The influence of banking competition on solvency: An analytical study on a sample of commercial banks listed on the Iraqi Stock Exchange for the period (2005-2022)

Keywords:

banking competition, solvency capacity.Abstract

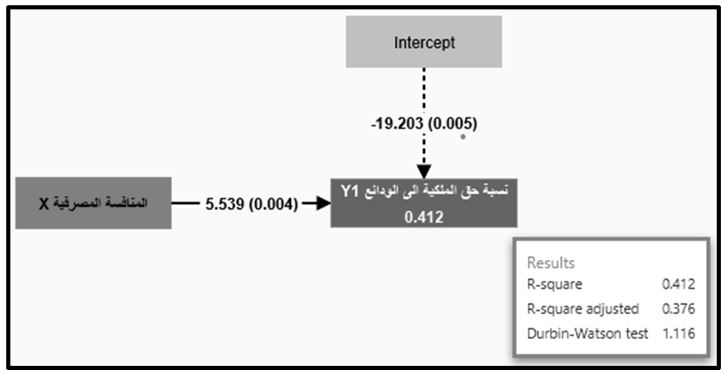

The research seeks to measure and analyze the impact of banking competition on solvency capacity through several financial indicators, namely (Herfindahl-Hirschman (HHI)) to measure banking competition. As for the solvency capacity, it was measured by the following indicators (the ratio of ownership rights to total deposits, the ratio of ownership rights to total assets, The ratio of ownership rights to total loans, the ratio of liabilities to total assets), and the research sample was chosen from among the commercial banks listed on the Iraq Stock Exchange, which includes ten banks: (Baghdad, Iraqi Commercial, Investment, Middle East, Iraqi National, Credit, Sumer Commercial, Gulf, Mosul, and Babylon Bank) for the period 2005 until 2022. The research used simple linear regression using the Smart PLS4 statistical program. The research reached a set of results, the most important of which is that there is a statistically significant effect of banking competition on the bank’s fulfillment capacity. In light of this, the research came out with a number of The most important recommendations are that commercial banks should follow policies and strategies that lead to improving the competitiveness of banks by diversifying bank deposits and not following a policy of concentration.

References

القرآن الكريم

الجنابي، سعد مجيد& عبد، احمد حاضر(2022). الملاءة المصرفية وتأثيرها في المخاطر الائتمانية دراسة تحليلية لعينة من القطاع المصرفي العراقي الخاص، مجلة المثنى للعلوم الإدارية والاقتصادية، المجلد 12، العدد 4.

النعيمي، زهراء احمد محمد توفيق& المزوري، اشتي عبدالستار عبدالغني(2017)، أثر الائتمان الأخضر في القدرة الإيفائي دراسة تحليلية في القطاع المصرفي الصيني، مجلة اقتصاديات الأعمال، المجلد 4، العدد 2، 2023.

بيداوي، حسين احمد حسين(2023). الفشل المالي المصرفي، دراسة تحليلية مقارنة بين مصرف الوركاء للاستثمار والتمويل وعينة من المصارف المسجلة في سوق العراق للأوراق المالية، مجلة العلوم الانسانیة لجامعة زاخو، المجلد 5، العدد 3.

حميدي، أنعام عباس(2014). المخاطر السوقية وتأثيرها على كفاية رأس المال وفق اتفاقية بازل II، دراسة تحليلية في المصارف الحكومية العراقية، رسالة ماجستير غير منشورة، الجامعة المستنصرية، العراق.

Acaravci, Songül Kakilli & Çalim, Ahmet Ertuğrul (2013), Turkish banking sector’s profitability factors. International Journal of Economics and Financial Issues, vol.3, no.1.

Adhamovna, Bekmurodova Go’zal(2016), Banking competition and stability: comprehensive literature review, International Journal of Management science and business Administration, Volume 2, Issue 6.

Aleemi, Abdur Rahman & Uddin, Imam & Kashif, Muhammad( 2019), Competition and risk taking behavior of banks: New evidence from market power and capital requirements, Pakistan Business Review, Volume 21 Issue 3.

Alktrani, Sundus Hameed Mousa& Talib, Karrar Hayder(2021), Impact of Concentration and Diversity of Loan Portfolio on The Bank Equity Return: A Cross Country Analysis, Turkish Journal of Computer and Mathematics Education,Vol.12, No.7.

