اثر المحتوى المعلوماتي لإعلانات اعادة شراء الاسهم في اسعارها اعتماداً على نمط الاسهم

الكلمات المفتاحية:

إعلانات اعادة شراء الاسهم، نمط الاسهمالملخص

هدفت هذه الدراسة الى تسليط الضوء لبيان اثر اعلان اعادة شراء الاسهم العادية في اسعارها باطار نظرية الاشارة اعتمادا على نمط الاسهم , والدور الذي تلعبه هذه النظرية في تفسير معالجة عدم التماثل المعلوماتي وبالشكل الذي يسهم في رفع كفاءة السوق , وتوافر المعلومات لمساعدة المستثمرين باتخاذ قرارات اكثر دقة , فإعادة الشراء تعد كإشارة ايجابية مرسلة الى السوق تعبر عن انخفاض اسعار الاسهم دون قيمتها الحقيقية . وتمحورت الدراسة على بعدين رئيسين للمشكلة والتي صيغت لأجلها الفرضيتين الآتيتين :

• ليس لنمط السهم علاقة بقوة الاشارة المرسلة لسوق المال عبر اعلان اعادة الشراء .

• ان سوق الكويت للأوراق المالية ليست كفوءة بالمستوى نصف القوي في الاستجابة للمحتوى المعلوماتي لإعلان اعادة الشراء .

وتكونت عينة الدراسة من 170 اعلاناً من 65 شركة مدرجة في سوق الكويت للأوراق المالية للمدة من 1/1/2012 الى 24/4/2015. ومن الجدير بالذكر ان اختيار سوق الكويت للأوراق المالية جاء وسيلة وليس غاية , اذ ان الغاية الاساس هو دراسة سوق العراق للأوراق المالية لكن ولأسباب فنية ترتبط بغياب الوعي العلمي اللازم لبرامج اعادة الشراء من جانب الشركات من جهة ومن جانب المتعاملين في السوق من جهة اخرى , انعدم استخدام هذه الالية المبدعة لسياسة الدفع وغابت معها المزايا المتعددة التي يمكن ان تأتي بها لجميع الاطراف والتي تبدأ بمصالح المستثمر الفردي ولا تنتهي عند رأب فجوة عدم التماثل المعلوماتي والارتقاء بكفاءة السوق التخصيصية لموارد الاقتصاد النادرة .

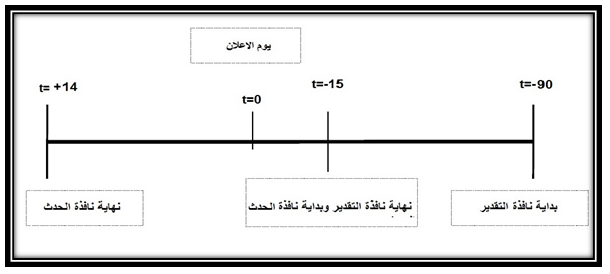

وباستعمال عدد من الأساليب المالية والاحصائية باستعمال برنامج EXCEL)) من أجل تحليل متغيرات الدراسة واختبار فرضياتها , وتوصلت الدراسة إلى عدد من الاستنتاجات لعل من أهمها ان لنمط السهم علاقة بقوة الاشارة المرسلة لسوق المال عبر اعلان اعادة الشراء , واستدل على ذلك عبر نتائج متوسطات العائدات غير العادية المتراكمة (CAAR) لاسهم القيمة مقابل اسهم النمو . اذ أن الغلبة من حيث الحجم والاتجاه كانت لاسهم القيمة وبفارق كبير , وهذا يتعارض مع الفرضية الاولى للدراسة . كما أثبتت النتائج الاستجابة غير الكفوءة ( متحيزة وبطيئة وغير تامة) من سوق الكويت للأوراق المالية للمحتوى المعلوماتي لإعلان اعادة الشراء , ما يؤكد عدم كفاءة السوق بالشكل نصف القوي وهذا يدعم صحة فرضية الدراسة الثانية . وبناءً على ذلك خرجت الدراسة بعدد من التوصيات لعل من اهمها ضرورة الاعتماد على نظرية الاشارة لاسيما في الاسواق المالية غير الكفوءة لتقليل مشكلة عدم التماثل المعلوماتي بين المطلعين والمستثمرين الخارجيين .

المراجع

Amling , Frederick , "Investments: An Introduction to Analysis and Management" 3rd ed. ., N.J. : Prentice- Hell , Inc,1974 .

Brealey, Richard & Myers, Stewart ." Principles of Corporate Finance". U.S.A : The McGraw-Hill., 2000 .

