credit capacity and its impact on the profitability of commercial banks

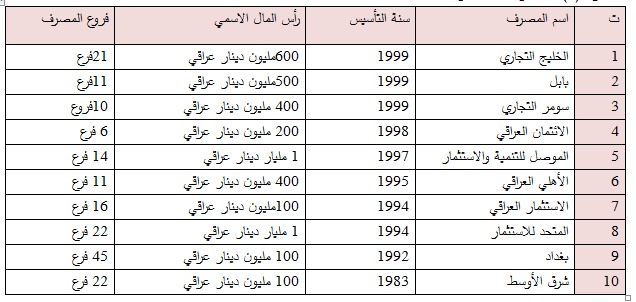

A study on a sample of commercial banks in the Iraq Stock Exchange Duration (2005-2018)

Keywords:

credit capacity, profitabilityAbstract

The research aims to measure the impact of credit capacity with its indicators (total loans to total deposits, total loans to total assets, capital adequacy ratio, loan loss provision ratio) on profitability indicators. In its study, it relied on a set of published financial reports and statements for a group of banks listed on the Iraq Stock Exchange, which were selected depending on the extent of data provision for the period of study 2005-2018. The study used a set of financial and statistical means to achieve its goals. The study used simple linear regression between the research variables by using the ready-made statistical program SPSSv.25 application and the Excel program.

The study reached a set of conclusions, the most important of which is that the statistical results showed the significance of the relationship between the loan-to-deposit ratio and profitability indicators, meaning that a higher percentage increases the profitability of banks, and this leads to the belief that the main reason for increasing profitability is the decrease in the interest costs paid on deposits or that the income from Loan interest covers the cost of interest on deposits. Then the study concluded with a set of recommendations, the most important of which is the need to rely on clear credit policies that are inspired by the general monetary policy of the Central Bank by reviewing and following up on the directives of the Central Bank for determining interest rates and reserves and developing future plans based on their fundamentals on the development of the banking sector and the economy in general.

References

Berk, jonathan & Demorzo, peter,” Corporate Finance “,4thed, pearson,2017.

Friedlob, G.T. & Schleifer, L.F., “Essentials of Financial Analysis”, New Jersey: John Wiley & Sons Ltd, (2003).

Higgins, Robert c.,” Analysis for Financial Management”, 11ed, McGraw-Hill/lrwin,2016.

Keown, Arthur J., Martin, John D. & Petty, J. William. "Foundations of Finance the Logic and Practice of Financial Management" 9 ed, Pearson Education, 2017.

Koch, Timothy W.& MacDonald,” Bank Management”, 8th Ed, Cengage Learning, USA,2015.

Madura, Jeff, “Financial Markets and Institutions" 11th ed., Cengage Learning, Canada, 2015.

Megginson, William. L, Smart, Scott. B, Graham, John. R., “Financial Management" 3rdEd, Cengage Learning, South-Western, 2010.

Parrino, Robert &Kidwell, David S.& Bates, Thomas w.,” Fundamental of Corporate Finance”,2nd Ed, USA: John Wiley & Sons, 2012.

Poznanski, Julie & Bryn, Sadownik & Irene, Gannitsos " Financial Ratio Analysis" 2013.

Rose, Peter S., Hudgins, Sylvia C.;” Bank Management & Financial Services”, 9th Ed, The McGraw–Hill, international Edition, (2013).

Ross, Stephen A.& Westerfield, Randolph W. & Jordan, Bradford D. "Essentials of Corporate Finance" 9 ed, McGraw-Hill/Irwin, New York Higher, New York, 2017.

Ross، S.A. & Westerfield، R.W.& Jaffe، J.F.، "Corporate Finance" 7thEd، McGraw-Hill Irwin, 2005.

Van Horne، James C.، & John Martin Wachowicz، " Fundamentals of Financial Management"، Pearson Education, 2005.

B.Journals and Periodicals

Adetunji & Adenugba, Adesoji,” Banking System Credit as An Instrument of Economic Growth in Nigeria (1983 - 2012)”, European Journal of Business, Economics and Accountancy Vol. 3, No. 7, 2015.

