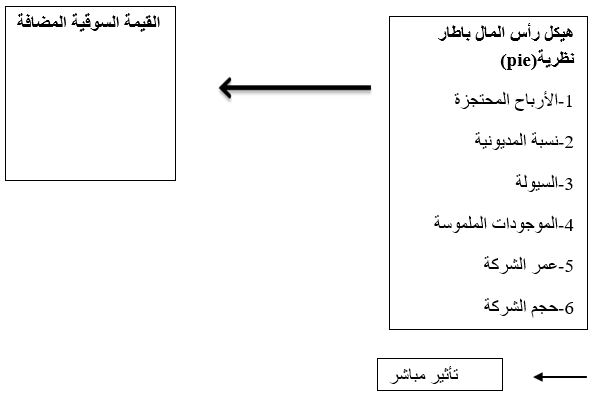

Capital structure and its impact on added market value within the framework of (pie) theory

Keywords:

Capital structure in the framework of the theory (pie) - market value addedAbstract

The current study aims to test the capital structure within the framework of PIE theory, with its dimensions (retained earnings ratio, debt ratio, tangible assets, liquidity, company age, company size) and its impact on the added market value. This is based on the data and financial statements published in the Iraq Stock Exchange for Iraqi industrial companies, which number (21) companies, representing the total of the study population, and (10) companies were selected from them on the basis of the availability of the required data during the study period from (2010-2021) and these companies The selected sample represented the study. The problem of the study was represented by the intellectual debate about the optimal method for formulating the capital structure and the most successful method in making comparisons between internal and external financing for Iraqi industrial companies and determining the sources of financing that are appropriate to the Iraqi financial.

References

الـ شبیب. (2012). دريد كامل مقدمة في الادارة المالية المعاصرة"، دار المسيرة، الأردن، عمان.

بعزيز، سهيلة2018)) استخدام المؤشرات المالية التقليدية والحديثة في تقييم الاداء المالي للبنوك التجارية رسالة ماجستير غير منشورة مقدمة الى كلية التسيير والعلوم الاقتصادية والعلوم التجارية، جامعة العربي بن مهيدي، أم البواقي.

التقارير المالية السنوية المنشورة لشركة الخياطة الحديثة للأعوام من 2021-2010.

الحمدوني، إلياس والصبيحي، فايز (2012): العلاقة بين الرفع المالي وعوائد الأسهم دراسة تطبيقية في عينة من الشركات الأردنية المساهمة كلية الإدارة والاقتصاد، جامعة القرارت الدار الجامعية، الإسكندرية، مصر. الموصل.

عاطف وليم أندراوس، التمويل والإدارة المالية للمؤسسات، دار الفكر الجامعي، الإسكندرية، 2007.

عبد الصاحب، علاء اكرم, "العلاقة بين هيكل رأس المال والأداء المالي المصرفي في العراق دراسة مقارنة بين المصارف التجارية والاسلامية"، رسالة ماجستير في العلوم المالية والمصرفية، جامعة الكوفة، كلية الإدارة والاقتصاد 2019.

فيروز، بوعزيز (2019) استخدام الأدوات الحديثة في التحليل المالي لتقييم الاداء المالي للمؤسسة الاقتصادية رسالة ماجستير مقدمة الى كلية العلوم الاقتصادية والعلوم التجارية وعلوم التسيير، جامعة العربي بن مهيدي، ام البواقي.

المالك، احمد عبد، الرضا، عقبة، (2023) ، اثر هيكل رأس المال على اداء شركات التأمين المساهمة المدرجة في سوق دمشق للأوراق المالية، مجلة جامعة دمشق للعلوم الاقتصادية والسياسية، المجلد 39، العدد2، صفح6.

Abate, M. T., & Kaur, R. (2023). The Evolution of Modern Capital Structure Theory: A Review. Central European Management Journal, 31(2), 958-974.

Acedo-Ramirez, M. A., Ayala-Calvo, J. C., & Navarrete-Martinez, E. (2017). Determinants of Capital Structure: Family Businesses versus Non-Family Firms. Finance a Uver: Czech Journal of Economics & Finance, 67(2), 80-103.

Akgun, A. I., Samiloglu, F., & Oztop, A. O. (2018). The impact of profitability on market value added: evidence from turkish informatics and technology firms. International Journal of Economics and Financial Issues, 8(4), 105-111.

