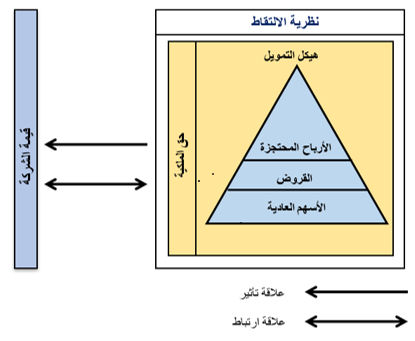

The impact of the Financing structure of the framework of the pecking order theory in firm value

Analytical study of a sample of industrial companies listed in the Iraqi Stock Exchange for the period (2004-2019)

Keywords:

firm value, pecking order theory, financing structureAbstract

The current study aims to show the impact of the financing structure within the framework of the pecking order theory as an independent variable in enhancing the firm value as a dependent variable, Companies, the study adopted a time series of 2004-2019. And on a set of financial indicators for the financing structure according to the theory of the study, and a set of statistical methods represented in simple linear regression, t-test, f-test and coefficient of determination R2, using the programs (Excel2019) and (SPSSV.26), and the study came out with a set of conclusions, the most important of which are the economic and security conditions that Iraq is going through and these factors have obstructed the capture of funding sources and imposed a lot of difficulties in obtaining appropriate funding sources. Available investment opportunities.

References

المصادر العربية

- توفيق، جميل احمد (1987)، "اساسيات الإدارة المالية"، دار النهضة العربية للطباعة والنشر، بيروت.

- زهري، عقيلة (2015)، "أثر الهيكل المالي على الاداء المالي للمؤسسة الاقتصادية"، رسالة ماجستير، جامعة قاصدي مرباح - ورقلة، كلية العلوم الاقتصادية والتجارية وعلوم التيسير، قسم علوم التيسير.

- الشيخي، حمزة والجزراوي، إبراهيم (1998)، " الإدارة المالية الحديثة "، دار صفاء للنشر والتوزيع، عمان.

- العامري، محمد علي إبراهيم (2013)، " الإدارة المالية الحديثة "، دار وائل للنشر والتوزيع، عمان.

- هندي، منير إبراهيم (2005)،" الفكر الحديث في هيكل تمويل الشركات"، ط2، توزيع منشأة المعارف، الإسكندرية.

المصادر الأجنبية:

- Abor, Joshua (2007), "Industry Classification and The Capital Structure of Ghanaian Sme", Studies in Economics and Finance, Vol. 24 No 3.

- Blocker, Christopher P. (2011), "Modeling Customer Value Perceptions in Cross-Cultural Business Markets", Journal of Business Research, Vol. 64, No. 5.

- Broyles, Jack (2003), "Financial Management and Real Options", Wiley & Sons Ltd, England.

- Degryse, Hans & De Goeij, Peter & Kappert, Peter (2012), "The Impact of Firm and Industry Characteristics on Small Firms Capital Structure", Small Business Economics: An International Journal, Vol.38, No. 4.

- Frank, Murray Z. & Goyal, Vidhan K. (2003), Testing the Pecking Order Theory of Capital Structure, Journal of Financial Economics, Vol. 67, No. 2.

- Gansuwan, Phansamon (2012), "The Influence of Capital Structure on Firm Performance", Master Thesis, Umeå School of Business and Economics, Umeå University.

- Gitman, Lawrence J. & Zutter, Chad J. (2012), "Principles of Managerial Finance", Prentice Hall, United States, 13th Ed.

- Iasonidou, Sofia (2016), "Determinants of Capital Structure of Swedish Limited Companies", Master Thesis, Business Administration, Dalarna University.

- Khan, Asad & Tanveer, Sarfaraz & Malik, Umbreen (2017), "An Empirical Analysis Of Corporate Governance And Firm Value: Evidence From Kse-100 Index", Accounting, Vol.3, No.1.

- Kisgen, Darren J. (2006), "Credit Ratings and Capital Structure", The Journal of Finance, Vol. 61, No. 3.

- Koch, Timothy W. & Macdonald S. Scott (2005), "Bank Management", The Dryden Press, Usa, 4th ed.

- Lovelock, Christopher H. (2001), "Services Marketing: People, Technology, Strategy", Prentice Hall, New Jersey, 4th ed.

- M, Hirdinis (2019), "Capital Structure and Firm Size on Firm Value Moderated by Profitability", International Journal of Economics and Business Administration, Vol. Vii, No. 1.

- Mahdaleta, Ela & Muda, Iskandar & Nasir, Gusnardi Muhammad (2016), "Effects of Capital Structure and Profitability on Corporate Value with Company Size as The Moderating Variable of Manufacturing Companies Listed on Indonesia Stock Exchange", Academic Journal of Economic Studies, Vol. 2, No.3.

- Mangwengwende, Tadiwanashe Mukudzeyi (2012), "International Joint Ventures and Firm Value: An Empirical Study of South African Partner Firms", Phd, Commerce, Rhodes University.

- Ofori-Sasu, D. & Abor, J., & Mensah, L. (2019), "Funding Structure and Technical Efficiency", International Journal of Managerial Finance, Vol. 4, No. 15.

- Paramasivan, C. & Subramanian, T. (2009), "Financial Management", New Age Pub, New Delhi.

- Parrino, Robert & Kidwell, David S. & Bates, Thomas W. (2012), "Fundamentals of Corporate Finance", John Wiley & Sons, Inc., United States, 2th ed.

- Smart, Scott B., Megginson, William., & Gitman, Lawrence J. (2004), "Corporate Finance", South –Western a division of Thomson Learning.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 حسام حسين شياع السلامي ، كرار عباس حسين الشريفي

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.