The Main Determinants of Financial Inclusion in Arab Countries

Keywords:

Financial Inclusion, Financial Exclusion, Dimensions of Financial Inclusion, Autoregressive Distributed Lag (ARDL).Abstract

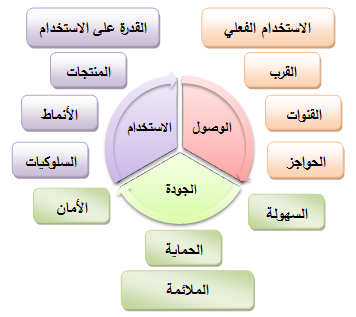

The research aims to identify the main determinants of financial inclusion in the Arab countries. The research used theoretical principles and applied studies that dealt with these factors. These theoretical and applied were divided into two main trends: demand side factors (income, age, education, gender, urbanization, employment, etc.) and supply side factors (distance, regulation, Inappropriate products, risks, etc.). In addition to these two main trends, the economic, financial and legal environment of the State (institutional frameworks, legal systems, political stability, etc.) is another trend. In order to support theoretical frameworks and principles, the research used quantitative analysis based on the ARDL methodology. The Panel Data Unbalance for 17 Arab countries for the years 2011, 2014 and 2017. The research found that the variable financial structure (X8) had a positive impact on the three indicators of financial inclusion (AC) , (BC) and (SC), the income variable (X1) was positive impact in both (AC) and (SC), the education variable (X2) was negative impact in both (SC) and (BC), and the manufacturing variable (X9) was positive impact in both (SC) and (BC).

References

السواعي, خالد محمد )2015). اثر تحرير التجارة والتطور المالي على النمو الاقتصادي: دراسة حالة الأردن, المجلة الأردنية للعلوم الاقتصادية, 2 (1):18-32.

Abel, Sanderson, Mutandwa, Learnmore & Le Roux, Pierre (2018). A Review of Determinants of Financial Inclusion, International Journal of Economics and Financial Issues,8(3):1-8.

Adetunji, Olubanjo Michael(2017). The Drivers of Financial Inclusion in Nigeria, The International Journal Of Business & Management,5 (7),273-279.

Adeyemi, Adewale Abideen , Ataul Huq Pramanik, & Ahamed Kameel Mydin Meera (2012).A Measurement Model of the Determinants of Financial Exclusion among Muslim Micro-entrepreneurs in Ilorin, Nigeria, Journal of Islamic Finance, 1(1):30-43.

Ajide, Kazeem B.(2017). Determinants of Financial Inclusion in Sub-Saharan Africa Countries: Does Institutional Infrastructure Matter?, CBN Journal of Applied Statistics,8(2):69-89.

Akileng, Godfrey, Gillian Mercy Lawino, & Eric Nzibonera (2017). Evaluation of determinants of financial inclusion in Uganda, Journal of Applied Finance & Banking, 8(4):47-66

Akudugu, Mamudu Abunga, (2013). The Determinants of Financial Inclusion in Western Africa: Insights from Ghana. Research Journal of Finance and Accounting, 4:1-10.

Alam ,Tasneem et al,(2017). Pakistan: Selected Issues, Country Report, No.213, International Monetary Fund.

Ali, Khadija, Umer Khalid & Khalid Zahra (2012). Promoting Financial Inclusion and Literacy in Pakistan via G2P Payment Programs, Pakistan Microfinance Network.

Allen,Franklin,et al.(2012).The Foundations of Financial Inclusion Understanding Ownership and Use of Formal Accounts, Policy Research, Working Paper ,No.6290 ,The World Bank, Washington, DC.

Al-Swai'e , Khaled M.(2015). The Impact of Trade Liberalization and Financial Development on Economic Growth: Jordan Case Study. Jordan Journal of Economic Sciences,2(1):18-32

Al-Tarawneh, Alaaeddin A. & Ghazi I. Al-Assaf (2014). Trade Openness and Real Investment in Jordan An ARDL Bound Testing Approach , Jordan Journal of Economic Sciences, 1(1):79-94.

Amidzic ,Goran, Alexander Massara, & Andre Mialou (2014). Assessing Countries Financial Inclusion Standing - A New Composite Index , Working Paper,No.36, International Monetary Fund.

Armendariz de Aghion, Beatriz and Jonathan Morduch (2005).The Economics of Microfinance, Cambridge, MA: MIT Press.

