The performance of the optimal risky international portfolio in light of the financial crisis - an analytical study of a sample of international stock markets

Keywords:

Risky international portfolio, financial crisisAbstract

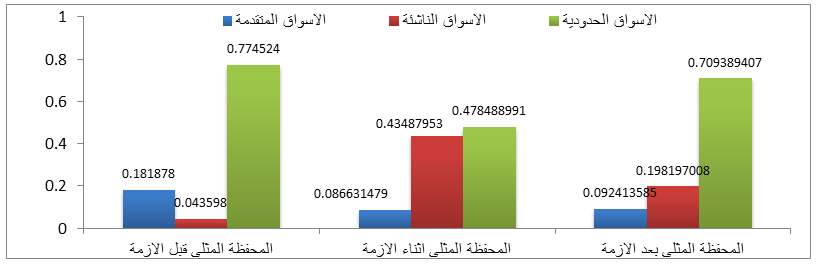

The economic globalization has positive and negative effects. The positive lies in the broad base of investment opportunities available to the local investor. The negativity comes from the fact that international markets are becoming more integrated, and this may reduce the feasibility of performing diversified portfolios internationally. The intellectual debate lies in the fundamental question of whether the performance of the international portfolios was affected by the financial crisis compared to what before and after. In fact, this cognitive problem has been and continues to be a very important debate at both the academic and practical levels. The study seeks to build the optimal international portfolio and to show how it is structured and different from the optimal local portfolio, and to determine the extent to which its performance was affected during the financial crisis as compared to what preceded it and beyond. And disclosure of whether the international diversification of the investment portfolio of dangerous best in the era of globalization is a useful tool that allows to build an optimal investment portfolio provides the best trade-off between risk and return. The study conducted a detailed analysis of the performance of the international optimal risk portfolio in the light of the financial crisis in the light of the data obtained for the sample of the study of indicators of the Iraqi and international stock markets. The latter was selected according to the FTSE rating for a sample of 53 international stock market indices, The Iraqi market for securities was included in the sample because the study is concerned with evaluating the performance of the diversified portfolio internationally from the perspective of the local Iraqi investor. The study period included (771) trading days for the sample studied as a whole, and started on (13/9/2006) until (26/05/2011). For the purpose of knowing the feasibility of the international diversification performance during the crisis compared to the previous period, the sampling period was divided into three periods, in equal terms, and for each period (257) days. Using many financial and statistical methods, the study reached a number of conclusions, the most important of which are:

References

Books

Alexander ,Gordon J.,& Sharpe ,William F.,Bailey, Jeffery V., Fundamentals Of Investment ,3rd Ed , Prentice Hall, 2001.

Bacon, R. Carl, Practical Portfolio Performance Measurement And Attribution, 2ed, Wiley & Sons, England, 2004.

Bodie, Zvi,& Kane, Marcus, Alan J., Investments And Portfolio Management , 9th Edition, Mcgraw-Hill, USA, 2011.

Bodie, Zvi,& Kane, Marcus, Alan J., Investments,10th Edition, Mcgraw-Hill, USA, 2014.

Bodie,Zvi, & Merton, Robert C.,Cleeton, David L., Financial Economics,2nd Ed, N.J, Prentice Hall,2009.

Brown, Keith C.& Reilly, Frank K., Analysis Of Investments And Management Of Portfolios, 9th, South-Western, 2009.

Chance,Don M. ,An Introduction To Derivatives,4th Ed.,Forth Worth :The Dryden Press,1998.

Elton ,Edwin J.& Gruber, Martin J.,& Brown, Stephen J., Goetzmann, William N. , Modern Portfolio Theory And Investment Analysis, 9th Edition, Printed In The United States Of America,2014.

Elton, Edwin J. And Martin J. Gruber, Modern Portfolio Theory And Investment Analysis, 5th Ed., N.Y., John Wiley & Sons, Inc., 1995.

