Possessed capital and deposits and their role in determining the bank’s lending policy/a comparative study between the Jordanian, Kuwaiti and Al Rajhi Investment Banks

Keywords:

Owned capital, deposits, lending policyAbstract

The loan policy is one of the important policies that banks adopt after deep study and analysis of the various factors affecting them. Among these factors are deposits and practicing various loan and investment activities. Therefore, increasing them may have an appositive effect on the bank if it invests and correctly uses them depending on barking and finance experts to ensure the loan process without endangering the bank to varied risks and great losses According to those factors, specific measures and returns on rates ought to be used, showing their role in achieving a successful loan policy.

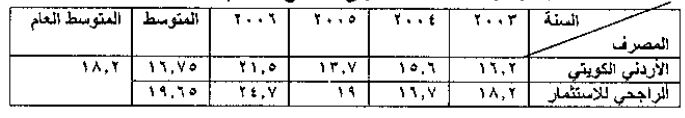

It is concluded that Al-Kujhi Bank for investment in measuring owned capital sufficiency, return on rates, and fojita style is proficient. The Jordanian-Kuwaiti bank proved to be more efficient in the percentage of its owned capital and its profits. Generally, Ai-Rajihi Bank is more efficient than the . Jordanian Kuwaiti bank. It is recommended that it is necessary to take care of these two factors and activate them without belittling the other factors that affect this policy, Astudy must be carried out on them according to banking and finance measures because of the international fame of these two banks locally and international.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2008 College of Administration and Economics - University of Karbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.