Almarzoqi, Raja& Naceur, Sami Ben& Scopelliti(2021), Alessandro. How does bank competition affect solvency, liquidity and credit risk? Evidence from the MENA countries. International Monetary Fund.

Bandaranayake, Samangi Upasama Kumari(2018), Essays on bank competition and financial stability, Doctoral dissertation, University of Canterbury.

Collin, P. H, Dictionary of Economics(2003), A & C Black Publishers, First published, Great Britain, London.

Fatima, Nikhat(2014), Capital Adequacy: A Financial Soundness Indicator For Banks, Global Journal Of Finance And Management, Issn 0975-6477 Volume 6, Number 8.

Fungáčová, Zuzana; Solanko, Laura; WEILL(2010), Laurent. Market power in the Russian banking industry. Economie international.

Hempel George H. & Simonson Donald G.(1999), Bank Management: Text & Cases, 5th Ed., New York: John Wiley & Sons, Ice.

Henriksson, Daniel & Ottosson, Anna(2021), Does competition in the EU banking market lead to lower interest margins?: A panel data analysis on how market competition affects banks interest margin across EU countries.

Khan, Mohmad Mushtaq, and Attaullah Niazi(2021), "Impact of Liquidity, Efficiency and Solvency on Profitability of Select Banks." Turkish Online Journal of Qualitative Inquiry, vol. 12, no.7.

Leon, Florian(2014), Measuring competition in banking: A critical review of methods.

Mang’ana, R.(2022), "Strategic Adoption of Technological Innovations on Competitive Advantage of Commercial Banks in Kenya". Journal of Business and Strategic Management, Vo 7 No 2.

Mustafa, Arben M.(2014), Banking sector competition and its impact on banks’ risk-taking and interest margins in the Central and East European countries, Doctoral dissertation, Staffordshire University.

Northcott, Carol Ann(2004), Competition in banking: A review of the literature.

Pardosi, Dolly Parlindungan; Siagian, Harlyn L(2021), Debt to Assets Ratio and Management Asset on Financial Performance: an Evidence of Chemical Companies in Indonesia Stock Exchange. Ekonomis: Journal of Economics and Business, vol. 5, no. 2.

Prabowo, F. P. S. R., Sarita, B., Syaifuddin, D. T., Saleh, S., Hamid, W., & Budi, N.(2018), Effect of equity to assets ratio (EAR), size, and loan to assets ratio (LAR) on bank performance. IOSR Journal of Economics and Finance, vol. 9 no.(4).

Rokhimah, Zulaika Putri, Novitasari Eviyanti, and Aditya Rizqi Senoaji(2024), "Analysis of the Influence of Financial Performance on the Value of Sharia Banking Companies in Indonesia." Economics Studies and Banking Journal (DEMAND), vol.1, no.1.

Sakinc, İlker(2018), The Financial Differences of Islamic And Commercial Banks In The Gulf Cooperation Council Region. In: International Academic Conference On Social Sciences International Academic Conference.

Sanya, Sarah; Gaertner, Matthew(2012), Assessing bank competition within the East African Community. International Monetary Fund.

Sari, Widya Novita & Novari, Eri & Fitri, Yuda Septia & Nasution, Ade Iskadar(2022), Effect of Current Ratio (Cr), Quick Ratio (Qr), Debt To Asset Ratio (Dar) and Debt To Equity Ratio (Der) on Return On Assets (ROA). Journal of Islamic Economics and Business, vol. 2, no.1.

Shrestha, Anupama(2010), A Study of Capital Structure Management of Commercial Banks, PhD Thesis, Shanker Dev Campus, Kathmandu.

Tóth, József(2016), Bounds of Herfindahl-Hirschman index of banks in the European Union.

Troug, Haytem Ahmed & Sbia, Rashid(2015), The Relationship between Banking Competition and Stability in Developing Countries: The Case of Libya, Munich Personal Repec Archive Paper, No. 64932.

Vadym, Trembovetskyi(2010), Testing for competition in banking sector: Evidence from Ukraine, Diss, Kyiv School of Economics.

Wibowo, Buddi(2017), Banking Competition Measurement and Banking Sector Performance: Analysis of 4 Asean Countries, Signifikan: Jurnal Ilmu Ekonomi, Volume 6, no 1.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 College of Administration and Economics - University of Karbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.