Eun, Cheol S. ,& Resnick Bruce G. ,& Sabherwal Sanjiv : International Financial Management, 6th Edition, Front Matter Preface , The Mcgraw−Hill Companies, 2012.

Fabozzi, Frank J.& Peterson, Pamela P., Financial Management And Analysis, 2nd Edition, Canada, Published By John Wiley & Sons, Inc., Hoboken, New Jersey Published Simultaneously, 2003.

Gitman, Lawrence J.& Zutter, Chad J., Principles Of Managerial Finance, 13th Edition, Manufactured In The United States Of Copyright By Lawrence J. Gitman. All Rights Reserved America, 2012 .

Jones, Charles P., Investments: Analysis And Management, 6th Ed., N.Y.: John Wiley & Sons, Inc.,1998.

Jordan ,Bradford D.,& Thomas W.Miller ,Fundamentals Of Investments : Valuation And Management, 5th Ed,N.Y:Mcgraw-Hill,2009.

Mayo , Herbert B . " Investments :An Introduction " 9th, South-Western, Canada, 2008.

Mayo, Herbert B., Investments: An Introduction, 6th Ed., Fort Worth: The Dryden Press, 2000.

Ross Stephen A.& Westerfield, Randolph W.& Jordan, Bradford D., FUNDAMENTALS OF CORPORATE FINANCE, 8th Ed, Mcgraw-Hill/Irwin, New York, 2008.

Shapiro, Alan C., Multinational, Financial Management, 10th Edition, John Wiley & Sons, Inc., 2014.

Solnik,Bruno& Mcleavey, International Investments, 5thed, Pearson Education, Inc., 2004.

Periodical

Abid, Fathi, Pui Lam Leung, Mourad Mroua And Wing Keung Wong, International Diversification Versus Domestic Diversification Mean-Variance Portfolio Optimization And Stochastic Dominance Approaches, J. Risk Financial Manag, 2, Journal Of Risk And Financial Management ,Issn: 1911-8074, 2014

Arestis, P., Demtriades, P., & Luintel K. Financial Development And Economic Growth: The Role Of Stock Markets. Journal Of Money, Credit And Banking, 33, 16-41. 2001.

Bawa, Vijay, Elton, Edwin J., And Gruber, Martin J. “Simple Rules For Optimal Portfolio Selection In A Stable Paretian Market,” Journal Of Finance, 34, No. 2, June, 1979

Blackman, S., Holden, K., And Thomas, W., Long-Term Relationships Between International Share Prices‘ Applied Financial Economics, (4) 4, 1994.

Bruno H. Solnik, “Why Not Diversify Internationally Rather Than Domestically?” Financial Analysts Journal, July/ August 1974.

Carrieri, F.; Errunza, V.; Sarkissian, S. Industry Risk And Market Integration. Manag. Sci, NO. 50, 2004.

Chen, Son-Nan, And Brown, Stephen J. “Estimation Risk And Simple Rules For Optimal Portfolio Selection,” Journal Of Finance, 38, No. 4, Sept, 1983.

Chen, Son-Nan, And Brown, Stephen J. “Estimation Risk And Simple Rules For Optimal Portfolio Selection,” Journal Of Finance, 38, No. 4, Sept, 1983.

Demaskey, A. L., Dellva, W. L., & Heck, J. L. Benefits From Asia-Pacific Mutual Fund Investments With Currency Hedging. Review Of Quantitative Finance And Accounting, 21(3), 2003.

Diana R. Harrington, “Whose Beta Is Best?” Financial Analysts Journal 39, No. 4, 1983.

Edwards, S. And Susmel, R., Volatility Dependence And Contagion In Emerging Equity Markets, Journal Of Development Economics 66, 2001.

Elbannan, Mona A., The Capital Asset Pricing Model: An Overview Of The Theory, International Journal Of Economics And Finance; Vol. 7, No. 1; 2015.