Brigham , Eugene . F, &Ehrhardt , Michael, "Financial Management Theory and Practice"11th ed. , U.S.A: South / Westernin, Thomson Learning , 2005 .

Brown , Keith ,C. & Rielly, Frank , K. , "Analysis of Investment and Management of Portfolios", 9th ed. , South-Western , 2009 .

Gitman, Lawrence , J. " Principles of Managerial Finance " 12th ed. , New York : Pearson /Prentice-Hall, 2009 .

Jones, Charles , P. , " Investments, Analysis and Management", 7th ed. , America : John Wiley and Sons, Inc., 2000 .

Koch, Timothy W. & MacDonald, S. Scott, "Bank Management", 7th ed. , South Western , 2010 .

Ross , Stephen , A.; Westerfield , R .W. ; Jaffe, J. & Jordan, B. .D " Modern Financial Management" 8th ed. , New York : McGraw-Hill . Irwin , 2008 .

Ross , Stephen . A; Westerfield , Randolph .W; Jaffe,Jeffrey; Jordan, B.D. " Fundamentals of Corporate Finance" 6th ed. , New York: McGraw-Hill . Irwin , 2003 .

Al-Kuwari , D. "Determinants of the Dividend Policy in Emerging Stock Exchanges: The Case of GCC Countries", "Global Economy & Finance Journal",Vol.No(2), 2009 .

Bhana , N. " The market reaction to open market share repurchases announcements: The South African experience", "Investment Analysts Journal" , No (65) , 2007 .

Brown, S.J. & Warner, J.B., "Using Daily Stock Returns: The Case of Event Studies", "Journal of Financial Economics" Vol . 14, 1985 .

Chan , Konan; Ikenberry, David & Lee, Inmoo "Economic Sources of gain in Stock Repurchases", "Journal of Financial and Quantitative Analysis", Vol . 39, No.(3) , 2004 .

Chatterjee, C. & Rakshit , D. " An Empirical Investigation of Sharse Repurchases In India ", "South Asian Academic Research Journals", Vol . 2, No( 1) , 2012 .

D Mello , Ranjan & Shroff , Pervin "Equity Undervaluation and Decisions Related To Repurchase Tender Offers: An Empirical Investigation", "The Journal of Finance" , Vol . 5 , 2000 .

Diamond, D.&Verrecchia, R ." Disclosure, liquidity and the cost of capital" , "Journal of Finance" Vol . 46, No (4) , 1991 .

Dittmar , Amy,K."Why do firms repurchase stock?", "The Journal of Business", Vol . 73, No.( 3) , 2000 .

Dudley, Evan &Manakyan,Ani,"Corporate Repurchase Decisions Following Mutual Funds Sales", "Financial Management" Vol . 40 , 2011 .

Fama, Eugene F. "Efficient Capital Market: II","The Journal of Finance", Vol . XLVI, No.(5) , 1991 .

Farzanfar, Farzad ; Zare, Reza & Boroumand , Maryam" Dividend Policy from the Signaling Perspective and its Effects on Information Asymmetry Among Investors", "Journal of Contemporary Research In Business" Vol. 4, No.( 12) , 2013 .

Gottesman, Aron& Jacoby, Gady, "Payout policy, taxes, and the relation between returns and bid-ask spread", "Journal of Banking & Finance", Vol. 30 , 2006 .

Grullon ,G.& Ikenberry, D.L."What Do We Know about Stock Repurchases?", "Journal of Applied Corporate Finance", Vol .13, No(1),2000 .

Gupta , S . ; Kalra , N. & Bagga , R . " Do Buybacks Still hold their Signaling Strength? An Empirical Evidence from Indian Capital Market ", "Amity Business Review" ,Vol .15, No(1) , 2014 .

Hail, Luzi ; Tahoun,Ahmed &Wang , Clare " Dividend Payouts and Information Shocks" , 2013 .

Harms , Philip . p ,"International Investment, Political Risk & Growth" , 2000 .

Heflin , F. ; Shaw, K. &Wild, J . "Disclosure Policies and Market Liquidity: Impact of Depth Quotes and Order Sizes". "Contemporary Accounting Research" ,Vol . 22, No (4) , 2005 .

Hribar , P. ; Jenkins, N. & Johnson, W. B. "Stock repurchases as an earnings management device". "Journal of Accounting and Economics" Vol .41, 2006 .

Hyderabad , R . L . " Market Reaction To Multiple Buy Backs In India " "Journal of Finance", Vol . I, Issue ( 2) , 2009 .

Ikenberry, D. ; Lakonishok, J. & Vermaelen, T. " Market under reaction to open market share repurchases" . "Journal of Financial Economics", Vol . 39 , No (2-3) , 1995 .

