Evaluating the financial performance of Iraqi banks through a matrix analysis (performance-importance)-

دراسة تطبيقية في عينة من المصارف التجارية المدرجة في سوق العراق للأوراق المالية للمدة (2006 – 2020)

Keywords:

financial performance evaluation, Iraqi banks, performance-importance matrixAbstract

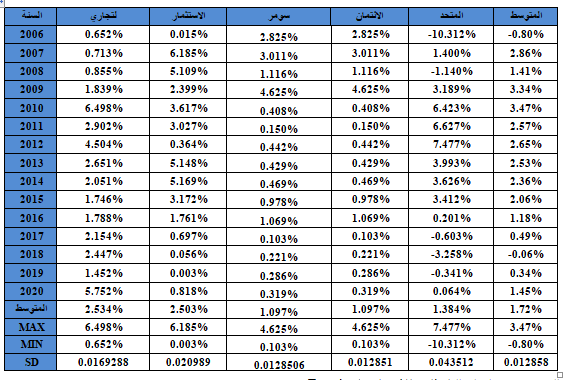

The research aims to assess the financial performance of Iraqi banks by analyzing the performance-importance matrix. This examination is based on five commercial banks listed in the Iraqi Stock Exchange for the period from 2006 to 2020, which are (Commercial Bank, Investment Bank, Sumer Bank, Credit Bank, United Bank), where Its financial data was obtained from its annual reports published on the Iraq Stock Exchange website, and the research applied the analysis of financial performance indicators represented by (profitability, liquidity, risk) to determine the financial performance of the research sample banks and then evaluate their performance through the analysis of the performance matrix - the importance of testing a series One of the hypotheses that emerged from a review of the previous literature. The results of the research, by analyzing the impact and importance of the matrix variables (performance-importance) through the Smart PLS statistical program, show that banks witnessed an increase in financial performance in the period (2016-2020) due to their positive performance during the research period, which reflected positively on profitability. And in order to improve the levels of financial performance of banks, the researcher recommends managers to evaluate financial performance through the performance-importance matrix on a regular basis because this approach allows managers to improve their management strategies because it indicates the main weaknesses that require immediate treatment.

References

Ahmed, Sayed Abbas, Ibrahim Elsiddig Ahmed, and Kiran Mir Zafarullah Khan, Banking Behaviour towards Small Business Financing In The Uae: Supply-Side Assessment Based On Importance Performance Map Analysis, Academy of Accounting and Financial Studies Journal, Vol.25, No.1, 2021.

Al Mamun, Md. Abdullah, Performance Evaluation of Prime Bank Limited in Terms of Capital Adequacy, Global Journal of Management and Business Research Finance, Volume 13, Issue 9, 2013.

Al-Eitan, Ghaith N., and Tareq O. Bani-Khalid, Credit risk and financial performance of the Jordanian commercial banks: a panel data analysis, Academy of Accounting and Financial Studies Journal, Vol.23, No.5, 2019.

Anthony, Patrick, Behnoee, Babak, Hassanpour, Malek & Pamucar, Dragan, Financial Performance Evaluation Of Seven Indian Chemical Companies, Vol. 2, Issue 2, 2019.

Brei, Michael, and Leonardo Gambacorta, The leverage ratio over the cycle, No 471, 2014.

Bučková, Veronika & Reuse, Svend, Basel III Global Liquidity Standards: Critical Discussion And Impact Onto The European Banking Sector, Financial Assets and Investing, Vol.2, No.3, 2011.

Fatihudin, Didin & Jusni & Chklas, Mochamad, How measuring financial performance, International Journal of Civil Engineering and Technology (IJCIET), Vol.9, No.6, 2018.

Fatima, Nikhat, Capital adequacy: A financial soundness indicator for banks, Global Journal of Finance and Management, Vol.6, No.8, 2014.

Gao, Chunkai, Diversification, Systemic Default and Regulation, University of California, Santa Barbara, 2013.

García-Fernández, Jerónimo, Fernández-Gavira, Jesús, Sánchez-Oliver, Antonio Jesús, Gálvez-Ruíz, Pablo, Grimaldi-Puyana, Moisés, & Cepeda-Carrión, Gabriel, Importance-Performance Matrix Analysis (IPMA) to Evaluate Servicescape Fitness Consumer by Gender and Age, International Journal of Environmental Research and Public Health, Vol.17, No.18, 2020.