Eling, Martin,& Schuhmacher, Frank, Does The Choice Of Performance Measure Influence The Evaluation Of Hedge Funds? Working Papers On Risk Management And Insurance No. 29, September, 2006.

Elton, Edwin J., Gruber, Martin J., And Padberg, “Simple Rules For Optimal Portfolio Selection: The Multi Group Case,” Journal Of Financial And Quantitative Analysis, XII, No. 3, Sept, 1977.

Elton, Edwin J., Gruber, Martin J., And Padberg, Manfred W. “Simple Criteria For Optimal Portfolio Selection,” Journal Of Finance, Xi, No. 5, Dec, 1976.

Fletcher, J. & Marshall, A. The Performance Of Uk International Unit Trusts. European Financial Management, 11(3), 2005.

Goel, Deepika,& Chaudhary, Monika Singh, Advantages Of International Portfolio Diversification., International Journal Of Marketing, Financial Services & Management Research, Vol.2, No. 4, April, 2013.

Lessard, Donald R. International Portfolio Diversification: A Multivariate Analysis For A Group Of Latin American Countries, The Journal Of Finance, Vol. 28, No. 3, Jun., 1973.

Mansourfar, Gholamreza.& , Shamsher Mohamad, &Taufiq Hassan, A Review On International Portfolio Diversification: The Middle East And North African Region, African Journal Of Business Management Vol. 4(19), 2010.

Mirza, Nawazish& Shabbir, Ghalia, The Death Of Capm: A Critical Review, The Lahore Journal Of Economics 10 : 2, Winter, 2005.

Mitta, Rishab, The Effects Of Market Capitalization Ratio On GDP Growth And Capital Market Robustness In Newly Industrialized Countries , U Chicago Undergraduate Business Journal, 2014.

Steven L. Heston And K. Geert Rouwenhorst, ‘‘Does Industrial Structure Explain The Benefits Of International Diversification?’’ Journal Of Financial Economics, August 1994.

Stockman, A. C. On The Roles Of International Financial Markets And Their Relevance For Economic Policy. Journal Of Money, Credit And Banking, 20(3), 1988.

internet

Abidin, Sazali Zainal& Mohamed Ariff , Annuar Md. Nassir , Shamsher Mohamad, International Portfolio Diversification: A Malaysian Perspective, Investment Management And Financial Innovations, 3/2004.

Addae, Dapaah, Kwame& Trecia, Yeo Hui Siang, Currency Risk And International Diversification Of Property Investments: A Singaporean Investor’s Viewpoint, JEL Classification, Eighth European Real Estate Society Conference, Alicante June, 2001.

Ali, Yansen, Simplifying The Portfolio Optimization Process Via Single Index Model, Industrial Engineering Honors Program ,Mccormick School Of Engineering ,Northwestern University, June 2008.

Allen, Franklin,& Ana Babus,& Elena Carletti., Financial Crises: Theory And Evidence, June 8, 2009.

Bordo, M., B. Eichengreen, D. Klingebiel And M. Martinez-Peria “Is The Crisis Problem Growing More Severe?” Economic Policy, Web Appendix, April 2001.

Couto, Gualter,& Duque, Joao, An Empirical Test On The Forecast Ability Of The Bayesian And Blume Techniques For Infrequently Traded Stocks, JEL Classification: G12 - Asset Pricing ,2005.

Crystal, Michelle Swafford, Accounting For Risk A Fundamental Beta Prediction Model, University Of North Carolina At Asheville Senior Economics Research December 2010.

Damodaran, Aswath, Estimating Risk Parameters, Stern School Of Business 44 West Fourth Street New York, 2012.

De Soto, Hernando, Why Capitalism Triumphs In The West And Fails Everywhere Else,New York: Basic Books, 2000.