Arnold, G. (2008). Corporate financial management. Pearson Education.

Balasem, S. K. The Effect of Voluntary Disclosure on the Market Value of the Shares of Companies Listed in the Iraq Stock Exchange1.

Baloch, Q. B., Ihsan, A., Kakakhel, S. J., & Sethi, S. (2015). Impact of firm size, asset tangibility and retained earnings on financial leverage: Evidence from auto sector, Pakistan. Abasyn Journal of Social Sciences, 8(1), 143-155.

Block, S. B., Hirt, G. A., & Danielsen, B. R. (2014). Foundations of financial management. McGraw-Hill Education.

Booth, L., Aivazian, V., Demirgüç-Kunt, A., & Maksimovic, V. (2006). Capital structures in developing countries. A Reader in International Corporate Finance, 2, 199-242.

Brigham, E. & Ehrhardt, M. (2010) .An Overview of Corporate finance &The Financial Environment.

Brusov, P., & Filatova, T. (2023). Capital structure theory: past, present, future. Mathematics, 11(3), 616

Campbell, J. Y., Gao, C., & Martin, I. W. (2023). Debt and Deficits: Fiscal Analysis with Stationary Ratios (No. w31224). National Bureau of Economic Research.

Clacher, I., Duboisée de Ricquebourg, A., & May, A. (2019). Who gets all the PIE? Regulation of the statutory audit for private UK companies. Accounting, Auditing & Accountability Journal, 32(5), 1297-1324.

Damodaran aswath, (2007) , Valuing Financial Service Firms.

de Almeida, D. L., de Souza Costa, P., & Martins, E. (2016). Ações preferenciais brasileiras: passivos financeiros ou instrumentos patrimoniais?. Enfoque: Reflexão Contábil, 35(1), 129-145.

Durinck, E., Jansen, K., Laveren, E., & van Hulle, C. (1990). Leasing and the pie approach to capital structure. Tijdschrift voor economie en management, 35, 4.

Fabozzi, Frank J. & Modigliani, Franco & Jones, Frank J., Foundations of Financial Markets And Institutions, 4th ed, Pearson Prentice Hall, New Jersey, 2010 .

Gapenski,Louis C., "Healthcare Finance", Aupha Hap Editorial Board, 3rd Ed, 2005.

Gazia, S., & Najmus, S., (2015), "Indian Banking Sector: Measurement and Analysis of Market Value Added an Empirical Study in the Select Indian Banks", Great Lakes Herald Vol. 9, No.1, PP: 19-34.

Gitman, L. J., Joehnk, M. D., Smart, S., & Juchau, R. H. (2017). Fundamentals of investing. Pearson Higher Education AU.

Gitman,Lawrence J. Zutter, Chad J., "Principles Of Managerial Finance", Pearson Education, 14th Edition, 2015.

Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60(2-3), 187-243.

Heimberger, P. (2023). Do higher public debt levels reduce economic growth?. Journal of Economic Surveys, 37(4), 1061-1089.

Hoang, L. D., Viet, N. Q., & Anh, N. H. (2021). Trade-Off Theory and Pecking Order Theory: Evidence from Real Estate Companies in Vietnam. Economics and Business Quarterly Reviews, 4(2).

Ikbar, M., & Dewi, A., (2015), "The Analysis of Effect of Economic Value Added (EVA) and Market Value Added (MVA) on Share Price of Subsector Companies of Property Incorporated in LQ45 Indonesia Stock Exchange in Period of 2009-2013", International Journal of Science and Research (IJSR), Volume 4 Issue 4, April 2015

Kramer, K., & Peters, R., (2001), "An Inter industry Analyses of Economic Value Added as a proxy for Market Value Added", OP Cit.

Kusuma, D. I. (2018). Pengaruh Rasio Keuangan, Economic Value Added, Dan Market Value Added Terhadap Harga Saham Perusahaan Terindeks Pefindo.

Mohammad, A. H. J., Ahmed, A. H., & Alabbas, S. A. A. (2022). The Capital Management System After The Adoption Of Basel Iii Norms: Evidence From Iraqi Credit Banks. International Journal of eBusiness and eGovernment Studies, 14(2), 57-77.

Muhammed, A. A. (2023). The Role of Capital Structure on Profitability during Financial Crisis: An Empirical Evidence of Financial-Firms listed in the Iraq Stock Exchange. Central European Management Journal, 31(2), 658-667.

