Merger of Jordanian banks in light of financial liberalization

Keywords:

Bank mergers, financial liberalizationAbstract

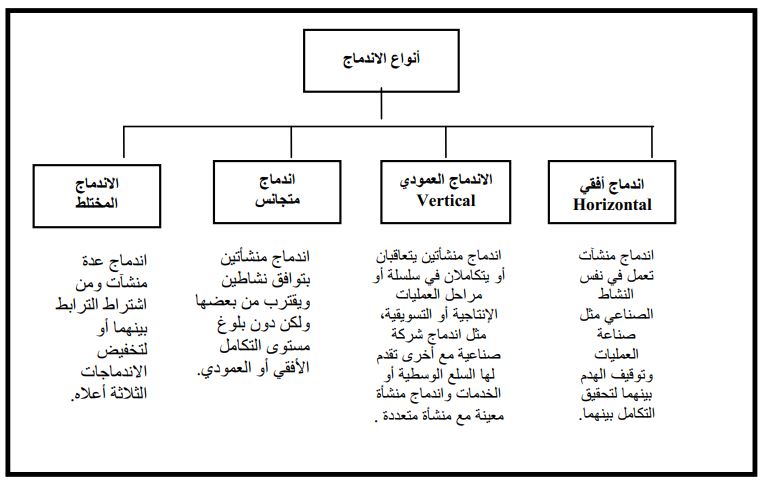

With the growing role and spread of the phenomenon of privatization, the information revolution, the emergence of the World Trade Organization (70), and the increase of giant conglomerates, the phenomenon of globalization spread, which calls on all countries to comply with the ideas and requirements of globalization, and with the growing economic, financial and banking changes, the financial and banking industry institutions witnessed a new era represented by mergers. The bloc, whether this is within one country or outside, comes out with high competitive advantages that give this bloc and mergers the ability to stand up to the global financial market, and thus increase their position in those markets, thus exceeding their regional competitive capabilities through unifying the capabilities available to the parties involved in mergers in various aspects.

The banking sector occupies a large space in global economies, including the Jordanian economy, and therefore studying the challenges and pressures that this sector faces in light of the changes that have occurred and are occurring to it is of great importance, especially since opening local markets to foreign investment brings these markets and their institutions face to face with the markets. Global banking requires increasing its competitive capabilities in terms of capital adequacy and quality standards, and from here begins the problem of the study, as banking work in the Kingdom of Jordan faces great challenges in light of Jordan’s membership in the World Trade Organization, the opening of the Jordanian financial market to foreign investment, and the increase in financial liberalization.

The study adopts the hypothesis that banking mergers have positive effects in supporting the competitiveness of the Jordanian banking sector and facing global challenges. The research aims to study the financial, banking, and economic dimensions of banking mergers in the Kingdom of Jordan and explain the importance of these operations in facing challenges, especially after adopting financial liberalization policies.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2008 College of Administration and Economics - University of Karbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.