Akani, Henry Waleru,” Credit Expansion and Commercial Banks Sowndness in Nigeria: An Application of Multi -Dimensional Analysis”, European Journal of Business and Innovation Research, Vol.7, No.1,2019.

Al-Harbi, Ahmad,” The Determinants of Rate of Return Deposits in Islamic Banks”, Journal of Finance and Islamic Banking Vol. 2 No. 2, 2019.

AL-Hawari, Mohammed &Ward, Touy,” The Effect of Automated Service Quality on Australian Banks Financial Performance and The Mediating Role of Customer Satisfaction “, Marketing intelligence &planning, Vol 24, No.2,2006.

Badreldin, Ahmed Mohamed, "Measuring the performance of Islamic Banks by Adapting Conventional Ratios”, German University in Cairo, Working Paper n. 16 ,2009.

Bahrini, Raef,” Empirical Analysis of Non-perfuming Orming Loans in The Case of Tunisian Banks”, Journal of Business Studies Quarterly, Vol. 3, No. 1, 2011.

Bateni, Leila & Vakilifard, Hamidreza& Asghar, Farshid,” The Influential Factors on Capital Adequacy Ratio in Iranian Banks”, International Journal of Economics and Finance; Vol. 6, No. 11, 2014.

Durrah, Omar & Abdul Aziz, Abdul Rahman & Jamil, Syed Ahsan, "Ghafeer Exploring the Relationship between Liquidity Ratios and Indicators of Financial Performance- an Analytical Study on Food Industrial Companies Listed in Amman Bursa", International Journal of Economics and Financial, Issues 6, 2016.

El-Ansary, Osama A.& Hafez, Hassan M., “Determinants of Capital Adequacy Ratio: An Empirical Study on Egyptian Banks”, Corporate Ownership & Control / Vol. 13, Issue 1, 2015.

Fatima, Nikhat,” Capital Adequacy: A Financial Soundness Indicator for Banks”, Global Journal of Finance and Management, Vol. 6, No. 8, 2014.

Funso, Kolapo, T.& Kolade, Ayeni, R.& Ojo, Oke, M.,” Credit Risk and Commercial Banks” Performance in Nigeria: A Panel Model Approach”, Australian Journal of Business and Management Research Vol.2 No.02 ,2012.

Haque, Ansarul,” Comparison of Financial Performance of Commercial Banks: A Case Study in Context of India (2009-2013)”, journal of finance and Bank management, Vol.2, No.2,2014.

Hassan, Shahidul & Hatmaker, Deneen M., “Leadership and Performance of public Employees: Effects of the Quality and Characteristics of Manager -Employee Relationships”, journal of public Administration Research and Theory, Vol .25, No.4,2014.

John, Ebele Emmanuel& Terhemba, Iorember Paul, “Commercial Bank Credit and Manufacturing Sector Output in Nigeria”, Journal of Economics and Sustainable Development, Vol.7, No.16, 2016.

Martha, Dimgba Chidinma & Ese, Eginiwin Joseph & Stanley, Ogbonna Kelechukwu& Ngunan, Atsanan Angela, “Bank Credit and Economic Growth in a Recessed Economy”, Journal of Finance and Accounting, Vol.8, No.12, 2017.

Mileris, Ricardas,” The Impact of Economic Downturn on Banks’ Loan Portfolio Profitability”, Inzinerine Ekonomika-Engineering Economics, Vol.26, No.1,2015.

Ongore, Vincent O.& Kusa, Gemechu B., “Determinants of financial performance of commercial bank in Kenya”, international. journal of Economics financial issues, Vol.3, No.1,2013.

Ongore, Vincent O.& Kusa, Gemechu B., “Determinants of financial performance of commercial bank in Kenya”, international. journal of Economics financial issues, Vol.3, No.1,2013.

