Using the CAMELS model as a tool to measure banking safety “An analytical study of a sample of banks listed on the Iraqi Stock Exchange for the year 2017”

"دراسة تحليلية لعينة من المصارف المدرجة في سوق العراق للأوراق المالية لسنة 2017"

Keywords:

CAMELS Model, Capital Adequacy, Assets Quality, Management Efficiency, Earning Quality, Liquidity and SensitivityAbstract

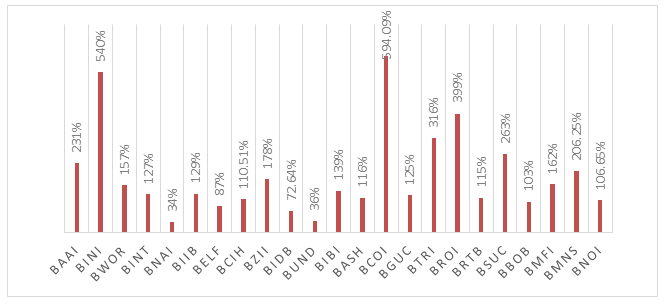

The aims of research is classify the most important banks listed in the Iraqi stock exchange according to the degree of banking soundness using the evaluation criteria CAMELS. This research included to testing of 23 commercial and Islamic private sector banks for 2017 and determining which banks are the most efficient for support the depositors confidence and investors. Thus enhancing its role in the financial services sector as a whole via identifying bank risks that are the weak points of the Bank's financial, operational and administrative. This research tested one main hypothesis (CAMELS contributes to the assessment of banking safety and guidance of decision makers). The results showed that all banks research sample that tested has not achieved the degree of rating (strong) in all six indicators combined the specimen. However, all of them achieved the strongest degree in accordance with the capital adequacy standard adopted by the Central Bank of Iraq for all commercial and Islamic banks. The most important recommendations were to emphasize the need for an annual ranking of all Iraqi banks, government or private commercial or Islamic to create a spirit of competition between banks as well as support the confidence of customers with the banking sector.

References

الامام ، صلاح الدين محمد أمين : "استخدام نظام التصنيفcamel في تحقيق السلامة المالية للمصارف"، مجلة المنصورة، العدد 13 ، العراق ، 2010 .

زغود، ايمان: " الإنذار المبكر بإستخدام نموذج Camelsلتقييم أداء البنوك التجارية -دراسة حالة البنك الوطني الجزائري" ، جامعة العربي بن مهيدي - أم البواقي- ، كلية العلوم الاقتصادية والعلوم التجارية وعلوم التسيير ، رسالة ماجستير ، الجزائر ، 2016 .

سعيد، حسين: كفاية رأس المال في المصارف الإسلامية ، المؤتمر الدولي الاول للمالية الاسلامية ، كلية الشريعة، جامعة الاردن، 2014.

شاهين ، دكتور علي عبد الله : "أثر تطبيق نظام التقييم المصرفي الأمريكي Camels لدعم فعالية نظام التفتيش على البنوك التجارية: حالة دراسية على بنك فلسطين المحدود" ، الجامعة الإسلامية غزة –، كلية التجارة قسم المحاسبة ، 2005.

طلفاح، أحمد: "مؤشرات الحيطة الكلية لتقييم سلامة القطاع المالي"، المعهد العربي للتخطيط، الكويت، 2005

عاشوري ، صورية: " دور نظام التقييم المصرفي في دعم الرقابة على البنوك التجارية-دراسة حالة البنك الوطني الجزائري" ، جامعة فرحات عباس، سطيف، 2011.

العلي، احمد ابريهي: "المصارف والائتمان والعمق المالي بين العراق والتجربة الدولية"، البنك المركزي العراقي، 2018.

الفرا ، احمد نور الدين ، " تحليل نظام التقييم المصرفي الأمريكي Camels كأداة للرقابة على القطاع المصرفي "، الجامعة الاسلامية – غزة ، كلية التجارة ، رسالة ماجستير ، فلسطين ، 2008 .

Ahsan, Mohammad Kamrul , "Measuring Financial Performance Based on CAMEL: A Study on Selected Islamic Banks in Bangladesh", Department of Business Administration, Metropolitan University, Asian Business Consortium, Sylhet, BANGLADESH, 2016

Aspal , Parvesh Kumar , and Dhawan , Sanjeev , " Camels Rating Model For Evaluating Financial Performance of Banking Sector: A Theoretical Perspective' , International Journal of System Modeling and Simulation Vol. 1, 2016 .

Barr, Richard S, Killgo, Kory A, Siems, Thomas F and Zimmel, Sheri, “Evaluating the productive efficiency and performance of U.S. commercial banks”, Engineering Management, vol. 28, no. 8, 2002.

Brigham, Eugene F. and Ehrhardt, Michael C.; "Financial Management Theory and Practice", R. R. Donnelley Willard, 11th Edition, 2005.

Dang , Uyen ; " The Camel ratung system in banking supervision a case study", ARCADA University of Applied Sciences , International Business , 2011

Dechow, PM and Schrand, CM; “Earnings Quality”, the Research Foundation of CFA Institute, United States of America, 2004.

Deyoung, R., Flannery, M.J., Lang, W.W. & Sorescu, S.M., “The information content of bank exam ratings and subordinated debt prices”, Journal of Money, Credit and Banking, vol. 33, no. 4, 2001.

Gilbert, R. Alton and Wheelock, David C.; "Measuring Commercial Bank Profitability: Proceed with Caution" November/December, vol. 89, no. 6, 2007.

Gul, S, Faiza, Khalid, Z, “Factors affecting bank profitability in Pakistan”, The Romanian Economic Journal, vol. 2, no. 3, 2011.

Jermanics Darja,; "System of measures for Evaluating The financial Performance of The company Lasko", Master Thesis, university of Ljubljana،Slovene.2006.

Kalakkar, Sudeep,; “Key factors in determining the financial performance of Indian banking sector", viewed 5 August 2014.

MacDonald, S. Scott and Koch, Timothy W.,; "Management of Banking", Courier Westford, MA, Sixth Edition,USA, 2006.

Merchant, I. P. ; " Performance analysis of banks using CAMEL approach" An Empirical study of Islamic Banks Versus Conventional Banks of GCC, 2012.

Myers, S.C. and Rajan, R.G.; “The paradox of liquidity”, Quarterly Journal of Economics, vol. 113, no. 3, 1998.

Piyu, Y.; " Data Envelopment Analysis & Commercial Bank Performance: A Primer with Application to Missouri Banks", Austin: IC2 Institute, University of Texas, 1992

Sangmi , MD and Nazir, T., “Analyzing financial performance of commercial banks in India: Application of CAMEL model”, Pakistan Journal of Commerce and Social Science, vol. 4, no. 1, 2010.

Sarker, A, “CAMEL rating system in the context of Islamic banking: A proposed ‘S’ for shariah framework”, Journal of Islamic Economics and Finance, vol. 1, no. 1, 2005.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2018 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.