Atkinson, Adele & Flore-Anne Messy (2014). Promoting Financial Inclusion through Financial Education: OECD/INFE Evidence, Policies and Practice”, OECD Working Papers on Finance, Insurance and Private Pensions, No. 34, OECD Publishing.

Attia, Habib & Carol Coye Benson, (2018). Digital Financial Services: Payment Aspects for Financial Inclusion in the Arab Region, Working Paper , Arab Monetary Fund.

Barua, A., R.Kathuria, & N.Malik, (2016). The status of financial inclusion, regulation, and education in India. ADBI Working Paper, No. 568. Tokyo: Asian Development Bank Institute.

Bhuvana,M. & S.Vasantha (2016). Drivers of Financial Inclusion to Reach Out Poor, International Journal of Engineering Research and General Science, 4(3):37-46.

Bruhn, Miriam, et al. (2016). The Impact of High School Financial Education: Evidence from a Large-Scale Evaluation in Brazil. American Economic Journal: Applied Economics, 8(4), 256-295.

Burjorjee ,Deena M. & Barbara Scola (2015).A Market Systems Approach to Financial Inclusion: Guidelines for Funders, Consultative Group to Assist the Poor (CGAP).

Camara, Noelia &Tuesta, David (2015).Factors that matter for financial inclusion : Evidence from Peru. The International Journal of Finance, 10:8-29.

Chakraborty, KC.( 2012). Financial Inclusion – Issues in Measurement and Analysis, Keynote Address at the BIS-BNM Workshop on Financial Inclusion Indicators at Kuala Lumpur, November 5.

Chamlou, Nadereh (2008).The Environment for Women’s Entrepreneurship in the Middle East and North Africa. World Bank.

Chehade, Nadine et al. (2017). Financial Inclusion Measurement in the Arab World, AMF & CGAP.

Chiteli, Nefa (2013). Agent Banking Operations as a Competitive Strategy of Commercial Banks in Kisumu City. International Journal of Business and Social Science, 4(13): 306-324.

Claessens, Stijn & Liliana Rojas-Suarez (2016). Financial Regulations for Improving Financial Inclusion, A CGD Task Force Report, Center for Global Development, Washington DC.

Clarisse ,Ingabe Rwanyindo (2016). The Impact of financial inclusion on economic growth in Rwanda. Econometric study for the period 2006-2014, Masters of Science in Economics, College of Business and Economics, University of Rwanda.

Coffinet, Jérôme & Christophe Jadeau (2017). Household financial exclusion in the Euro zone: the contribution of the Household Finance and Consumption Survey, Bank of France .

Cole, S., T.Sampson & B. Zia (2011). Prices or Knowledge? What drives Demand for Financial Services in Emerging Markets? The Journal of Finance, 66(6), 1933-1967.

Coleman, Susan (2000). Access to Capital and Terms of Credit: A Comparison of Men and Women-owned Businesses, Journal of Small Business Management,38(3):37–52.

Coleman, Susan (2002).Constraints Faced by Women Small Business Owners: Evidence from the Data, Journal of Developmental Entrepreneurship, 7(2):151–174.

Dabla-Norris, Era et al. (2015). Financial Inclusion: Zooming in on Latin America, Working Paper, No.206, International Monetary Fund.

David, Okoroafor O. K., Adeniji, Sesan Oluseyi & Awe Emmanuel (2018).Empirical Analysis of the Determinants of Financial Inclusion in Nigeria: 1990 – 2016, Journal of Finance and Economics, 6(1):19-25.

Davutyan, N. & B. Ozturkkal, (2016). Determinants of Saving-Borrowing Decisions and Financial Inclusion in a High Middle Income Country: The Turkish Case, Emerging Markets Finance & Trade, 52, 2512–2529.

De Koker, L. (2011). Aligning anti‐money laundering, combating of financing of terror and financial inclusion. Journal of Financial Crime. 18: 361-386.

Deepika Gupta (2015).Key Barriers Faced in Implementing Financial Inclusion, International Journal of Engineering Technology Management and Applied Sciences, 3(1):171-174.

Demirguc¸-Kunt, Asli , Leora Klapper & Dorothe Singer (2013). Financial Inclusion and Legal Discrimination Against Women: Evidence From Developing Countries, Policy Research, Working Paper, No. 6416,The World Bank, Washington, DC.

