Analysis of the financial synchronization hypothesis in the Iraqi economy using the Toda-Yamamoto causality methodology

Keywords:

Financial Synchronization, Toda-Yamamoto Causation MethodologyAbstract

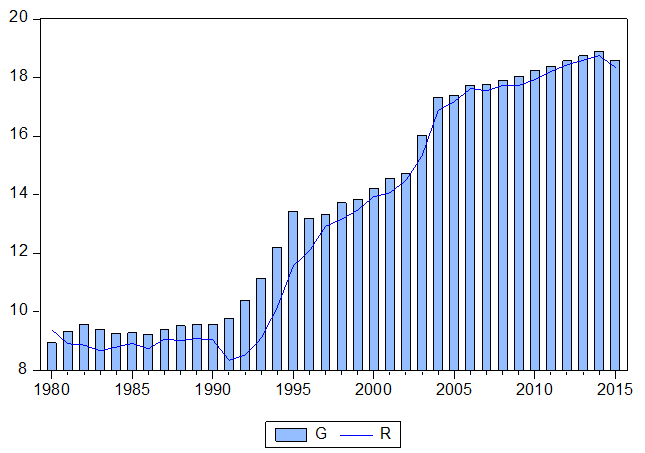

The nature of the relationship between government revenues and expenditures has attracted increasing attention from researchers and policymakers in oil countries following the sharp collapse of crude oil prices in mid-2014, the worsening of fiscal deficits and public debt levels At rates that threaten the sustainability of growth, stability and economic growth in these countries. Identifying the correlation between government revenue and expenditure will help economic decision-makers understand the source of underlying financial imbalances and design a financial reform strategy that is appropriate to the current economic conditions and conditions in the oil-rent economies. The methodology of Johansen and Juselius and Toba and Yammamoto was used to test the hypothesis of fiscal synchronization and the three alternative hypotheses in the Iraqi economy during the period (1980-2015) to verify the nature and direction of the relationship between the variables mentioned.

References

هيشام، عياد، العلاقة السببية بين معدل الفقر واللامساواة والنمو الاقتصادي باستعمال منهجية Toda-Yamamoto، مجلة جامعة القدس المفتوحة للأبحاث والدراسات الإدارية والاقتصادية ، المجلد الثاني: العدد (7)، 2017.

References

Abuai-Foul, B. and Baghestani, H. ‘The Causal Relation between Government Revenue and Spending: Evidence from Egypt and Jordan’, Journal of Economics and Finance, 28(2), 2004.

Aisha Z, Khatoon S, Government expenditure and tax revenue, causality and cointegration: the experience of Pakistan 1972–2007, Pak Dev Rev 48, 2010.

Al-Quadir K, The relationship between government expenditures and revenues in the Kingdom of Saudi Arabia: testing for co-integration and causality, JKAU Econ Adm, 2005.

Al-Zeaud H (2014) The causal relationship between government revenue and expenditure in Jordan, Int. J. Manag. Bus. Res., 5 (2), 2015.

Baghestani, H. and McNown, R., “Do revenues or expenditures respond to budget disequlibria?”Southern Economic Journal 61, 1994.

Barro, R., J, “Are government bonds net wealth?” Journal of Political Economy 82, 1974.

Buchanan, J., M. and Wagner, R., W. ,“Dialogues concerning fiscal religion”. Journal of Monetary Economics 3(4), 1978..

Darrat, Ali F., Tax and Spend, or Spend and Tax? An Inquiry into the Turkish Budgetary Process’, Southern Economic Journal, 64(4), 1998.

Dickey, D. and Fuller, Likelihood Ratio Statistical for Autoregressive Time Series with a Unit Root , Econometrica ,1981.

Dizaji, Sajjad Faraji, The effects of oil shocks on government expenditures and government revenues nexus (with an application to Iran's sanctions), Economic Modelling, Elsevier, vol. 40(C), 6, 2014.

Eita, Joel Hinaunye and Mbazima, Daisy ‘The Causal Relationship between Government Revenue and Expenditure in Namibia’, MPRA Paper, No. 9154, 2008.

Elyasil Y, Rahimi M The causality between government revenue and government expenditure in Iran, Int J Econ Sci Appl Res 5, 2012.

Friedman, M., “The limitations of tax limitations”. Policy Review 5: 7-14, 1978.

Heij, Christiaan, and others, Econometric Methods with Applications in Business and Economics, Oxford University Press, New York, USA, 2004.

Hill C. , William E. Griffiths, and Guay C. Lim Principles of econometrics .4th ed. John Wiley & Sons, Inc, New Jersey , USA, 2011.

Johansen, S and Juselius, K “Maximum Likelihood Estimation and Interference on Co-integration with AP-Plication to the Demand for Money”, Oxford Bulletin of Economics and Statistics, 52, USA, 1990.

Johansen, S. “Statistical Analysis of Co-integration Vectors”, Journal of Economics, Dynamics and Control, 12,USA,1988.

Li, X Government revenue, government expenditure and temporary causality: evidence from China, Appl Econ 33, 2001.

Lojanica, Nemanja "Government Expenditure and Government Revenue – The Causality on the Example of the Republic of Serbia", MIC, 2015.

Luković, Stevan & Grbić, Milka. "THE CAUSAL RELATIONSHIP BETWEEN GOVERNMENT REVENUE AND EXPENDITURE IN SERBIA", ECONOMIC THEMES 52 (2), 2014.

Manage N, Marlow M, The causal relation between federal expenditures and receipts. South Econ J 52, 1986.

Mehrara, Mohsen & Abbas ali Rezaei, The Relationship between Government Revenue and Government Expenditure in Iran, International Journal of Academic Research in Business and Social Sciences Vol. 4, No. 3, 2014.

Meltzer, A., H. and Richard, S., P. “A rational theory of the size of government”. Journal of Political Economy 89, 1981.

Musgrave R, Principles of budget determination. Random House, New York, 1966.

Narayan, Paresh Kumar, The Government Revenue and Government Expenditure Nexus: Empirical Evidence from Nine Asian Countries’, Journal of Asian Economics, 15(6), 2005.

Nwosu, Damian C. & Okafor, Harrison O. "GOVERNMENT REVENUE AND EXPENDITURE IN NIGERIA: A DISAGGREGATED ANALYSIS", Asian Economic and Financial Review, Asian Economic and Financial Review, 2014.

Nyamongo M, Sichei M, Schoeman N, Government revenue and expenditure nexus in South Africa., S Afr J Econ Manag Sci 10, 2007.

Obeng S, A causality test of the revenue-expenditure nexus in Ghana ADRRI, J Arts Soc Sci 11, 2015.

Obioma E, Ozughalu U, An examination of the relationship between government revenue and government expenditure in Nigeria: cointegration and causality approach. Econ Financ Rev 48, 2010.

Peacock, S., M. Wiseman, J., “Approaches to the analysis of government expenditure growth”.Public Finance Quarterly 7, 1979.

Petanlar, Saeed Karimi & Sadeghi, Somaye "Relationship between Government Spending and Revenue: Evidence from Oil Exporting Countries" , IJEME Volume 2, Issue 2, 2012.

Toda, H. Y. , & Yamamoto T., Statistical inference in vector autoregressions with possibly integrated processes. Journal of econometrics,66 (1) , 1995.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2018 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.