Institutional framework for reference crude oil markets

Keywords:

Institutional framework, oil marketsAbstract

That of the crude oil market. Like all other markets, “its institutional and financial features have evolved over time in response to the various forces, needs, and circumstances it has encountered.”

This research aims to establish and develop knowledge about global oil markets, their actual pattern of operations, their participants, their performance, their relationships with each other, and their role in shaping and determining crude oil prices.

This required exploring facts and phenomena and analyzing them with the help of economic and financial concepts and methods.

This research also seeks to enable producers, consumers, companies, and governments to measure the discrepancy between what they expect from global crude oil markets and what they expect from the pricing mechanisms adopted by crude oil producers.

The prices of crude oil determined by the markets do not always give correct and accurate indications of the degree of scarcity of the raw materials, either because of the high concentration in the markets, or because of the weakness and scarcity of information, or because of the slow process of adjusting events. Also, setting prices in the global crude oil markets depends largely on operations. Institutions that are primarily concerned with relative prices (that is, the differences between the prices of different raw materials or between the prices of a single crude on different dates and between the prices of refined products and the prices of crude oil) rather than absolute prices.

This usually differs from what markets should do, and the meaning of that may be important. The research came out with a number of conclusions, the most important of which is that there is a very high dependence in global crude oil pricing on one or two reference crudes that suffer from a weak financial basis, which reflects negatively on Price objectivity.

Therefore, the time has come to establish a more liquid and more representative spot market in the Arabian Gulf region in the era of the Internet, in which trading in oil has become easier than before. In this way, the fulcrum of (1) is a research drawn from the doctoral thesis titled “Using Commodity Futures Options.” On hedging the price risk of crude oil - an applied study of hedging the price risk of Iraqi crude, submitted by Maytham Rabie Hadi to the Council of the College of Administration and Economics - University of Baghdad as part of the requirements for obtaining the degree of Doctor of Philosophy in Business Administration.

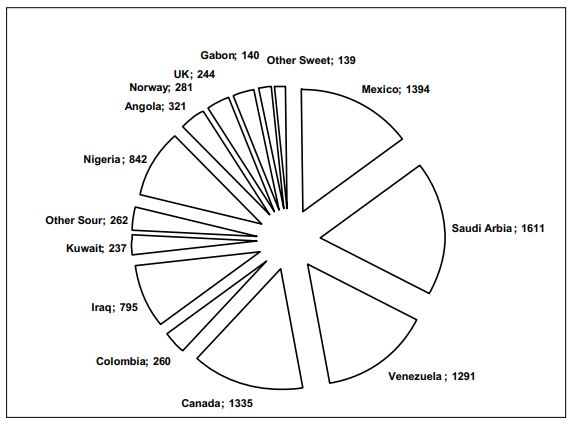

Crude oil pricing will be attracted to its true home (the Gulf) as it is the source of approximately 9630% of the global oil supply.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2008 College of Administration and Economics - University of Karbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.