Isa , Mansor ; Ghani, Zaidi and Lee, Siew‐Peng "Market Reaction to Actual Share Repurchase in Malaysia ", "Asian Journal of Business & Accounting", Vol .4,No (2) , 2011.

Isagawa, N."Open-market repurchase announcement and stock price behavior in inefficient markets" , "Financial Management", Vol .31, No(3), 2002 .

Jensen , G. R . ; Donald, P.S. &Thomas Zorn, "Simultaneous Determina- tion of insider Ownership, Debt and Dividend Policies". "Journal of Financial and Quantitative Analysis" , Vol . 27, 1992 .

Kato, Hideaki K. ; Michael, Lemon; Mi Luo and Jay Schallheim , "An Empirical Examination of the Costs and Benefits of Executive Stock Options: Evidence from Japan", "Journal of Financial Economics" , Vol .78, 2005.

Li , K. & McNally, W. "The Information Content of Canadian Open Market Repurchase Announcements" . "Managerial Finance" ,Vol. 33, 2007 .

Lie, E. "Operating performance following open market share repurchase announcements", "Journal of Accounting and Economics" ,Vol . 39, 2005 .

Moore , James M. " TSX Stock Repurchase Announcements and the Impact of TSX Disclosure Requirements ", "International Journal of Financial Research" Vol . 4, No ( 2) , 2013 .

Negakis , Christos , J. " Accounting and Capital Markets Research", "Managerial Finance", Vol . 31, No(2) , 2005 .

Nittayagasetwat , W. & Nittayagasetwat , A . " Common Stock Repurchases: Case of Stock Exchange of Thailand" PhD, International Journal of Business and Social Science , Vol . 4 No( 2 ) , 2013 .

Nossa , S. N; Lopes , A. B. & Teixeira, A . "Stock repurchases and fundamental analysis: an empirical study of the brazilian market in the period from 1994 to 2006", "Brazilian Business , Review Vitoria" ,Vol . 7, No ( 1) , 2010 .

Pemale P. Peterson, "Event Studies: A Review of Issues and Methodology", "Quarterly Journal of Business &Economics", Vol .28 , No(3) , 1989.

Prahala R .N , "Conditional Methods in Event Studies and an Equilibrium Justification for Standard Event-Study Procedures". "The Review of Financial Studies", Vol .10, No.(1) , 1997 .

Sharp, W.F. " Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk", "Journal of finance", Vol . 19, No( 3), 1964 .

Tabtieng , Naratip, "Motivations for Share Repurchase Programs and the Effect of Share Prices on Managerial Decisions to End Share Repurchase Programs in Thailand", "International Journal of Business and Social Science", Vol . 4, No. (10), 2013 .

Talmor, E.,"Asymmetric Information, Signaling, And Optimal Corporate Financial Decisions", "Journal of Financial and Quantitative Analysis" Vol. 16 , 1981 .

Wiyada , Nittayagasetwat & Aekkachai , Nittayagasetwat , " Common Stock Repurchases : Case of Stock Exchange of Thailand" ,"International Journal ofBusiness and Social Science", Vol . 4 No(2) , 2013 .

Zhang, H."Share price performance following actual share repurchases". "Journal of Banking and Finance ",Vol . 29, 2005.

: Internet C. .

Anderson Warwick, & McLaughlin Samuel, " Buybacks versus Ordinary Dividends : Marginal Investor reactions to Cash-return Announcements" University of Canterbury, New Zealand , 2013 .

Andres , c. ; Betzer, A. ; Doumet , M. &. Theissen, E. " Open Market Share Repurchases in Germany: A Conditional Event Study Approach ". University of Cologne , 2013 .

Axelsson, Lars & Brissman , Philip, "Share repurchase announcements and abnormal returns for Swedish listed real estate companies" , Master Thesis number: 94, Stockholm , 2011 .

Bhattacharya , N. ; Desai, H. & Venkataraman , K. " Does Earnings Quality Affect Information Asymmetry ? Evidence From Trading Costs " Southern Methodist University , 2012 .

Chemmanur,Thomas. J; Cheng, Yingmei & Zhang, Tianming , "Why do Firms Undertake Accelerated Share Repurchase Programs?", 2009 .

Chen , Tai-Yuan , " Payout Policy, Signaling , and Firm Value" Durham University , 2006 .

Chen, Chao, " The Credibility of Stock Repurchase Signals" California State University , 2007 .

