Measuring the pattern of variations in the behavior of Arab capital market indicators

Keywords:

Data Pattern, Capital market indicesAbstract

The research attempts to show the importance of financial forecasting as one of the important techniques in building investment and financing decisions after it provides the necessary tools to achieve and maximize profit or avoid expected loss. Therefore, the research dealt with predicting stock prices through indicators of Arab stock markets participating in the Arab Monetary Fund database to reach the best financial investment and financing decision.

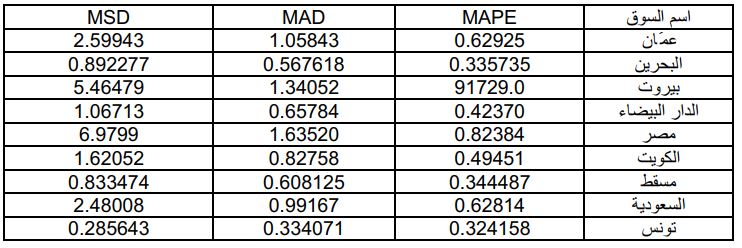

The research based its methodology on two aspects: the first, a theoretical review of the most important financial literature that dealt with the subject of the study, and the other, an economic analysis of the data by making comparisons of predictive applications and determining the accuracy of the forecast based on three statistical models, which are the moving average model, the exponential adjustment model, and the general trend analysis model.

The research results showed that the Doha Market and the Tunisian Stock Exchange were the best performing. The accuracy of the results was tested, and the accuracy of the predicted values was confirmed. On this basis, the study sample was classified. Therefore, the research recommends that the Arab investor invest in these two markets.

Financial forecasting is one of the most important techniques the investor relies on to build his investment decisions and portfolios. Financial literature has relied to a large extent on forecasting future events because of its exceptional importance in economic work, after which profit or loss is determined. Since those dealing with money are eager to maximize profit, they devoted research to forecasting as providing the necessary tools to achieve this. For this reason, a great abundance of titles dealt with the subject, especially in forecasting stock prices and their movement down and up due to their importance on the wealth of those dealing with them, including stockholders, speculators, investors, owners and many others.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2008 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.