Hidayat, Taufiq, Masyita, Dian, Nidar, Sulaeman Rahman, Febrian, Erie, & Ahmad, Fauzan, The Effect of COVID-19 on Credit and Capital Risk of State-Owned Bank in Indonesia: A System Dynamics Model, Vol. 6, No. 20, 2021.

Himawan, Ferdinandus A., & Widiastuti, Anik, Pengaruh Ukuran Perusahaan, Profitabilitas, Leverage Dan Umur Perusahaan Terhadap Pengungkapan Intellectual Capital, Jurnal Manajemen Bisnis, Vol. 24, No. 2, 2021.

Husnadi, Tengku Chandra, Marianti, Tatik, Ramadhan, Tarisya, Determination of Shareholders’ Welfare with Financing Quality as a Moderating Variable, Aptisi Transactions on Management (ATM), Vol 6, No. 2, 2022.

Khemraj, Tarron, & Pasha, Sukrishnalall, The determinants of non-performing loans: an econometric case study of Guyana, 2009.

Pamela, Anya Chioma Joanna, G. I. Umoh, and Gift Worlu, Human resource planning and organizational performance in oil and gas firms in Port Harcourt, Human Resource Planning, International Journal of Advanced Academic Research, Social & Management Sciences, Vol. 3, Issue 9, 2017.

Pinto, Prakash, Hawaldar, Iqbal Thonse, Rahiman, Habeeb Ur, TM, Rajesha & Sarea, Adel, An evaluation of financial performance of commercial banks, International Journal of Applied Business and Economic Research, Volume 15, No.2, 2017.

Ramadhan, M. Arna, Analisis Intensi Menabung Pada Bank Syariah Dengan Importance-Performance Matrix Analysis (IPMA), Jurnal Tabarru': Islamic Banking and Finance, Vol.4, No.1, 2021.

Saba, Irum, Narmeen, Sakina, Kouser, Rehana, & Khurram, Haris, Why Banks Need Adequate Capital Adequacy Ratio? A Study of Lending & Deposit Behaviors of Banking Sector of Pakistan, Journal of Accounting and Finance in Emerging Economies, Vol. 4, No. 1, 2018.

Septinia, Nindya Putri, Pengaruh Current Ratio, Debt To Equity Ratio (DER), Return On Asset Ratio (ROA), Dan Net Profit Margin Terhadap Pertumbuhan Laba Pada Perusahaan Subsektor Makanan Dan Minuman Yang Terdaftar Di Bursa Efek Indonesia (BEI) Periode 2015-2019, Nindya Putri Septinia / Emabi : Ekonomi Dan Manajemen Bisnis,Vol. 1, No. 1, 2022.

Stankevičienė, Jelena & Mencaitė, Evelina, The evaluation of bank performance using a multicriteria decision making model: a case study on Lithuanian commercial banks, Technological and economic development of economy, Vol. 18, No. 1, 2012.

Sukmadewi, Refni, The Effect of Capital Adequacy Ratio, Loan to Deposit Ratio, Operating-Income Ratio, Non Performing Loans, Net Interest Margin on Banking Financial Performance, eCo-Buss, Vol. 2, No. 2, 2020.

Susilo, Dwi Ermayanti & Chandrarin, Grahita & Triatmanto, Boge, The Importance of Corporate Social Responsibility and Financial Performance for the Value of Banking Companies in Indonesia, International Journal of Economics and Business Administration, Volume 7, Issue 2, 2019.

Tammenga, Alette & Haarman, Pieter, Liquidity risk regulation and its practical implications for banks: the introduction and effects of the Liquidity Coverage Ratio, Maandblad voor Accountancy en Bedrijfseconomie, Vol. 94, 2020.

Tarazi, Dana Dawoud, Agency Theory and the Companies’ Financial Performance: An Empirical Study with Evidence from Companies Listed in Palestine Exchange (PEX) (2012-2016), Doctoral dissertation, 2019.

Zielińska-Chmielewska, Anna & Kaźmierczyk, Jerzy & Jaźwiński, Ireneusz, Quantitative Research on Profitability Measures In The Polish Meat And Poultry Industries, Agronomy, Vol. 12, No.92, 2022.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.