Oynaka, Negalign Nigatu,” Factors Affecting Non-Performing Loans in Commercial Banking Sector: A Comparative Study of Public and Private Banks A Case Study of Commercial Bank of Ethiopia and Dashen Bank District in Southern Region of Ethiopia”, Research Journal of Finance and Accounting, Vol.10, No.3, 2019.

Ponce, Antonio Trujillo” What Determines the profitability of bank? Evidence from Spain “, Journal of Accounting & finance, Vol.53, Issue 2,2013.

Prabowo, Fahrul Puas Sriawan Rio& Halim& Sarita, Buyung& Syaifuddin, Dedy Takdir& Sujono& Saleh, Salma & Hamid, Wahyuniati,& Budi, Nuryamin, “Effect Of Equity To Assets Ratio (EAR), Size , And Loan To Assets Ratio (LAR) On Bank Performance”, IOSR Journal of Economics and Finance (IOSR-JEF), Vol 9, Issue 4 Ver. II,2018.

Sjahrifa, Cut& Daryanto, wi wiek Mardawiyah & Ananggadipa, Vanya Kanyaka,” Measuring the Financial Performance of Indonesian Banking Industry Using Risk-Based Bank Rating” International Journal of Business Studies Vol. 2, No. 1,2018.

Vivian, Akani,” Theoretical perspectives of Earnings, profitability and Asset Quality in Banking :Descriptive Evidence from Nigeria Economy”, world journal of finance and Investment Research Vol.3,No.1 Issn 2550-7125 www.iiardpub.org,2018.

Yakubu, Z& Affoi, A.Y,” An Analysis of Commercial Banks’ Credit on Economic Growth in Nigeria”, Current Research Journal of Economic Theory 6(2):2014.

Zhang, Mei & Wen, ginyhua, “profitability analysis of king long nearly 5years “, journal of physics, couf. series887,2017.

C.Thesis & Dissertation

AbuTawahina, Mohammed S.,” Capital Structure and Firms Financial Performance: Evidence from Palestine”, A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master in Accounting & Finance,2015.

Amino, Sitina,” Determinants of Non-performing Loans in Ethiopian Commercial Banks”, MSc Thesis submitted to College of Business and Economics of Addis Ababa University in partial Fulfillment of the Requirement for award of the degree of Master Science in Accounting and Finance Program,2018.

Chandulal, Gagera A.,” A Comparative Study on Financial Performance of Private and Public Sector Banks with Special are France to Affecting Factors and their Impact on Performance Dedicators “A thesis submitted to ceujarat technological univevsity,2016.

Elyor, Saidov, " Factors Affecting the Performance of Foreign Banks in Malaysia", Master thesis of Science (Banking), University Utara Malaysia,2009.

Ndung’u, Ann Wanjiru, "Effect of Financial Risk Management on Financial Performance of Oil Companies in Kenya" Submitted in partial fulfillment of the award of masters of business administration, university of Nairobi, 2013.

Omondi, Onono Ronaid,” Credit Management practices in the Service Industry: The Case Study of Telkom Kenya limited” a research project submitted in partial fulfilment for the degree of master’s in business administration in the faculty of commerce ,2006.

Ozili, Peterson K.& Outa, Erick,” Bank Loan Loss Provisions Research: A Review, Borsa Istanbul Review”, vol.17, issue3,2017.

Tekatel, Wesen Legessa,” Financial Performance Analysis: A study on Selected Private Banks in Ethiopia”, Project Submitted to Andhra University, School of Distance Education, Visakhapatnam For the Award of the Degree of Executive Master of Business Adminestratio,2019.

D. Internet

Berrospide, Jose M.& Edge, Rochelle M.,” The Effects of Bank Capital on lending: What do we know, and what does it mean?”, www.federalveserve.gov, 2010.

Wahyuni, Sri Fitri,” Influence of Capital Adequacy Ratio, Operational Efficiency Ratio and Loan to Deposit Ratio Toward Retun on Asset (ROA) at General Bank National Private Listed on Indonesia Stock Exchange Period 2010-2014”, https://researchgate .net/publication/326835716,2018.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.