Dullien, Sebastian,& Kotte, Detlef J., & Alejandro Márquez& Jan Priewe, The Financial And Economic Crisis Of 2008-2009 And Developing Countries, UNITED NATIONS: New York And Geneva, December 2010 ,Copyright , United Nations, 2010 All Rights Reserved UNCTAD/GDS/MDP/2010/1.

Goetzmann, William N., and Kumar, Llok. “Equity Portfolio Diversifications,” Yale School of Management working papers YSM 17, Yale School of Management 2004.

https://www.nyse.com/markets/hours-calendars,2017.

Islam, Abu Hena Md Mamunul & Faisal Md , Investment Diversification A Study On Six European Countries, Student Umea School Of Business Autumn Semester 2011 Master Thesis.

Kamaralzaman, Binti ,Surianor,. Market Integration And International Portfolio Diversification From Malaysian Perspective, Thesis Submitted In Fulfilment Of The Requirements For The Degree Of Doctor Of Philosophy Department Of Finance And Banking Faculty Of Business And Accountancy University Of Malaya, December 2011.

Lehkonen, Heikki ,. Essays On Emerging Financial Markets, Political Institutions And Development Differences, University School Of Business And Economics, April 11, 2014.

Livnat, Joshua &Segal Dan .The Calculation Of Earnings Per Share And Market Value Of Equity: Should. Common Stock Equivalents Be Included,2000 .

Maringer ,Dietmar, Portfolio Management With Heuristic Optimization, Springer, Netherlands, 2005.

Mauer, David C.,& Song Wang, &Xiao Wang, Global Diversification And Ipo Returns, Current Version: January, 2015.

Meyer, Thomas O.& Rose, Lawrence C., Do International Diversification Benefits Continue Beyond The Portfolio Formation Period In A Small Market? Evidence For New Zealand Before And During The Asian Crisis, JEL Classification: F36: Financial Aspects Of Economic Integration; G11: Portfolio Choice; G15, January 2001.

Modigliani, Franco., And Pogue Gerald A. ,AN INTRODUCTION TO RISK AND RETURN CONCEPTS AND EVIDENCE, March 1973 .

MSCI Emerging Markets List, D The S&P Global Broad Market Index, 31 December 2010, P. 2.

Nellor, David C. L., The Rise Of Africa’s “Frontier” Markets A Number Of Sub-Saharan Countries Are Beginning To Attract Investors To Their Financial Markets, Downtown Highrises In Dar Es Salaam, Tanzania., Finance & Development September 2008.

NYSE, Brian Curran, Potential Unlocked... On The Biggest Stage In Business, Cleary Gottlieb Steen & Hamilton LLP NYSE IPO Guide, Second Edition, Is Published By Caxton Business & Legal, Inc Www.Caxtoninc.Com Printed By RR Donnelley ISBN 978-0-615-84229-5 NYSE IPO Guide, Second Edition, 2013 Caxton Business & Legal, Inc.

Pal, Parthapratim, Foreign Portfolio Investment, Stock Market And Economic Development: A Case Study Of India. Promoting Development In A Globalized World 2006.

Pritzker, Penny S.& Ken Arnold& Brian C. Moyer, Measuring The Economy A Primer On GDP And The National Income And Product Accounts, BEA’s National Income And Wealth Division, December 2015.

Richard D. Landsberg, JD, Sharpe Ratio And Risk Adjusted Measurement” Advanced Consulting Group Nationwide Financial Services Insurance Company ., Columbus, Ohio, (03/13),2013.

Tehrani, Amir Ehsan, A Comparative Analysis Of The Tehran Stock Exchange And Selected Stock Markets: Evidence From A Correlation Matrix, , Mediterranean University, Gazimağusa, North Cyprus, August 2011.

Vincent , Scott, Is Portfolio Theory Harming Your Portfolio? , Managing Partner Green River Asset Management 503 Albemarle St. Baltimore, MD 21202 United States , 2011.Electronic Copy Available At: Http://Ssrn.Com/Abstract=1840734.