Chen, Fei,"Capital Market Reaction to Share Repurchase Announcements : An Empirical Test on Shanghai Stock Exchange (SSE)", A research project submitted in partial fulfillment of the requirements for the degree of Master of Finance, Saint Mary’s University , 2013 .

Cremers, J.S. ,"Testing the Motivation for Share Repurchases: Firms in the Netherlands and Germany" Master Thesis Finance, Tilburg University , 2012

De Jong , F. &De Goeij , P. ,"Event Studies Methodology", Tilburg University , 2011 .

Fisal , Shafina , " Motivations Behind Firms’ Share Repurchases " Selangor International Islamic University, 2008 .

Gonzalez . Victor, M. & Gonzalez , Francisco " Stock Repurchases With Legal Restrictions Evidence From Spain" , University of Oviedo , 2000 .

Gunalpa, B. ; Kadioglu , E . & Kilic,K, " The Announcement Effect of Cash Dividend on Share Prices and the Tax Clientele Effect: Evidence from Turkish Capital Markets" Hacettepe University. Ankara, Turkey, 2011 .

Gupta. L. C. ; Jain, Naveen M. ; Com. M. Phil & Anil Kumar, M. Com. " Corporate Practions Regarding Buyback of Shares and ITS Regulation in India" Indian Council of Social Science Research , 2005 .

Hackethal , A. & Zdantchouk , A . , " Signaling Power of Open Market Share Repurchases in Germany" , 2005 .

Hsu , Yenshan & Liu , Shu-Hua , " The Option to Repurchase Stock: Free Cash Flow vs . Information Asymmetry Hypotheses" National Chengchi University, Taipei City, Taiwan , 2009 .

Hun, Seung Hon& Song, Minji ,"Stock Repurchases Signaling &Corporate Governance: Evidence from Korea", 2013 .

Kim , Inho & Kim ,Y. H . , " Share Repurchase Rumors : Signaling, Publication, and Reputation Effects" University of Cincinnati , 2012.

Kim , Jaemin; Schremper , Ralf & Varaiya, Nikhil ," Survey on Open Market Repurchase Regulations : cross-country examination of the ten largest stock markets," San Diego State University , 2010 .

Kivi & Heidi , " Share Repurchase Practices in Finland" Lappeenranta University of Technology , 2006 .

Lasfer , A. , " Market Valuation of Share Repurchases in Europe" City University Working Paper , 2014 .

Leung , Joanne, " Voluntary Compliance and Implied Cost of Equity Capital : Evidence From Canadian Share Repurchase Programs " University of Saskatchewan Saskatoon , 2008

Micheloud ,G . A . ," How Do Investors Respond To Share Buyback Programs? Evidence From Brazil During 2008 Crisis ", 2013 .

Minnick , Kristina &Zhao, Mengxin ,"Levered Repurchases: Who benefits?", 2006 .

Otchere, Isaac & Ross, Matthew , " Do Share Buy Back Announcements Convey Firm Specific or Industry wide Information? A Test of the Undervaluation Hypothesis" , University of Melbourne , 2000 .

Seifert ,Udo & Stehle , Richard ," Stock Performance around Share Repurchase Announcements in Germany" , 2003 .

Shen, Pu , " The P/E Ratio and Stock Market Performance " Federal Reserve Bank of Kansas City , 2000 .

Thanatawee ,Yordying ,"The Information Content of Dividends and Open market Share Repurchases: Theory & Evidence" A thesis submitted to the degree of Doctor of Philosophy , University of Bath , 2009 .

Tong , Jiao ; Suzuki , Katsushi ; Kato, Hideaki, K. & Bremer, Marc " Stock Repurchases in Japan : A Preliminary Study" , 2012 .

w.kuwaitse.com .

Wada , Kenji , " Stock Repurchases in Japan" , Keio University , 2010 .

Wronska , E . M . ," Information Content of Share Repurchase Programs " Maria Curie- Skłodowska University in Lublin, Poland , 2013 .

Yen , N, T. Kem , " Efficient Market and Signaling Hypothesis on Vietnam Stock Exchange 2006-2009"A thesis submitted in fulfillment of the requirements of the degree of Master of Science in Finance and Accounting, 2011 .

Young ,Steven & Yang, Jing,"Stock Repurchases and Executive Compensation Contract Design: The Role of Earnings Per Share Performance Conditions" , 2008 .

التنزيلات

منشور

كيفية الاقتباس

إصدار

القسم

الرخصة

الحقوق الفكرية (c) 2017 كلية الإدارة والإقتصـــاد _ جامعة كربـــلاء

هذا العمل مرخص بموجب Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

يحتفظ المؤلفون بحقوق الطبع والنشر لأوراقهم دون قيود.