Djankov, S., P. Miranda, E. Seira and S. Sharma. (2008). Who are the unbanked?, Washington, D.C: World Bank.

Ellis, Amanda, Mark Blackden, Jozefina Cutura, Fiona MacCulloch, & Holger Siebeens(2007). Tanzania Gender and Economic Growth Assessment. World Bank: Washington, DC.

Evans, Olaniyi (2016). Determinants of Financial Inclusion in Africa: A Dynamic Panel data Approach. MPRA Paper No. 81326.

Fanta ,Ashenafi Beyene & Kingstone Mutsonziwa (2016). Gender and financial inclusion: Analysis of financial inclusion of women in the SADC region, Policy research paper, No.1, Fin Mark Trust.

Fatukasi, Bayo, et al.(2015). Bounds Testing Approaches to the Analysis of Macroeconomic Relationships In Nigeria, European Journal of Business and Management, 7(8),26-34.

Fungacová, Zuzana & Laurent Weill (2014).Understanding financial inclusion in China, BOFIT Discussion Papers,No.10, Institute for Economies in Transition, Bank of Finland.

Gallardo, J. et al. (2005). Comparative review of microfinance regulatory framework issues in Benin, Ghana, and Tanzania. (World Bank Policy Research Working Paper 3585) Africa Regional Financial Sector Group, World Bank, Washington, DC. Retrieved from

Gilberto, M. Llanto (2015). Financial Inclusion, Education, and Regulation in the Philippines. Asian Development Bank Institute, Working Paper Series,No.541.

Global Partnership for Financial Inclusion (GPFI) (2016).G20 financial inclusion indicators, China. . www.gpfi.org/sites/default/files/documents/G20.

Goheer, Nabeel(2003). Women Entrepreneurs in Pakistan: How to Improve their Bargaining Power. International Labor Organization, Geneva

Goodwin, D. et al.(2000). Debt, money management and access to financial services: evidence from the 1999 PSE Survey of Britain, 1999.Centre for Research in Social Policy, Southborough University.

Karlan, Dean & Jonathan Morduch (2009).Access to Finance, in: Handbook of Development Economics, Eds. Dani Rodrik and Mark Rosenzweig, Elsevier, Amsterdam, 4703-4784.

Klapper, Leora, & Dorothe Singer(2013).Financial Inclusion in Africa: The Role of Informality, Presented at the African Economic Research Consortium Biannual Research Workshop, The world Bank.

Leyshon, Andrew & Nigef Thrift (1993).The Restructuring of the UK Financial Services Industry in the 1990s: a Reversal of Fortune, Journal of Rural Studies, 9(3):223-241.

Llanto, Gilberto M. & Maureen Ane D.Rosellon (2017).What Determines Financial Inclusion in the Philippines? Evidence from a National Baseline Survey, Discussion Paper Series,No.38, Philippine Institute for Development Studies.

Lusardi, Annamaria, & Peter Tufano(2009).Debt Literacy, Financial Experiences,&Overindebtedness.NBER,Working Paper Series,No. 4808.

Lusardi, Annamaria, Olivia Mitchell, & Vilsa Curto(2010). Financial Literacy among the Young. The Journal of Consumer Affairs,44(2),358-380.

Mandell, Lewis, & Klein, Linda Schmid (2009). The Impact of Financial Literacy Education on Subsequent Financial Behavior. Journal of Financial Counseling and Planning, 20 (1), 15-24.

Morimune, Kimio, & Mantani, Akihici(1995). Estimating the Rank of Cointegration After Estimating The Order Of A Vector Autoregression. The Japanese Economic Review, 46(2):191-205.

Morrison, Andrew, Raju Dhushyanth, & Sinha Nistha(2007).Gender Equality, Poverty and Economic Growth, World Bank, Policy Research Working Paper, 4349.

Musau, Salome, Stephen Muathe, & Lucy Mwang (2018).Financial Inclusion, Bank Competitiveness and Credit Risk of Commercial Banks in Kenya, International Journal of Financial Research,9(1): 203-2018.

Nandru, Prabhakar, Byram Anand, & Satyanarayana Rentala (2016). Determinants of financial inclusion: Evidence from account ownership and use of banking services, International Journal of Entrepreneurship and Development Studies (IJEDS), 4(2):141-155.

Nora, Garcia (2012). The financial inclusion data working group and the Mexican experience, IFC Workshop on Financial Inclusion Indicators Co-hosted by Bank Negara Malaysia 5 – 6 Nov, Sasana Kijang, Kuala Lumpur, Bank for International Settlements.