Zweig, Jason, Divarication Pitfalls ,Http: //Jasonzweig. Com/Uploads/ 10.98 youareanegg 1.Pdf, 1998.

Http://Www.Cbe.Org.Eg/En/Auctions/Pages/Auctionsegptbonds.Aspx.

Http://Www.Bankofbotswana.Bw/Content/2009103014034-Government-Bonds.

Https://Www.Centralbank.Go.Ke/Securities/Treasury-Bonds/.

Http://Www.Hnb.Hr/En/Statistics/Statistical-Data/Credit-Institutions/Interest-Rates.

Http://Www.Cbm.Gov.Mm/Content/Issuance-Government-Treasury-Bonds.

Https://Www.Bom.Mu/Markets/Money-Markets/Gmtb.

Http://Dsbb.Imf.Org/Pages/Sdds/Dqafbase.Aspx?Ctycode=MAR&Catcode=INR00.

Http://Www.Cbo-Oman.Org/Inv_Tbills.Htm.

Http://Www.Cbsl.Gov.Lk/Htm/English/_Cei/Ir/I_3.Asp.

Https://Www.Bct.Gov.Tn/Bct/Siteprod/Stat_Index.Jsp?La=AN.

Https://Www.Investing.Com/Rates-Bonds/Vietnam-Government-Bonds.

Http://Www.Iraq-Businessnews.Com/Tag/Government-Bonds/.

Http://Data.Worldbank.Org/Indicator/NY.GDP.PCAP.CD?View=Map.

Http://Data.Worldbank.Org/Indicator/NY.GDP.PCAP.KD.ZG?View=Map.

Https://Data.Oecd.Org/Gdp/Gross-Domestic-Product-Gdp.Htm.

Http://Www.Worldeconomics.Com/Data/Madisonhistoricalgdp/Madison%20Historical%20GDP%20Data.Efp.

Https://Stats.Oecd.Org/Mei/Default.Asp?Lang=E&Subject=15&Country=AUS.

Http://Stats.Oecd.Org/Index.Aspx?Querytype=View&Queryname=86.

Http://Data.Worldbank.Org/Indicator/NY.GDP.MKTP.CD

Https://Knoema.Com/Tbocwag/Gdp-By-Country-Statistics-From-Imf-1980-2021

Http://Www.Tradingeconomics.Com/Egypt/Forecast .

Ministry Of Statistics And Programme Implementation Planning Commission, Government Of India. Http://Statisticstimes.Com/Economy/Gdp-Growth-Of-India.Php.

World Bank National Accounts Data, And OECD National Accounts Data Files.

Http://Data.Worldbank.Org/Indicator/PA.NUS.FCRF.

Http://Www.Worldeconomics.Com.

Http://Databank.Worldbank.Org/Data/Databases.Aspx.

Http://Esa.Un.Org/Wpp/Excel-Data/Population.Htm.

Https://En.Wikipedia.Org/Wiki/Geary%E2%80%93Khamis_Dollar

Https://Www.Ig.Com/Au/IgIndices/Australia00?CHID=1&QPID=1718673&QPPID=1&S.

Http://Www.Prsgroup.Com/2016.

Https://Ar.Wikipedia.Org/Wiki Lobby.,2017.

Https://Www.Wienerborse.At/Enaustria/Indices/Index-Values/Overview/?ISIN=AT0000A06434&ID_NOTATION=19515307.

Https://Www.Bourse.Lu/Documents/Brochure-TRADING-Indice-45.Pdf.

Https://Markets.Ft.Com/Data/Indices/Tearsheet/Summary?S=OMXH:HEX.

Https://Web.Tmxmoney.Com/Indices.Php?Section=Tsx&Index=^TSX#Indexinfo.

Https://Www.Quandl.Com/Data/XHKG-Hong-Kong-Stock-Exchange-Prices.

Https://Tradingeconomics.Com/France/Stock-Market.

