The use of Japanese Wax in Ready stock Market to help in reducing investment per shares

Keywords:

Japanese candlesticks, reduce investment riskAbstract

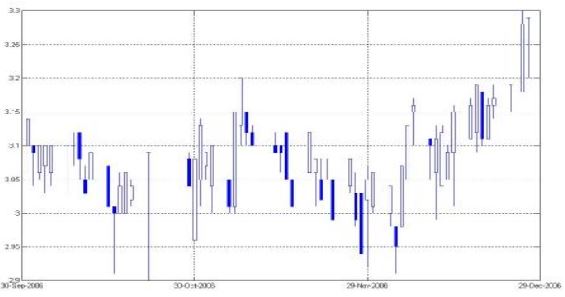

The present study sheds light on one of the important technical styles used efficiently in stock markets. A sample of four companies registered in the Amman stock market has been chosen. These companies are representatives of all Jordanian economic sects.

The study covers the task in the months of 2006. The programmer MATLAB 7, O has been conducted to conduct the study analysis.

It is hypothesized that the Japanese wax style helps those working in the stock market to read the movement and direction of the prices of shares, which would decrease risks and increase profits.

The study concludes the following :

1- The Japanese wax maps are considered an important tool in technical analysis if they are correctly read. Sometimes, they are not dependable in making a certain viewpoint concerning prices. Dealers in stock markets are advised to adopt more than one style to build a clear strategy for investment.

2- Some shares of the sample might be reflexive or optimistic. That is to say, when the share goes up, it will reflect and go down and vice versa. This would enable dealers to use it when analyzing the movement of the prices of the company's shares.

3- Some shares are continuous. That is when the share price goes up .it will continue going up, and when it goes down, it will keep going down. This trend might be repeated for the prices of some of the company's shares .chance. It is probable to depend on it as a guide in the investment processor.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2008 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.