Oyelami ,Lukman O., Olufemi M. Saibu, & Babatunde .S. Adekunle (2017).Determinants of Financial Inclusion in Sub-Sahara African Countries , Covenant Journal of Business & Social Sciences (CJBSS), 8(2):104-116.

Pearce, Douglas(2011) . Financial Inclusion in the Middle East and North Africa: Analysis and Roadmap Recommendations. Policy Research Working Paper 5610, World Bank.

Pena, X., C.Hoyo, & D.Tuesta (2014). Determinants of Financial Inclusion in Mexico based on the 2012 National Financial Inclusion Survey (ENIF). BBVA Working Paper, 14/15.

Pesaran, M. Hashem., Yongcheol Shin(1999).An Autoregressive Distributed Lag Modeling Approach To Cointegration Analysis. In: S. Strom (ed.), Econometrics and Economic Theory in the 20th Century: The Ranger Frisch Centennial Symposium, (1999), Ch. 11. Cambridge University Press, Cambridge.

Pesaran, M. Hashem., Yongcheol Shinn& Richard J. Smith(2001). Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics, 16(3):289-326.

Rajput, Bhawna (2017). Financial Inclusion and its Determinants: An Empirical Study on the Inter-State Variations in India, International Journal on Arts, Management and Humanities, 6(1): 8-18.

Rojas-Suárez, Liliana (2016), Financial Inclusion in Latin America: Facts, Obstacles and Central Banks’ Policy Issues, Department of Research and Chief Economist, Discussion Paper, No. IDB-DP-464.

Safavian, Mehnaz(2012). Are Pakistan’s Women Entrepreneurs Being Served by the Microfinance Sector? World Bank: Washington, DC.

Sahoo, Auro Kumar,et al. (2017). Determinants of Financial Inclusion in Tribal Districts of Odisha: An Empirical Investigation, Social Change,47(1) :45–64.

Shah P, Dubhashi M (2015). Review Paper on Financial Inclusion – The Means of Inclusive Growth. Chanakya International Journal of Business Research,1:37-48.

Shankar, Savita (2013). Financial Inclusion in India: Do Microfinance Institutions Address Access Barriers? ACRN Journal of Entrepreneurship Perspectives, 2: 60-74.

Sharma, Radha Krishan , et al. (2014).Financial Inclusion in Rural Oman: A Demand and Supply Analysis, International Journal of Management and International Business Studies,4(3):285-296

Soumare, Issouf , et al.(2016). Analysis of the determinants of financial inclusion in Central and West Africa, Journal Transnational Corporations Review,8(4),231-249.

Tuesta, David et al.(2015). Financial inclusion and its determinants: the case of Argentina, Working Paper, No.3,BBVA Research.

Uddin, Ajim , Chowdhury,et al.(2017), Determinants of financial inclusion in Bangladesh: Dynamic GMM and quantile regression approach, Journal of Developing Areas, 51(2), 221-237.

Wang, X., & Guan, J. (2017). Financial Inclusion: measurement, spatial effects and influencing factors. Applied Economics, 49(18), 1751-1762.

World Bank(2014). Financial Inclusion ,Global Financial Development Report, Washington, DC.

World Trade Organization (2016). Financial Inclusion and the GATS - Barriers to Financial Inclusion and Trade in Services, Committee on Trade in Financial Services.

Yakubu, Issahaku, et al. (2017). Determining and Forecasting Financial Inclusion in Northern Ghana Using Discriminate Analysis, International Research Journal of Finance and Economics,163,60-72.

Yorulmaz, Recep (2012). financial inclusion & Economic Development: A Cace Study of Turkey and A Cross-country Analysis European Union, Master of Arts Economics, Clemson University.

Zaiz,Adriana, Patricea Elena Bertea, (2014).Financial Literacy– Conceptual Definition and Proposed Approach for a Measurement Instrument, Journal of Accounting and Management,4(3),37-42.

Zins, Alexandra & Laurent Weill (2016).The determinants of financial inclusion in Africa, Review of Development Finance,(6):46-57.

Zulkhibri, Muhamed & Ghazal Reza.(2016). Financial Inclusion, Governance, and Institutions: Evidence from Developing Economies, Islamic Research and Training Institute, Working Paper No.3, Jeddah.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.