Https://Tradingeconomics.Com/Portugal/Stock-Market.

Https://Tradingeconomics.Com/Germany/Stock-Market.

Http://Www.Jpx.Co.Jp/English/Markets/Statistics-Equities/Daily/Index.Html.

Http://Countryeconomy.Com/Stock-Exchange/Netherlands.

Https://Www.Quandl.Com/Data/XSES-Singapore-Exchange-Prices.

Https://Www.Nzx.Com/Markets/Nzsx/Indices/NZ50.

Http://Www.Infomine.Com/Investment/Stock-Markets/Indexes/Oseax/All/.

Https://Markets.Ft.Com/Data/World/Countries/Italy?Mhq5j=E3.

Https://Tradingeconomics.Com/Denmark/Stock-Market.

Https://Www.Google.Com/Finance/Historical?Q=KRX:KOSPI&Ei=Hcqjvzl1wo7ybpecs3g.

Https://Tradingeconomics.Com/Spain/Stock-Market#Historical.

Https://Www.Six-Swiss-Exchange.Com/Shares/Explorer/Download/Download_En.Html.

Https://Markets.Ft.Com/Data/Indices/Tearsheet/Historical?S=PX:PRA.

Http://Www.Taiwanindex.Com.Tw/Index/Index/T00.

Http://Www.Borsaistanbul.Com/En/Indices/Bist-Stock-Indices.

Https://Www.Bloomberg.Com/Quote/WIG20:IND.

Https://Www.Federalreserve.Gov/Monetarypolicy/Fomc_Historical.Htm.

Https://Tradingeconomics.Com/Brazil/Interest-Rate.

Https://Www.Cnb.Cz/En/Statistics/Government_Fin_Stat/.

Https://Tradingeconomics.Com/Taiwan/Interest-Rate.

Https://Stats.Oecd.Org/Mei/Default.Asp?Lang=E&Subject=15&Country=POL.

Https://Tradingeconomics.Com/Mexico/Interest-Rate.

Https://Fred.Stlouisfed.Org/Series/IR3TIB01HUQ156N.

Http://Stats.Oecd.Org/Mei/Default.Asp?Lang=E&Subject=15.

Https://Www.Resbank.Co.Za/Pages/Default.Aspx.

Https://Stats.Oecd.Org/Mei/Default.Asp?Lang=E&Subject=15&Country=CHL.

Http://Www.Bnm.Gov.My/Index.Php?Ch=Statistic

Https://Knoema.Com/Pjeqzh/Gdp-Per-Capita-By-Country-Statistics-From-Imf-1980-2021?Action=Export&Country=Vietnam.

Http://Data.Imf.Org/Regular.Aspx?Key=60998119

Https://Www.Ofx.Com/En-Us/Forex-News/Historical-Exchange-Rates/

Http://Data.Worldbank.Org/Indicator/NY.GDP.PCAP.KD.ZG?View=Map

Http://Www.Amf.Org.Ae/Ar/Arabic_Economic_Database.

Https://Www.Ofx.Com/En-Us/Forex-News/Historical-Exchange-Rates/.

Http://Www.Rba.Gov.Au/Statistics/Historical-Data.Html#Interest-Rates.

Https://En.Wikipedia.Org/Wiki/New_York_Stock_Exchange.

Http://Www.Menara.Ma/Ar/2014/12/19/1510032 86.Html.

Https://Financial.Thomsonreuters.Com/En/Products/Data-Analytics/Market-Data.Html,Database.

Http://Online.Thomsonreuters.Com/Datastream.

Https://Data.Oecd.Org.

Http://Www.Xe.Com/Currencytables/?From=IQD&Date=2017-03-21

https://www.investopedia.com/terms/f/ftse.asp2017.

Data.Albankaldawli.Org/Indicator/NY.GDP.MKTP.CD

World Bank National Accounts Data, And OECD National Accounts Data Files.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.