Nesta, K. A., & Amir, A. (2023). The Effect of Capital Structure, Profitability, Leverage and Company Size on Company Value. Ratio: Reviu Akuntansi Kontemporer Indonesia, 4(2).

Niresh, J., & Alfred, M., (2014), "The Association between Economic Value Added, Market Value Added and Leverage", International Journal of Business and Management; Vol. 9, No. 10.

Nurcahaya, C., & Yogasnumurti, R. R. (2023). Penggunaan metode economic value added dan market value added untuk mengukur kinerja keuangan pt. Mayora indah, tbk. Periode 2018-2022. Equivalent: Journal Of Economic, Accounting and Management, 1(2), 200-214.

Nurcahya, M. (2021). Pengaruh Economic Value Added (EVA), Market Value Added (MVA) Dan Likuiditas Terhadap Harga Saham Pada Perusahaan Kelompok Indeks LQ45 Yang Terdaftar Di Bursa Efek Indonesia Periode 2016-2019 (Doctoral dissertation, Universitas Islam Negeri Sumatera Utara).

Ozkan, A. (Determinants of capital structure & Adjustment to long run target: evidence from UK company panal data) Journal of business financial & accounting (vol 28) No. 1&2, 2001.

Parmar, B. L., Freeman, R. E., Harrison, J. S., Wicks, A. C., Purnell, L., & De Colle, S. (2010). Stakeholder theory: The state of the art. Academy of Management Annals, 4(1), 403-445.

Rachmani, A. S., & Rizkianto, E. (2023). Capital Structure And Firm Performance: An Evidence Of Transportation, Logistic And Warehouse Company Listed At IDX 2018-2022. Jurnal Scientia, 12(03), 3295-3304.

Renaldo, N., Musa, S., & Wahid, N. (2023). Capital Structure, Profitability, and Block Holder Ownership on Dividend Policy using Free Cash Flow as Moderation Variable. Journal of Applied Business and Technology, 4(2), 168-180.

Robert Merton Zvi Bodie, Finance, 3 Edition Nouveaux Horizon, Pearson, 2011.

Rocca M & La Rocca, T & Cariola A (2011) "Capital Structure Decisions During a Firm's Life Cycle " Journal: Small Business Economics Vol: 37 Issue: 1Pages: 107-130 Provider: Springer

Sani, A., & Irawan, I. (2021). Model Panel Regression: Pengaruh Economic Value Added (Eva), Market Value Added (Mva), Kebijakan Dividen Dan Kepemilikan Manajerial Terhadap Nilai Perusahaan Food And Beverage Di Bursa Efek Indonesia (Bei). Jurnal AKMAMI (Akuntansi Manajemen Ekonomi), 2(3), 598-610.

Saroh, J. N., Hariyani, D. S., & Dessyarti, R. S. (2021). Bulletin of Management and Business. Bulletin of Management & Business (BMB), 2, 2.

Shah, A. and S. Khan (2007). "Determinants of Capital Structure: Evidence from Pakistani Panel Data." International Review of Business Research Papers 3(4): 265-282

Silalahi, E., & Manullang, M. (2021). Pengaruh Economic Value Added dan Market Value Added Terhadap Return Saham Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Riset Akuntansi & Keuangan, 30-41.

Silvia, R., & Wangka, N. (2022). Economic Value Added and Market Value Added as A Measuring Tool for Financial Performance. International Journal of Social Science and Business, 6(1), 135-141.

Smith, J., & Johnson, A. (2010). The impact of the pie approach to capital structure on firm performance. Journal of Finance, 45(2), 123-145.

Sonjaya, Y., & Muslim, M. (2023). The Effect of Capital Structure on Firm Value in Banking Companies Listed on the Indonesia Stock Exchange. Golden Ratio of Finance Management, 3(1), 44-55.

Titman, & R. Wessels. (The determinants of capital structure choice) Journal of finance (March), 1988.

Wu, N., Zhao, J., Musah, M., Ma, Z., Zhang, L., Zhou, Y., ... & Li, K. (2023). Do Liquidity and Capital Structure Predict Firms’ Financial Sustainability? A Panel Data Analysis on Quoted Non-Financial Establishments in Ghana. Sustainability, 15(3), 2240.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.