on changing the credit gradient

Keywords:

Earnings management, credit progressionAbstract

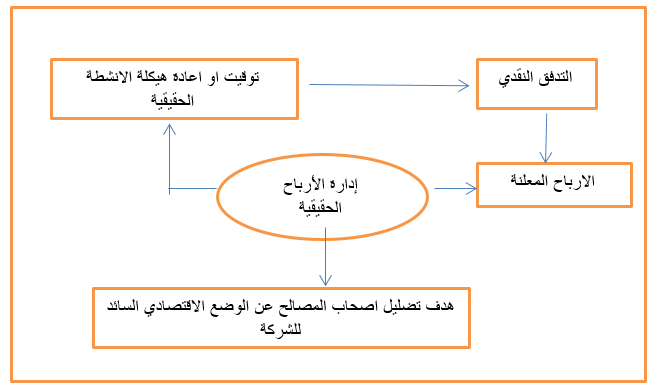

This study aims to determining the effect of Earnings management strategies on Credit rating changes . And this is executed by depending on Earnings management strategies Both types: the first Accruals-based earnings management (AM) and the second Real earnings management (RM) . As was expressed Credit rating through financial ratios. The study is being conducted in the Iraqi banking sector. The financial information is obtained by each bank of the study sample analyzed for this purpose and the sample consists of twelve banks. For the period from 2004 to the end of 2016.The study reached several conclusions that can be expressed briefly that there is an impact of the behavior of profit management on the changes in the credit rating of each of the Iraqi banks individually and collectively

References

اولاً / المصادر العربية :

التميمي ,أحمد : معايير التصنيف الائتماني في المؤسسات المالية الإسلامية، مجلة المستثمرون , 2009.

حسن, زهراء محمد : أثر الاحتياطيات السرية على إدارة الأرباح في البنوك المصرية –دراسة تطبيقية , رسالة الماجستير , كلية التجارة, جامعة المنصورة, مصر ,2015 .

السيد, صفا محمود :إدارة الربحية ومعايير المحاسبة المصرية , مجلة البحوث التجارية المعاصرة, كلية التجارة بسوهاج, جامعة جنوب الوادي , المجلد 1,العدد 18, 2004.

طلفاح , احمد : الازمة المالية ,المعهد العربي للتخطيط , 2010 .

طلفاح , احمد : الجدارة الائتمانية السيادية الوظائف و الفوائد والمؤشرات والمجالات ,المعهد العربي للتخطيط , 2005 .

ثانيا ً / المصادر الاجنبية :

Ahmed, A., Takeda, C. & Thomas S. :Bank loan loss provisions: a re-examination of capital management, earnings management and signaling effects, Journal of Accounting and Economics, 1999.

Ashari ,N. & et.al : Factors Affecting Income smoothing Among listed companies in Singapore , Accounting Business Research, ,1994 .

Bhojraj, Sanjeev and Sengupta ,Partha :Effect of Corporate Governance on Bond Ratings and Yields: The Role of Institutional Investors and Outside Directors ,The Journal of Business, 2003.

Bodie , Zvi and Alex Kane, Alain J. Marcus: Investments , 10th Edition ,2011.

Cheng, S. :R&D expenditures and CEO compensation, The accounting review , 2004.

Chi-keung Man, Brossa Wong : Corporate Governance And Earnings Management: A Survey Of Literature ,The Journal of Applied Business Research, Volume 29, Number 2, 2013.

Fabozzi Frank, Peterson Pamela; Financial Management And Analysis, John Wiley & Sons, Inc, Second Edition, New Jersey, USA,2003.

Feng Li : Earnings quality and earnings management in Chinese-listed companies, University of Wollongong Research Online, 2011.

Feschijan , Daniela : analysis creditworthiness of bank loan applicants , Economics and Organization , 2008

Fudenberg, D & Tirole, J. : A theory of income and dividend smoothing based incumbency rents, Journal of political economy, 103 ,1995.

Gaio, C., & Raposo, C. : Earnings quality and firm valuation: international evidence, Accounting and Finance, 2011.

George Drdmiotes & Thomas Hemmer : On the Stewardship and Valuation Implications of Accrual Accounting Systems , Journal of Accounting Research 2013.

George Pinches, E., and J. Clay Singleton.: The Adjustment of Stock Prices to Bond Rating Changes, Journal of Finance 1978 .

Healy, P., and J. Wahlen : A review of the earnings management literature and its implications for standard setting, Accounting Horizons, 1999.

Hepworth, S.R.: Periodic income smoothing, The Accounting Review, 1953.

Hossein Asgharian, : Reformation of the Credit Rating Industry – Is there a need?, Master Thesis, Lund University, Lund, Sweden, 2005.

Kin Lo, Earnings management and earnings quality, Journal of Accounting and Economics ,2008.

Mohanram, Parthia: How to manage earnings management?, Accounting World , India , 2003.

Rahman, Musfiqur , Moniruzzaman, Mohammad & Jamil, Sharif : Techniques, Motives and Controls of Earnings Management , International Journal of Information Technology and Business Management, 2013 .

Roychowdhury, S. : Earnings management through real activities manipulation, Journal of Accounting and Economics , 2006.

Schipper, K.:Commentary on earning Management, Accounting Horzons ,1989.

Scott B. Jackson, Marshall K. Pitman: Auditors and Earnings Management, July 2001, Available from: http://www.nysscpa.org/cpajournal /2001/0700/ features/ f073801.htm, (19/03/2010).

Sellami ,Mouna : Incentives and Constraints of Real Earnings Management: The Literature Review , International Journal of Finance and Accounting, 2015.

Standard & Poor’s Ratings , History of Standard & poor, Retrieved , USA,2010.

Standard &Poor, History of Standard & poor, Retrieved , USA, 2007 .

Stephen D. Maear & Pervaiz Alam & Michael A. Pearson : Earnings management, When Does Juggling the Numbers Become Fraud, Association of Certified Fraud Examiners, 2000. http://www.cfenet,com.search.

Stice Earl , James Stice , Michael A. Diamond : Financial Accounting Reports and analyzes , 6 ed , 2005.

Visvanathan, G. :Corporate governance and REM, Academy of Accounting and Financial Studies, 2008

White, Lawrence J. : Markets The Credit Rating Agencies ,Journal of Economic Perspectives, 2010.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Iraqi Journal for Administrative Sciences

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.